Weekly Brief #33

Are cybersecurity stocks the new AI craze?...Cybersecurity stocks' business analysis, Amazon’s ChatGPT rival and a Temu competitor, Target partners with Shopify, VW invests $5 billion in Rivian.

Good morning investors 👋,

Happy Friday and welcome, or welcome back, to the 33rd Weekly Brief.

Markets continued to rise again, both domestic and international (for the most part), this week, ahead of the much-anticipated US inflation report. They reached all-time highs again, with Amazon surpassing the $2 trillion market cap for the first time ever and Salesforce rebounding over 5% from its 21% loss last quarter. Did I forget to mention that Amazon also announced a ChatGPT rival called ‘Metis’ and a discount shopping experience to compete with Temu and Shein?

Also, this Friday is the last stock trading session of Q2 2024.

(I had to remove the ‘politics’ section for this week due to email length requirements, but let me know if you’d even like it to comeback next week. I’ll link a poll below for you all to decide. I replaced it with a ‘top stories’ section. (If the section were to be removed, I could make the ‘featured story’ and the analysis involved much longer.))

Let’s get into it.

In this issue:

🧑💻 ‘Big 4’ cybersecurity stocks analysis

🛍️ Amazon’s ChatGPT rival, ‘Metis’

🚀 SpaceX worth $210 billion

FEATURED STORY

Are cybersecurity stocks the new AI craze?

When a problem occurs in the world, there will be companies that somehow find a way to capitalize on that problem. When war occurs, which is arguably the largest problem humanity faces, Lockheed Martin steps in to capitalize on defense contracts from the US government. After Russia’s invasion of Ukraine, not only did Lockheed capitalize on military contracts, but oil giants like ExxonMobil, Shell, and TotalEnergies paid shareholders $200 billion in extra dividends after the rise in oil prices.

Then comes cybersecurity. Cyberattacks become more common and easier to execute every day that passes, resulting in losses of nearly $13 billion annually from these attacks, a figure that is growing at a rate of 6% per year. As cybertheft and the crimes resulting from it reach all-time highs, so do the biggest companies selling cybersecurity services.

These companies are Palo Alto Networks, CrowdStrike, and Fortinet (and Cisco, but that's a different issue). In the past year, the stocks of these three companies have risen by 34%, 200%, and fallen by 17%, respectively.

Individuals like us are like everyone, subject to these cyberattacks, but we normal individuals can’t pay Palo Alto Networks or CrowdStrike millions, if not billions, of dollars a year to prevent these incidents. If these companies were like Netflix and charged a $10 monthly fee to the masses, it would take a long time to accumulate such funds, and it would cost too much to convince everyone to subscribe to the service in the first place. And, of course, it probably wouldn’t be worth it to pay for such a service personally.

However, businesses, companies, governments, enterprises, and organizations with vast amounts of data, employees, and more money than any average individual are in need of protection from these potential attacks. Therefore, cybersecurity services are very useful to them. So useful, in fact, that the industry is expected to nearly double over the next 5 years, reaching a projected $485 billion by then. As of 2024, it is currently worth $268 billion.

But it’s worth noting that none of the companies I want to cover today is a clear winner in this industry. Unlike companies like Visa & Mastercard, Intuit, Google, or even Canadian National & Canadian Pacific, which control their entire industries alone (card networks, small business software, search engines, and North American railroads), cybersecurity becomes incredibly niche. Palo Alto Networks, CrowdStrike, and Fortinet each appear to be leaders in specific cybersecurity software, but that turns out to be false. Here’s what I mean:

Palo Alto Networks

Market share (total cybersecurity market): ~12-15%.

Market share (next-generation firewall (NGFW) and advanced threat detection): ~20-25%.

CrowdStrike

Market share (total cybersecurity market): ~5-8%.

Market share (endpoint security): ~12-15%.

Fortinet

Market share (total cybersecurity market): ~10-12%.

Market share (NGFW and advanced threat detection): ~15-20%.

There’s no clear ‘winner’ in any of these markets, whether the industry as a whole or the niche industries within the industry because its a firece industry, a growing one, and one with much competiton. Palo Alto is a leader in cybersecurity, and a bigger leader in NGFW, same goes for Fortinet. Yet, neither are the inherent leader. At least from the data I’ve looked at, there seems to be no de facto leader no matter how niche you get with product offerings of each company, or the industry as a whole, in cybersecurity.

