⚽️ Apple FC

A look at Apple's exclusive FIFA World Cup deal...Big Tech releases Q1 earnings; Honda’s $11 billion Canadian EV investment; Coca-Cola partners with Microsoft; US TikTok ban signed into law; and more.

Good morning friends and enthusiasts 👋,

Happy Friday and welcome to the 24th edition of Weekly Brief. A warm welcome to the 12 new enthusiasts who joined J. Nicholas this week. We now have 284 subscribers (28.4% of our 1,000 subscriber goal).

The S&P 500 is up ~1% this week despite lower first-quarter GDP growth of 1.6%, reports that Biden is considering raising capital gains tax and taxing unrealized gains, and increased tensions between China following the official signing of a TikTok ban into U.S. law (more on that later).

This issue is packed with a ton of news: Apple’s multi-billion dollar World Cup deal with FIFA, Big Tech earnings results, Amazon’s acquisition of Monday night NHL rights from Rogers, Honda’s record-breaking automobile investment in Canada, and Microsoft’s AI partnership with Coca-Cola.

Let’s get into it.

IN THIS ISSUE

⚽️ Apple’s exclusive FIFA World Cup deal

📈 Big Tech’s Q1 2024 earnings results

🇺🇸 U.S. TikTok ban signed into law

On this day. On April 25, 1986, an explosion and fire at the Chernobyl Nuclear Power Plant released large amounts of radiation into the air, killing 31 people and affecting over 5 million. This event is considered the worst nuclear disaster in history and is said to have cost $68 billion in emergency response.

FEATURED STORY

⚽️ Apple FC

Apple is reportedly working to secure an exclusive TV deal with FIFA for a revamped version of the World Cup (Club World Cup) in 2025. According to Reuters, the deal could potentially be worth around $1 billion. And this isn’t the first time they've dipped their toes into sports either:

In 2022, Apple paid $2.5 billion for a 10-year deal to secure global rights to broadcast Major League Soccer. In that same year, they also signed a seven-year $80 million-a-year deal with Major League Baseball for (you guessed it) more broadcast rights.

If the deal goes through, this would mark the first time that FIFA has agreed to a single worldwide contract. Senior executives at FIFA have raised concerns over the deal giving Apple “free-to-air rights”, which would make the event only available to subscribers of Apple TV+—something they don’t want. No one yet knows if the deal includes these rights.

A sports streaming problem

Many other companies such as Disney, Netflix, Amazon, and Warner Bros. are paying sports leagues millions, and sometimes billions, for these rights to lure people into subscribing to their streaming services. And while it’s obviously a great idea for their company, where does that leave the consumer? They’re expected to subscribe to seven or more monthly services just to watch their favorite teams play seven games throughout the week.

ESPN+ for example (owned by Disney) signed a deal this year to pay the NHL $400 million every year until 2028 for rights to broadcast. Warner Bros. Turner Sports struck a deal with the same league for a separate package of $250 million per year. And just recently, Monday night hockey across Canada will move to Prime Video.

That’s one sports league, with three companies owning three specific rights on three different streaming services.

Speaking of Apple

💰 Apple silently buys another AI company, goes open-source: This week, Apple acquired yet another AI startup called Datakalab, a French company focused on algorithm compression and computer vision. They also released OpenELM, a family of open-source LLMs designed to run on a single device for text generation with parameter sizes up to 3 billion (iOS 18 and WWDC foreshadowing it seems).

FINANCE

📈 Big Tech Q1 earnings release

Throughout this week, the largest, fifth-largest and seventh-largest companies on earth released earnings. Microsoft (MSFT), Alphabet (GOOGL) and Meta (META) are the names. Here’s how these companies performed (in USD):

MSFT Q1 2024:

Earnings per share: $2.94 vs. $2.82 expected

Revenue: $61.90 billion vs. $60.88 billion expected

Net income was $22.29 billion, or $2.94 per share, up 27% from $17.56 billion, or $2.35 per share a year ago. Revenue rose 13% to $61.90 billion from $56.5 billion the previous year.

GOOGL Q1 2024:

Earnings per share: $1.89 vs. $1.51 expected

Revenue: $80.50 billion vs. $78.75 billion expected

Announced dividend of $0.20/share + $70 billion buyback.

Net income was $23.70 billion, or $1.89 per share, up 57% from $15.05 billion, or $1.17 per share a year ago. Revenue rose 15% to $80.50 billion from $69.79 billion the previous year.

META Q1 2024:

Earnings per share: $4.71 vs. $4.32 cents expected

Revenue: $36.46 billion vs. $36.16 billion expected

Net income was $12.37 billion, or $4.71 per share, up 117% from $5.71 billion, or $2.20 per share a year ago. Revenue rose 27% to $36.46 billion from $28.65 billion the previous year.

🚘 Honda’s $11 billion Canadian EV investment

Honda plans to invest $11 billion (C$15 billion) in Ontario, Canada, to establish ‘a robust EV ecosystem,’ including both assembly and battery plants. Production is expected to start in 2028, with a capacity of 240,000 vehicles annually.

Honda’s goal is to exclusively offer electric and fuel cell vehicles by 2040 and sees this investment as good preparation for increased North American EV demand in the future. The project is set to create 1,000 jobs, with Prime Minister Justin Trudeau calling it the country's largest-ever automotive industry investment.

BUSINESS

🏒 Amazon to host Monday night NHL games

Starting in the 2024-25 NHL season, Monday night national across Canada will move to Prime Video. This marks the NHL’s first national broadcast package with a digital-only streaming service in Canada, just after the same happened in the U.S. with ESPN+ and Hulu.

Rogers, NHL, and Amazon announced the two-year agreement this Thursday, with Prime Video hosting the broadcasts exclusively for Prime subscribers. This decision is to help broaden Prime Video’s sports portfolio which already includes NFL’s Thursday Night Football and a few New York Yankees games.

