Weekly Brief #28

Microsoft's new surveillance—I mean, innovative Windows feature...Nvidia releases earnings, Ticketmaster sued by the DOJ, Red Lobster files for bankruptcy, Trump accepts crypto donations, and more.

Good morning investors 👋,

Happy Friday and welcome or welcome back to the 28th Weekly Brief.

Did you know, 'supercalifragilisticexpialidocious' is super and fragilistic because it’s also expialidocious? This is called word vomit. Let’s take Palo Alto Networks’ (NASDAQ: PANW) recent Q3 FY 2024 earnings presentation this week toexpand on this definition:

“Platformizations are defined as a count of all platformized platforms. A customer platformized on all three platforms would count as 3 platformizations.” — A verbatim quote from a Fortune 500 company.

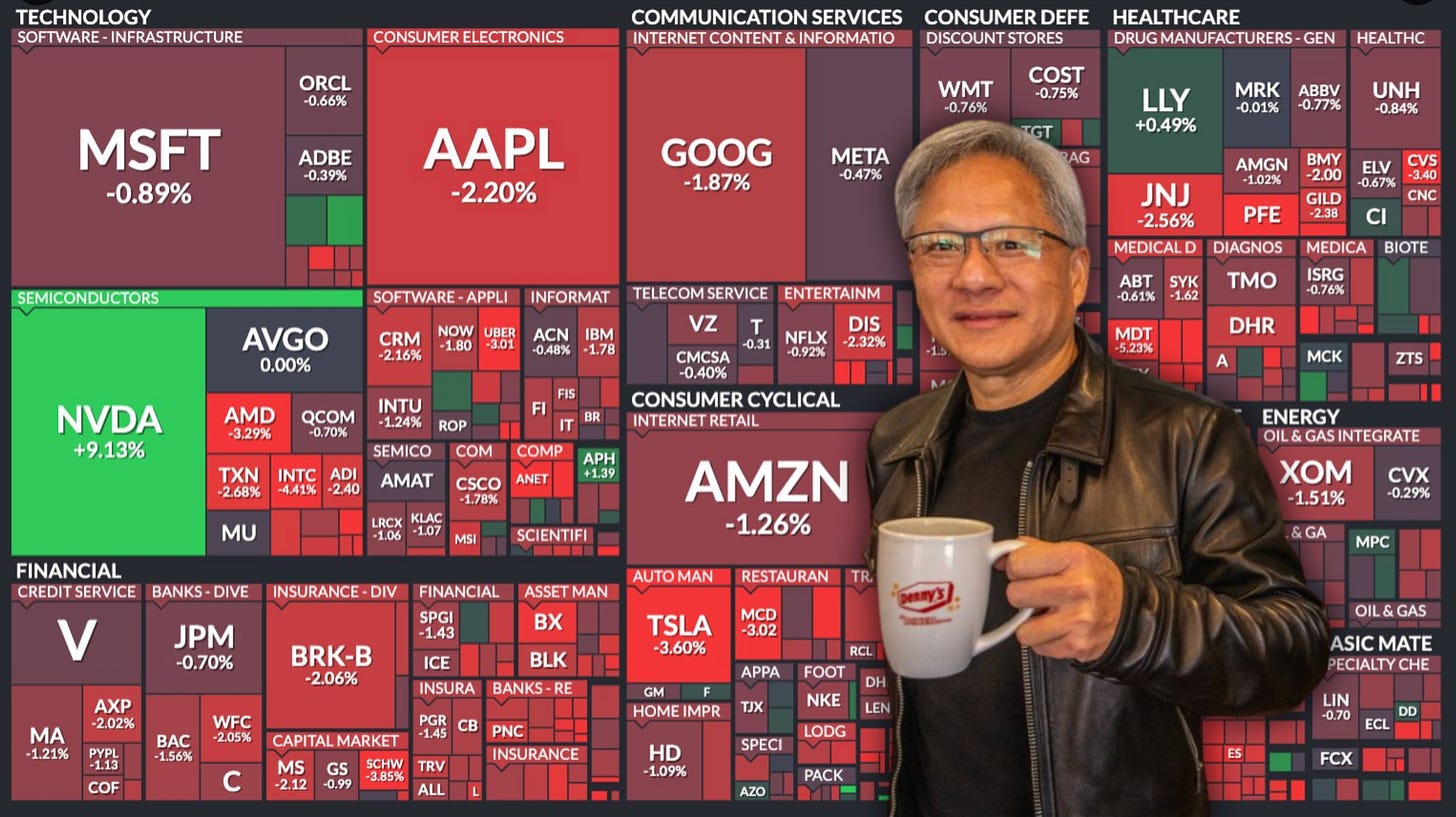