When it comes to CrowdStrike, who’s revenue is almost entirely from subscription revenue from endpoint security software of their ‘Falcon’ service, a ~12-15% market share is amazing. However, diving deeper, you find that Broadcom controls ~10-20% and Microsoft holds ~10-13% of the same niche industry, which is CrowdStrike’s core product offering (among other offerings, of course). How does that make CrowdStrike a good company to invest in?

Even if there were a de facto leader in any of these sectors, based on the data above, it would only be by a margin of 1-5%, which isn’t big enough to create a moat. There’s little room for companies, even the major players, to create a competitive advantage in this industry. Why? Because every cybersecurity company has dipped their toes in every niche sector of the industry (not every cybersecurity company, but you understand what I’m getting at).

But this is still a rapidly growing industry. At the end of this high-growth cycle, there has to be clear winners over the other players in this industry, right? If so, how do you spot the odd ones out? We know from Salesforce and Intuit that what makes a good successful software business is (1) a good product and (2) a good product that encaptures the customer. Let’s look at Falcon for example, CrowdStrike’s core offering:

The spider web fallacy

Falcon, as mentioned above, is an endpoint security software. What it does is constantly monitor all activities on devices, looking out for any signs of unauthorized access or malicious activity. It’s constantly updated with the latest information about new cyber threats and can quickly identify and respond to any suspicious behaviour. Pretty cool, but that’s not all. Much like how Salesforce and Adobe coax the customer (not forcefully, but by recommending) into using their suite of products rather than competitors, this helps build a competitive advantage and brand recognition over the long term.

For example, a first-time Salesforce customer will try their well-known CRM software. After using that software and enjoying its functionality, that same customer will look for more software solutions within the same company for convenience. The more software they use from the company, the harder it is for them to stop using it. I like to call it the spider web fallacy for software companies: customers are lured in by a main software and then stay with the same company, expanding their usage of its software, becoming dependent on their services.

The thing is, CrowdStrike doesn’t require the customer to opt-in to more subscriptions of software like Salesforce’s ‘spider web fallacy’ strategy entails. It’s all there from the start. You don’t have to be ‘baited by the spider’ into different software services because as soon as you land on the web, every software CrowdStrike sells, you’re already attached to.

In a market with such broad competition in niche industries and the industry as a whole, and no clear de facto leader in such industry, I believe this is how Palo Alto, Fortinet, and CrowdStrike are building a future market-leading position. If the market as a whole is expected to double over the next 5 years, cybersecurity companies want to take as much of that market share as they can. If they can’t do it just by growing, because someone likely already sells the product they offer, they’ll do it by building a brand moat while growing — a spider web fallacy.

I can’t dive too much into the fundamentals of each business sadly because I underestimated how lengthy describing these businesses would be. However, I will address these stocks in a separate issue sometime over the next month, covering everything I missed out on here. Be sure to look out for that. (These are amazing businesses.)

TOP STORIES

📦 Amazon’s ChatGPT rival and a Temu-Shein competitor

ChatGPT rivial: Amazon is reportedly entering the competitive AI chatbot market dominated by OpenAI and ChatGPT, with a project on the table called Metis, (named after the Greek goddess of wisdom). Metis is set to debut at Amazon’s annual Devices and Services event in September, and according to a report the chatbot will utilize Amazon’s proprietary AI model, Olympus ‘wielding’ (fits the Greek goddess vibe) conversational engagements, information retrieval, and image generation. It will also be integrated into Alexa.

Amazon Temu-Shein competitor: Amazon hosted a closed-door event for sellers in China this week, where it talked about plans for a new budget store that sells low-cost clothes, home goods and other items to directly compete with Temu and Shein, that have grown in popularity in the U.S. It wasn’t told when this store will be released but Amazon said in the event it will start accepting products this fall.

🛍️ Target partners with Shopify

Target Corporation, the second-largest US retailer, has partnered with Shopify this week to allow Target Plus, Target’s digital marketplace, to be integrated with Shopify’s merchants and their products. This move is hoping to introduce new, trendy products and brands, enhancing the shopping experience with more affordable and high-quality options from Shopify’s sellers.

