Weekly Brief #42

Consumer spending and recession possibilities... Berkshire hits $1 trillion market cap, Musk and Tesla win dogecoin lawsuit, OpenAI’s $100 billion valuation, Lockheed’s $1.3 billion missile contract.

Good morning investors 👋,

Happy Friday and welcome, or welcome back, to the 42nd Weekly Brief.

Note to reader: Lately, I’ve been struggling with creative distribution. (It took me way longer than it should have to come up with that phrase, believe me.) What I’m saying is that normally, when an idea comes to my mind for a newsletter issue, I’d go ahead and write a draft as soon as possible and spend a week revising and adding to the draft until eventually posting it.

Over the past few weeks, I’ve come up with many ideas and started way too many drafts but can’t seem to write them down and perfect them into an issue. For example, I’ll say, “Next week, I have a MercadoLibre stock analysis coming out,” or something along those lines, but I just never end up writing the issue well enough to allow myself to post it. (By the way, I’m still working on that MercadoLibre analysis.)

So from now on, maybe over the next month or two, I’m going to take it slow. I’m going to take my time, finishing the 11 or so drafts I have, one by one, and scheduling them weekly without giving notice of when they will be released. I feel that for some reason, when I say I’m going to finish an issue, or I announce when another stock analysis or particular issue will be released, it never gets released.

Hope this makes sense. Now, let’s get into it.

In this issue:

📉 Are we entering a recession?

💰 OpenAI’s $100 billion valuation

🇲🇽 Mexico suspends embassy relations

FEATURED STORY

📉 Are we entering a recession?

One of God’s greatest gifts is knowing when an economic downturn will happen. It seems as though every time some analyst at UBS or Bank of America runs their mouth about recession possibilities, they are more often wrong about whatever just came out of their mouth.

Trying to predict economic factors and the economy as a whole has always been foul play. For those who bet against their predictions being right, it has historically been outright gambling. Throughout the year of 2024, investors, analysts, and that dog down the street that barks and wakes you up every morning, have all been predicting an economic downturn. These are the same figures that predicted one back in 2022, only to be disappointed by a stable economy two years later.

But are we actually entering a recession?

