Hey investors,

First off, Happy Halloween. Second, welcome to the very first-ever exclusive Partner Update of the J. Nicholas newsletter—a paid-subscriber issue where I discuss my investment portfolio over the past month, recent trades, current watchlist, and the business side of this newsletter, including its revenue, profit, subscriber growth, and future outlook, in-depth.

Last week, I announced I’d be taking this newsletter full-time with the goal of making it my primary income. I enjoy writing, especially about finance, and an opportunity presented itself to potentially make a living from this passion. So, I took it. In today’s issue, we’ll cover this decision and how I plan to make a living from it, my new content schedule, and this month’s portfolio performance, recent trades, and current watchlist. (Since this is the first issue of its kind, it will be longer than the typical post.)

Note: I’ve decided to allow all subscribers, both free and paid, to read this exclusive issue. This is a one-time decision I made at the start of the week because I wanted everyone to see what this issue looks like and understand the future outlook of the newsletter.

Let’s get into it. (17 min read)

Portfolio Review

I believe it was on YouTube where I read a comment saying Bill Ackman looks like the son of Jeff Bezos and George Clooney. It’s stuck in my head forever now. So I thought I’d make you suffer alongside me by mentioning it, even though I didn’t have to, and even though it’s irrelevant to the rest of today’s post. Sorry, not sorry. Enjoy.

Investment strategy

I like to think my investment strategy is mostly a mix of Charlie Munger with a sprinkle of Warren Buffett and Bill Ackman. Buffett is a prime inspiration for the foundational principles of my investment strategy. He’s the one who got me interested in the stock market, which led to where I am today with my finances and this blog. But I don’t invest exactly like Buffett; I choose to invest more like Munger, who followed GARP (more on this below). But just so you can understand all sides, let’s talk about Buffett and Ackman first.

I appreciate how both Buffett and Ackman always steer their strategies towards a very long-term view, and how they both prefer concentrated portfolio strategies, investing in wide-moat, competitively advantaged businesses trading at discounted prices, holding these businesses until the price becomes inflated or the moat weakens.

It’s a simple and highly effective strategy, which is precisely why I love it. (I’m still working towards concentrating my portfolio, and you’ll see how that progresses over the next few months in these posts.)

Ackman’s unique trait, is his ability to get actively involved in the businesses he invests in. It’s called activist investing, and he’s possibly the best at it. It wasn’t until recent months that I started to appreciate Ackman and his strategy after listening to an interview with him and Lex Fridman. Turns out, I didn’t just like how he invests, but also his priorities in life and even his mindset. Much of what he shared in that particular interview personally resonated with me.

Buffett’s strategy has always been to focus on undervalued companies at a good price, holding them until the multiple expands. Yet, after Charlie Munger came into the picture, Buffett’s style slightly changed to investing in great companies at a reasonable price, or Growth at a Reasonable Price (GARP). This is where my influence of Munger’s strategy comes into play.

GARP involves investing in businesses with strong economic moats and growing or reaccelerating free cash flow, buying them at a reasonable price. It doesn’t have to be incredibly cheap like value investing entails, but it also doesn’t permit investing in absurdly-valued growth stocks. Simply, stocks trading at a “good price.” (It’s subjective.)

I follow GARP, and my goal is to obtain a 12-15% annual return consistently.

Beating the market doesn’t matter to me, as that’s usually a losing game. All I care about is obtaining these returns.

When I started investing last year, I thought I knew everything and therefore invested in everything. That was wrong.

Long story short, I eventually picked up the slack, learned about the different strategies, read a few books, and found myself drawn to the GARP strategy. I officially switched to this strategy in June, and that’s where I am now—the strategy I’ll be following, and where I plan to stay for the rest of my investing career.

What I learned from the past year: Don’t switch strategies often; stick to your goals, don’t slack on research, read some books, and you’ll do great long-term. More importantly, don’t lose money. Buy and leave your stocks alone for a few years, even decades. Adapt a long-term view. There will be market downturns and stocks will go down, up, sideways; everything. But in the long-term, picking the right businesses, or investing in the right ETFs, is all it takes to grow your wealth.

Warren Buffett quote to end this off:

“The first rule of investing is don’t lose. It’s that simple. Rule number one: never lose money. Rule number two: never forget rule number one.”

Holdings, recent trades, performance, & watchlist

My current portfolio consists of 10 wonderful businesses:

Amazon (19.3% of portfolio)

Leader in e-commerce and online retail, with a 40% market share globally, and the largest player in cloud computing with a 33% market share. A wide-moat business with numerous opportunities for future growth, including robotics, subscriptions, LLMs, advertising, third-party logistics services, streaming, and Project Kuiper (Starlink competitor).

MercadoLibre (12.2% of portfolio)

“Amazon of Latin America,” the largest e-commerce and online retail company in the Western Spanish-speaking nations, with a market-leading fintech business in that market. As more users turn to MercadoLibre (currently only 25% of online consumers use MercadoLibre, compared to Amazon’s 70% in North America), a ripple effect will trickle down on its fintech, advertising, and logistics businesses, fuelling growth as the South American economy grows.