In other news, Nvidia reported earnings again, or dare I say, exceptional earnings, spiking 10% the following trading day while the Dow dropped 600 points, marking the worst day for the Dow in 2024 so far. On top of that, the SEC approved the Spot Etherum ETF and the Trump campaign announced it will be accepting crypto donations.

Let’s get into it.

In this issue:

💻 Microsoft’s interesting new AI feature

📈 Nvidia releases Q1 FY2025 earnings

🇺🇸 Trump accepts crypto donations

FEATURED STORY

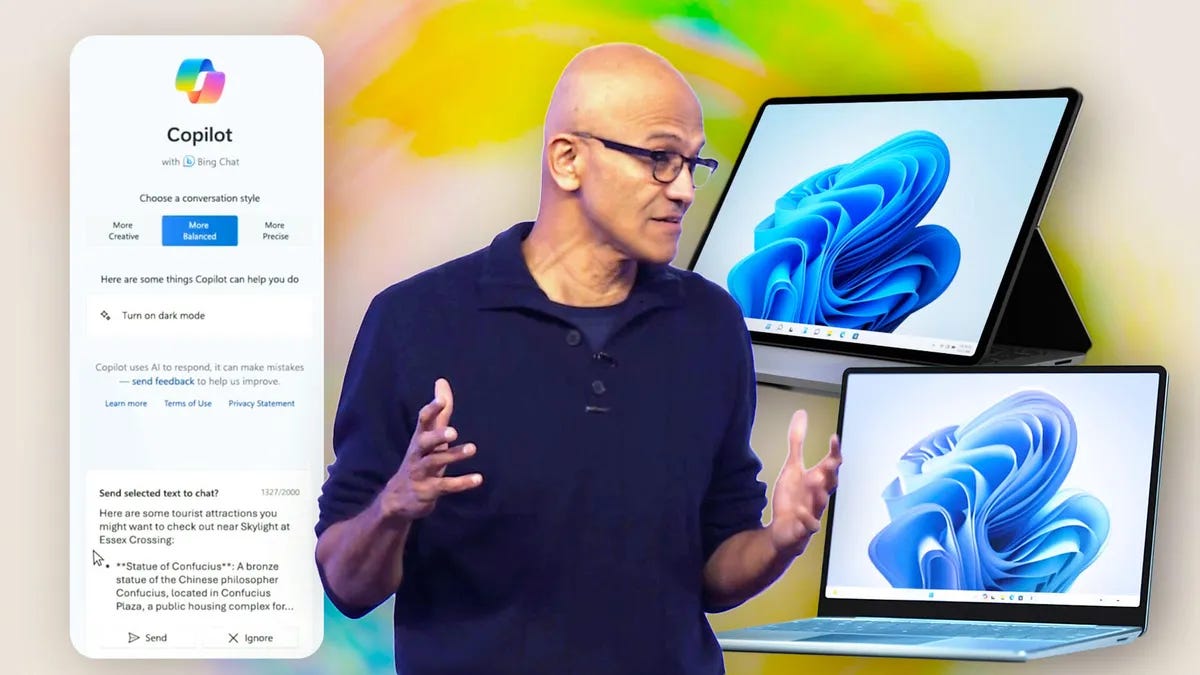

💻 Microsoft’s interesting new AI feature

Microsoft (MSFT), the most valuable publicly traded company on earth with a market cap of over $3 trillion and the oldest “Magnificent 7” company, held their Surface Event this week. As you may have guessed by now, it was all about AI, and one AI announcement has been gaining some attention.