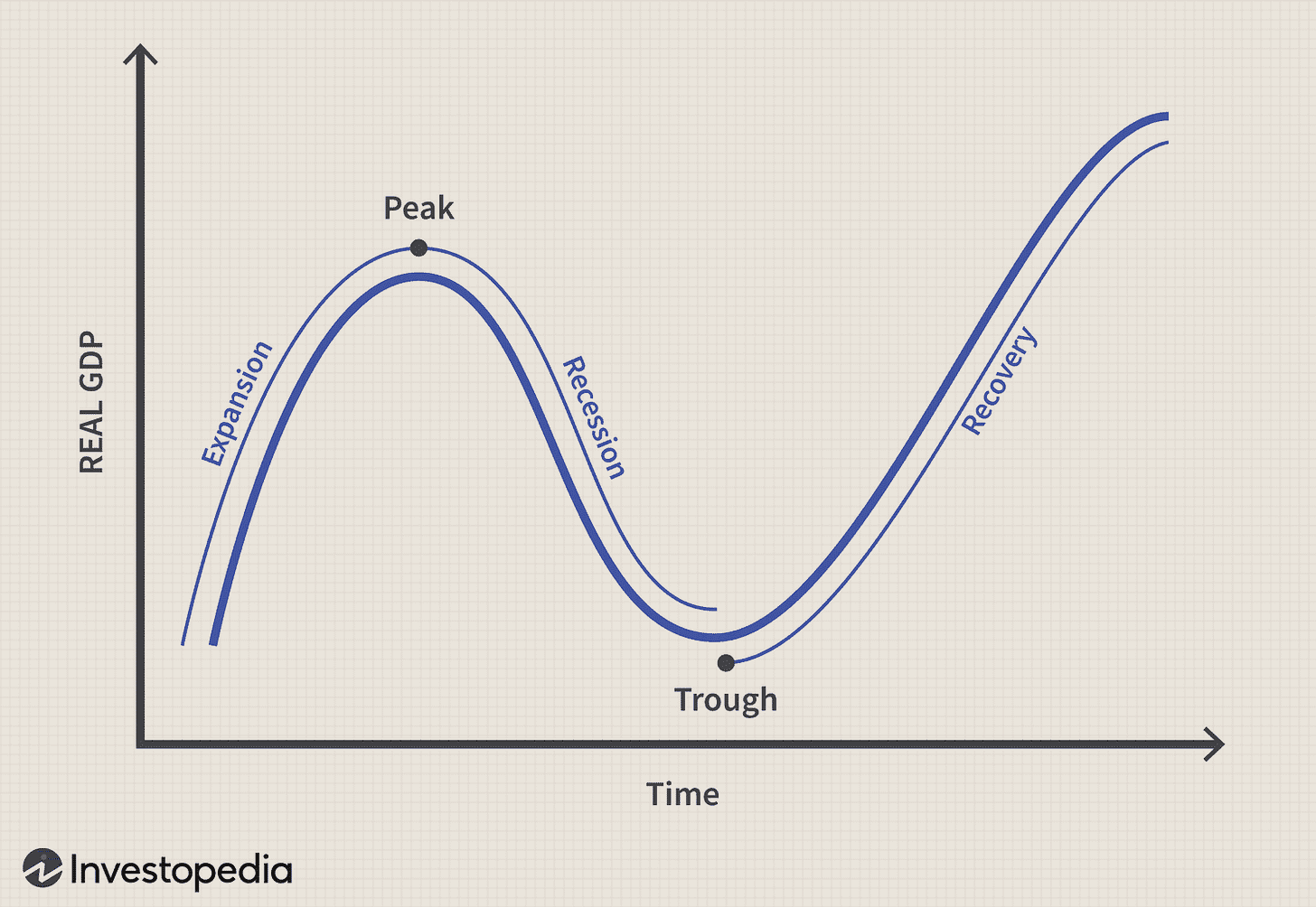

A recession is caused by a decline in GDP over a couple quarters. That decline is, in turn, caused by other factors as well, including unemployment, inflation, and interest rates or whatever it may be. As economic conditions tighten, consumers spend less, which affects businesses and, in turn, the stock prices of public businesses specifically. What it all eventually leads to is a sell-off in financial markets. Id est, stocks go down in a recession. (This is when you clap.)

It’s why technically speaking, one of the better ways to try and understand if we’re entering a recession is if consumer cyclical businesses are starting to tighten. If revenue is starting to pull back. If guidance is lower than expected. Companies like McDonald’s, PepsiCo, Starbucks, Nike, Lululemon, Estee Lauder, and Ulta Beauty.

All of the latter companies for the most part, are currently struggling. Others, like Dollarama and Amazon, have recently said they’re seeing a more price-conscious consumer looking for the best value for their money.

I’m not trying to insinuate or predict anything here; keep this in mind. There’s absolutely no way to accurately predict a recession. Above all, I’m literally the last person to come to when wanting answers for the macroeconomic environment. However, it’s definitely intriguing that of all the insanely specific macro indicators these analysts look at to predict recessions, they miss the easiest one: a price-conscious consumer. A struggling or price-conscious consumer can be one of the best indicators of economic weakness.

So are we entering a recession?

Well — and you’re going to hate me for this — but no one knows. All of the data we have regarding the economy right now says the economy is at its best and growing. The Fed and the BoC are both expected to and are currently lowering rates, unemployment isn’t terrible, and stocks are at all-time highs. But it’s interesting to see that, among all these factors, consumers are doing the worst.

As an investor, you’re going to experience a recession every so often, and it’s best not to worry or expect it to happen. After all, a recession on average lasts a year, which in the investing world is not that long at all. Keep saving consistently, keep growing your income, and keep investing regardless of whatever else happens with the economy. Over the long term, the economy will continue to rise, and so will your stocks. And that’s about it.