For the first time, Target will also bring select products from Shopify merchants into its physical stores, ‘blending online and offline shopping for a better experience.’ (Shopify merchants in the U.S. can apply to sell on Target Plus through Marketplace Connect to connent selling and inventory management.)

🚘 VW invests $5 billion in Rivian

In a sudden turn of events in the eletric vehicle space, Volkswagen Group announced it plans to invest up to $5 billion in Rivian, starting with an initial $1 billion investment with $4 billion expected by 2026, and $1 billion each in 2025 and 2026, followed by $2 billion related to a joint venture in software technology between the two companies.

Shares of Rivian soared over 30% in the day following the announcemrnt, but still down 40% year-to-date. Rivian CEO RJ Scaringe stated that the investment will help Rivian become cash flow-positive, and support the production ramp-up of its R2 SUVs in Illinois starting in 2026. (Fun fact: Rivian loses money for every car it sells and is losing nearly $2 billion every quarter.)

🚀 SpaceX scores $210 billion valuation

Elon Musk’s SpaceX is set to launch a tender offer sometime in the coming weeks that could value the company at $210 billion, a record for any privately held U.S. company. (Shares will be sold to employees and insiders at $112, which makes its valuation surge to $210 billion.)

The tender offer terms are not yet finalized, but if completed, SpaceX will be the second most valuable private company in the world, just behind TikTok owner ByteDance, valued at $268 billion. (SpaceX, however, operates the largest satellite network of any company in the world.)

📚 Book of the Week

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

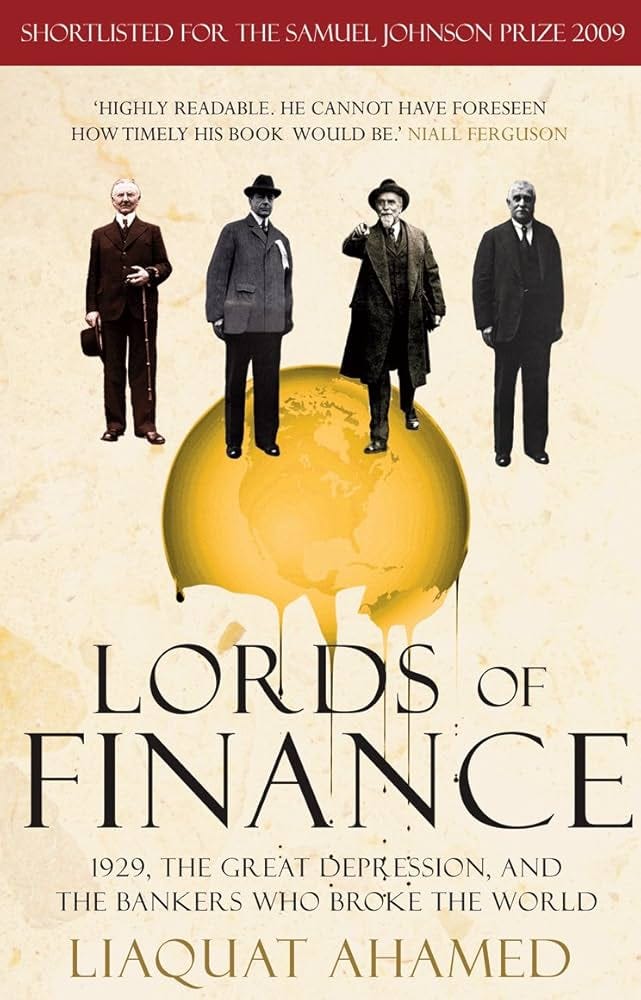

Lords of Finance — Liaquat Ahamed

Book Description:

It is commonly believed that the Great Depression that began in 1929 resulted from a confluence of events beyond any one person’s or government’s control. In fact, as Liaquat Ahamed reveals, it was the decisions made by a small number of central bankers that were the primary cause of that economic meltdown, the effects of which set the stage for World War II and reverberated for decades.

As we continue to grapple with economic turmoil, Lords of Finance is a potent reminder of the enormous impact that the decisions of central bankers can have, their fallibility, and the terrible human consequences that can result when they are wrong.

✩ This newsletter, along with my weekly Morningstar fair value estimates and PDFs, will always be free of charge. Your support, whether through a donation or by reading this newsletter and following along, is greatly appreciated.

Thank you for reading today’s Weekly Brief! If you enjoyed or learned anything, please spread the word.

— Jacob