Microsoft’s AI strategy

With AI at the forefront of the market and the current world, Microsoft is in a position to capitalize on this interest. And it has been doing just that. Enter Microsoft’s $11 billion investment in OpenAI.

As I mentioned last week, there are only two major AI development players: OpenAI and Google. Microsoft doesn’t create the AI, but it has invested heavily in one of the companies that does, bringing them to the forefront of AI development indirectly and allowing them to gain front-row access to the newest AI technologies. These AI technologies are then integrated into their suite of products. Azure Cloud, Microsoft 365, and Bing are just a few of the products that benefited from AI enhancements almost immediately after the launch of ChatGPT. And that wasn’t a coincidence.

The speed of these AI integrations was all thanks to the OpenAI partnership, which gave Microsoft a significant advantage, generating over $12 billion in extra annual revenue and causing Google and the other Big Tech giants to take over six months to catch up.

They again flaunted their access to the newest AI at the Surface Event by releasing some new features.

The interesting new AI feature

During the Surface event on Tuesday, Microsoft announced a new AI-powered feature for Copilot+ Windows devices called Recall. Recall takes screenshots of your screen and stores them in a timeline for you to search for later. Screenshots are taken every five seconds.

Many people were a little weirded out by this feature when it was announced, and it became a controversial topic overnight in the tech space. This isn’t something revolutionary, and most people believe it’s a privacy concern, including the UK’s data watchdog, who is inquiring Microsoft about their concerns.

Microsoft said the purpose of the feature is as a search tool to help users locate the content they’ve previously viewed on their device. And that’s a great idea. However, my concern is that the amount of data collected from running this feature is not something to laugh about and could include sensitive information from login details on websites and much more. Not to mention, all of this information is saved somewhere locally on your PC by Microsoft’s AI.

FINANCE

a. 📈 Nvidia releases Q1 FY2025 earnings

This week, the hottest stock in the market, Nvidia (NVDA), released earnings, wowing analysts again. Since that’s not enough, they also announced a 10-for-1 stock split and raised their dividend by 150%, sending the stock up 10%, locking in a market cap gain of $200 billion in a day when most of the market was down. Here’s how they performed:

NVDA Q1 FY2025 (GAAP):

Earnings per share: $5.98 vs. $5.60 expected.

Revenue: $26.04 billion vs. $24.59 billion expected.

Announced 10-for-1 stock split (ex-date June 7).

Raised quarterly divided by 150% to $0.10/share.

Net income was $14.88 billion, or $5.98 per share, up 462% from $2.04 billion, or $0.82 per share a year ago. Revenue rose 267% to $26.04 billion from $7.19 billion the previous year.

b. 🏦 Citigroup fined for $190 billion mess-up

UK regulators together fined Citigroup a combined £62 million ($79 million) for trading system failures that dumped nearly $189 billion worth of stocks onto European stock markets a few years ago. These fines were reduced by a third after discussions with Citi surrounding the matter.

The mess-up happened in May 2022, where an experienced trader sold $1.4 billion worth of stocks on accident, triggering a “flash crash.” The Financial Conduct Authority said the trader wanted to sell just $58 million, but made an error, resulting in an order to sell $444 billion. Citi blocked $255 billion of that, but $189 billion was sent for sale over the rest of the day.

BUSINESS

c. 🎟️ Ticketmaster sued by the DOJ

The U.S. Department of Justice has sued Ticketmaster and its parent company, Live Nation Entertainment (majority owned by Liberty Media), on the grounds of operating an illegal monopoly over live events in the U.S. The DOJ aims to break up the two companies.