FINANCE

📈 Berkshire hits $1 trillion market cap

Warren Buffett’s Berkshire Hathaway officially topped the $1 trillion market value mark for the first time this Wednesday, making Berkshire one of just six other U.S. companies who’ve reached the same milestone, and the first one of the six to not be a technology company.

Buffett has led Berkshire since 1965, growing it into a powerhouse generating over $10 billion in profit every quarter. Since Buffett took charge of the company, Berkshire shares have gained over 5,600,000%, nearly doubling the annualized gain of the S&P 500.

🧑⚖️ Musk and Tesla win dogecoin lawsuit

Elon Musk and Tesla won the dismissal of a federal lawsuit this week, accusing him and the company of defrauding investors through dogecoin promotions and insider trading during the ‘crypto craze’ in 2021.

The ruling by U.S. District Judge Alvin Hellerstein on Thursday said that Musk’s dogecoin-related statements were mere ‘aspirational puffery’ and not actionable fraud. Therefore, the investors who had claimed a whopping $258 billion in damages, alleging Musk manipulated dogecoin’s price and profited from it, were wrong. (‘Aspirational puffery’ is such word salad though.)

BUSINESS

💰 OpenAI’s $100 billion valuation

Apple and Nvidia, along with Thrive Capital and Microsoft, are reportedly in talks to invest in an OpenAI, potentially valuing the company at over $100 billion. OpenAI was valued at a reported $80 billion last year and $29 billion the year before that. All this, for a company with annual revenue of <$2 billion.

Apple has now integrated ChatGPT into its devices and is set to gain an observer role on OpenAI’s board from their partnership together, while Nvidia hasn’t yet confirmed anything regarding their investment. (Microsoft, which is OpenAI’s largest investor, is entitled to 49% of future profit distributions of the company.)

🪖 Lockheed’s $1.3 billion missile contract

The U.S. Army this week awarded Javelin Joint Venture (JJV) a $1.3 billion contract for Javelin missiles and related services for fiscal year 2024. This is the largest single-year Javelin production contract to date. (JJV is a partnership between Raytheon and Lockheed Martin.)

JJV is ramping up production to 3,960 missiles per year by late 2026, and the contract addresses increased global demand, including for Kosovo, and includes over 4,000 missiles to replenish supplies sent to Ukraine. To date, over 50,000 Javelin missiles and more than 12,000 Command Launch Units have been produced.

POLITICS

🇲🇽 Mexico suspends Canada and U.S. embassies

Mexican President Andrés Manuel López Obrador (wow, what a name) this week announced a complete pause in relations with the U.S. and Canadian embassies after their ambassadors criticized a proposal of his regarding judicial reform that aims to have judges elected by popular vote.

U.S. Ambassador Ken Salazar called the reform a ‘major risk to Mexico’s democracy’ and warned of potential impacts on trade between the countries. Lopez Obrador said the pause would continue ‘until the embassies respect Mexico’s sovereignty.’

📚 Book of the Week

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

Homo Deus — Yuval Noah Harari

This book is the sequel to last week’s book recommendation, Sapiens. — Jacob

Book Description:

Yuval Noah Harari, author of the bestselling Sapiens: A Brief History of Humankind, envisions a not-too-distant world in which we face a new set of challenges. In Homo Deus, he examines our future with his trademark blend of science, history, philosophy and every discipline in between.

Homo Deus explores the projects, dreams and nightmares that will shape the twenty-first century — from overcoming death to creating artificial life. It asks the fundamental questions: Where do we go from here? And how will we protect this fragile world from our own destructive powers? This is the next stage of evolution. This is Homo Deus.

✩ This newsletter, along with my weekly Morningstar fair value estimates and PDFs, will always be free of charge. Your support, whether through a donation or by reading this newsletter and following along, is greatly appreciated.

Thank you for reading today’s Weekly Brief! If you enjoyed or learned anything, please spread the word.

— Jacob