💻 Coca-Cola partners with Microsoft

Microsoft and Coca-Cola Co announced a five-year strategic partnership on Tuesday to enhance Coca-Cola’s technology and ‘foster innovation globally’. Coca-Cola is paying $1.1 billion for Microsoft’s Cloud and AI capabilities to accelerate its digital shift.

The collaboration includes Azure OpenAI Service and Microsoft 365’s Copilot. Coca-Cola has shifted most or all of its applications to using Microsoft Azure, with major bottling partners like Pepsi following suit. By Leveraging Azure, Coca-Cola plans to improve across marketing, manufacturing, and supply chain.

POLITICS

🇺🇸 U.S. TikTok ban signed into law

The long-anticipated bill forcing TikTok to sell off from its Chinese company, ByteDance, or face a ban was officially signed into law by President Biden on Tuesday. After passing the House a few weeks ago and gaining support from the Senate just last week, this bill becomes one of the fastest pieces of legislation ever to be passed in US Congress (unofficial data).

“Rest assured, we aren't going anywhere. The facts and the Constitution are on our side, and we expect to prevail again.” — TikTok CEO Shou Chew.

TikTok plans to challenge the law in court.

🇷🇺 Russia to retaliate after asset seizure

Valentina Matviyenko, speaker of the Russian upper house of parliament, warned Europe this week that Russia has drafted legislation to retaliate if nearly $300 billion of Russian assets are seized by the West to support Ukraine.

The U.S. and others have already blocked these assets with a bill just passed by the House of Representatives including just that. However, of the nearly $300 billion of Russian assets frozen abroad, only about $6 billion was in the U.S. while about $224 billion was in the EU according to Russia. “The Europeans will lose more than we do” Matviyenko said.

Thank you for reading today’s issue of Weekly Brief. As requested, next Wednesday will be a Deep Dive and stock analysis on EQ Bank (TSE: EQB). Until then, have a great weekend!

If you have any questions or feedback, reply to this email (I read every reply).

— Jacob

✩ This newsletter, along with my weekly Morningstar fair value estimates and PDFs, will always be free of charge. Your support, whether through a donation or by reading this newsletter and following along, is greatly appreciated.

📚 Book of the Week

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

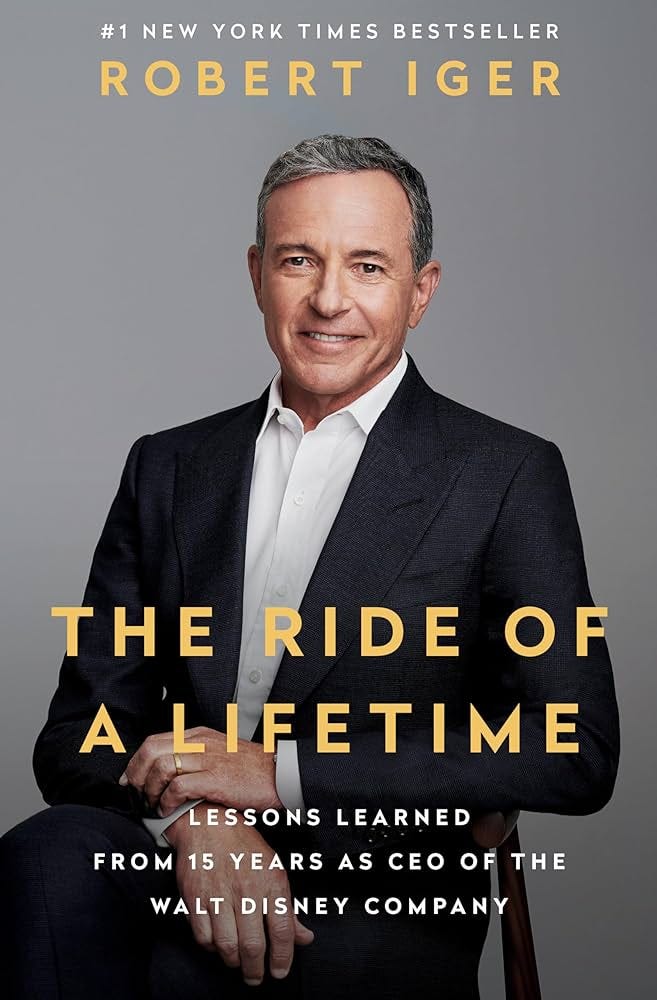

The Ride of a Lifetime — Robert Iger

Book Description:

Robert Iger became CEO of The Walt Disney Company in 2005 during a difficult time. Competition was more intense than ever and technology was changing faster than at any time in the company’s history. His vision came down to three clear ideas: Recommit to the concept that quality matters, embrace technology instead of fighting it, and think bigger—think global—and turn Disney into a stronger brand in international markets.

Today, Disney is the largest, most admired media company in the world, counting Pixar, Marvel, Lucasfilm, and 21st Century Fox among its properties. Under Iger’s leadership, Disney’s value grew nearly five times what it was, making Iger one of the most innovating and successful CEOs of our era.

In The Ride of a Lifetime, Robert Iger shares the lessons he learned while running Disney and leading its 220,000-plus employees, and he explores the principles that are necessary for true leadership.

This book is about the relentless curiosity that has driven Iger since the day he started as the lowliest studio grunt at ABC. It’s also about thoughtfulness and respect, and a decency-over-dollars approach that has become the bedrock of every project and partnership Iger pursues, from a deep friendship with Steve Jobs in his final years to an abiding love of the Star Wars mythology.

As of Jan 31, 2024, (resulting from my Amazon.ca Associates account being terminated) I do not earn any affiliate commissons from the links below.