Ticketmaster and its parent company have faced criticism from major artists like Taylor Swift and Bruce Springsteen in the past. Now, the DOJ alleges that the company engaged in anti-competitive practices, such as using long-term contracts to exclude rivals, blocking venues from using multiple ticket sellers, and threatening venues with financial repercussions if they didn't choose Ticketmaster and much more.

d. 🦞 Red Lobster files for bankruptcy

Red Lobster, the all-you-can-eat shrimp restaurant, has filed for Chapter 11 bankruptcy. The company plans to keep its restaurants open during the process but will reduce the number of locations. There are many rumours about how Red Lobster went bust, including CNN’s report that their endless shrimp deals were the cause. However, it’s more than just the shrimp.

In 2014, Red Lobster was bought by private equity firm Golden Gate Capital. Usually when a PE firm takes over a company, it will finance the deal by loading the company with debt. In Red Lobster’s case, Golden Gate not only added debt to Red Lobster’s balance sheet, but sold off Red Lobster’s $1.5 billion in real estate assets, forcing the company to lease their locations back to themselves, costing Red Lobster $200 million a year in rent. Golden Gate then sold the company off.

POLITICS

e. 🇺🇸 Trump accepts crypto donations

Former President Donald Trump’s 2024 campaign announced on Tuesday that they are now accepting cryptocurrency donations. His campaign launched a website for donations via Coinbase, making him one of the first major U.S. party Presidential nominees to do so.

This move comes as Trump gains on President Joe Biden’s fundraising lead, with Trump and the Republican National Committee raising $76 million in April, whereas Biden raised $51 million. Out of Trump’s $7 billion net worth, about $3 million is in cryptocurrency.

f. 🗺️ World Court votes on halting Israel offensive

The International Court of Justice (ICJ) will rule on Friday on South Africa’s request to stop Israel’s Rafah offensive in Gaza. While ICJ decisions carry some international weight, the court has no enforcement power over its rulings. In fact, some argue a ruling against Israel could further its isolation.

Israel’s retaliation on Gaza followed an Oct. 7 attack last year by Hamas-led militants, killing 1,200 people and seizing over 250 hostages. As of now, Gaza’s health ministry has reported over 35,000 Palestinians killed and 10,000 missing.

“No power on Earth will stop Israel from protecting its citizens and going after Hamas in Gaza.” — an Israeli government spokesman.

📚 Book of the Week

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

Titan: The Life of John D. Rockefeller, Sr. — Ron Chernow

Book Description:

From the acclaimed, award-winning author of Alexander Hamilton: here is the essential, endlessly engrossing biography of John D. Rockefeller, Sr.—the Jekyll-and-Hyde of American capitalism. In the course of his nearly 98 years, Rockefeller was known as both a rapacious robber baron, whose Standard Oil Company rode roughshod over an industry, and a philanthropist who donated money lavishly to universities and medical centers. He was the terror of his competitors, the bogeyman of reformers, the delight of caricaturists—and an utter enigma.

Drawing on unprecedented access to Rockefeller’s private papers, Chernow reconstructs his subjects’ troubled origins (his father was a swindler and a bigamist) and his single-minded pursuit of wealth. But he also uncovers the profound religiosity that drove him “to give all I could”; his devotion to his father; and the wry sense of humor that made him the country’s most colorful codger. Titan is a magnificent biography—balanced, revelatory, elegantly written.

As of Jan 31, 2024, (resulting from my Amazon.ca Associates account being terminated) I don’t earn any affiliate commissons from the links below.

✩ This newsletter, along with my weekly Morningstar fair value estimates and PDFs, will always be free of charge. Your support, whether through a donation or by reading this newsletter and following along, is greatly appreciated.

Thank you for reading today’s Weekly Brief! If you enjoyed or learned anything, please spread the word. Credit to

for sharing that Palo Alto quote which I had to write about here. Have a great week ahead!— Jacob