American Express (12.0% of portfolio)

Third-largest card network globally, and one of the largest credit card issuers in the world. Has a unique moat on consumer data within its products, leading to higher network fees and better benefits for cardholders, encapsulating a value proposition like none other in the financial space. Newer generation cardholders, who spend more, coming to the Amex franchise will fuel growth for the company.

Disney (11.1% of portfolio)

Second-largest entertainment company below Netflix in streaming, owner of valuable IP of popular brands and channels like Star Wars, Pixar, Marvel, 20th Century Fox, ESPN, Disney Classics, and many, many more. As the box office continues to rebound from COVID, and as Disney starts releasing more desired content, they will see hits at the box office. From this, Disney+ will benefit, along with Disney Parks and Disney’s licensing business (which are unreplicable), fuelling growth.

Shopify (10.2% of portfolio)

Leader in small business e-commerce with a 30% market share in that segment in America. The secular trend of e-commerce adoption worldwide, its constant innovation, ease of use, software integration, and the growing Shop Pay payment network, which could eventually become a PayPal competitor, will fuel growth.

Lululemon (9.9% of portfolio)

Leader in the athleisure segment of fashion with a strong brand. People will always want to wear comfortable clothing, and Lululemon capitalizes on this ideal. While growth has significantly slowed in Canada and the U.S. as they reach saturation, Lululemon is experiencing very fast growth in their men’s and international segments, mostly in China, which will fuel growth for the company over the next few years.

Salesforce (8.0% of portfolio)

Unprecedented leader in enterprise customer relationship management software (CRM) worldwide, controlling about a 21.8% share, larger than the next four competitors combined. Holds a moat similar to that of Microsoft Excel, where their CRM software product is the standard of the industry. Free cash flow and earnings are now starting to expand rapidly as the company shifts from rapid growth and acquisitions to providing immense value to shareholders.

Google (6.5% of portfolio)

Leader in global online advertising, primarily driven by Google Search and YouTube. Holds incredible brand assets from Android to Gmail, helping solidify its massive lead. It’s the third-largest cloud computing company, but the fastest-growing one, and the leader in autonomous vehicles via Waymo. Google Cloud, Waymo, and an increase in subscription revenue will fuel growth for Google in the next 5, 10, potentially even 20 years.

Apple (5.6% of portfolio)

Largest smartphone manufacturer in the world, with a 27% market share. Holds brand recognition in what is likely every nation on Earth, with loyalty and an ecosystem like none other. Service revenue continues to grow, but most hardware revenue has been stagnant over the past few years. Apple’s bet on AI with Apple Intelligence is said to spark a massive upgrade cycle for devices, which is the main growth story for Apple, along with virtual reality and a new push to compete with Amazon and Google in the smart home market.

Dollarama (5.3% of portfolio)

Largest discount-retail store in Canada, with an amazing track record of consistent growth in the mid-teens. The push towards the Latin American market with a 60%+ stake in Dollarcity will further drive growth as the Canadian market becomes saturated.

I made two trades this month, both in the last week of the month, funnily enough:

I sold some Lululemon shares (trade 1) and bought some Google shares (trade 2).

Google reported incredible Q3 earnings (dare I say stunning; outstanding) this time around, with the company’s future intrinsic value drivers—subscription revenue and cloud—growing at a massive 25% year-over-year. Cloud alone grew 35% year-over-year, search grew by 15%, total revenue by 14% and EPS by 36%.

Those who follow me should know I’ve been very bullish on cloud computing. It’s one of the many reasons I own such a large amount of Amazon. This report from Google gave me another reason to further allocate my portfolio toward cloud as I await Amazon earnings this week (earnings should be out by the time I release this issue). Google has been spending an absurd (~$20 billion) amount of money on AI, but 35% growth means an incredible return on investment. These investments are working, and I love to see it. It makes me incredibly confident in Amazon and their massive reinvesting efforts.

With these growth aspects, while trading at a forward P/E of 18 and an OCF yield of 5%, Google is trading at a very justifiable valuation. If it weren’t for the DOJ attention pressuring the stock, the price would have skyrocketed after earnings. This report was absolutely incredible.

I did sell shares from my Lululemon position to cover this trade, since I’m being very conservative with my cash due to a lower income (the downside of going full-time in a career that isn’t making money yet). As the days go on, my confidence in fashion stocks shifts further and further to the wrong side, so this was a very easy trade. Don’t be surprised if I completely exit my Lululemon position over the coming weeks.

Personally, I believe that betting on cloud is an inevitable win, so buying into Google’s 35% cloud growth feels like an inevitable win in my eyes.

Along with Amazon, I’m awaiting Apple’s earnings on October 31, 2024, to see if the growth of the iPhone upgrade cycle (Apple’s outlook) justifies the absurd valuation Apple is trading at. If not (which—from my experience using Apple Intelligence—it isn’t, but we’ll see), then I’ll be selling my Apple position to enter into ASML. If not ASML, I’ll be building out my cash position. By the time this issue is released, earnings for these two companies will have been released.

So far, the investment theses on my holdings have remained strong throughout the month of October as we lead into the holiday season. That is, except for Apple and Lululemon, with the reasons stated above.

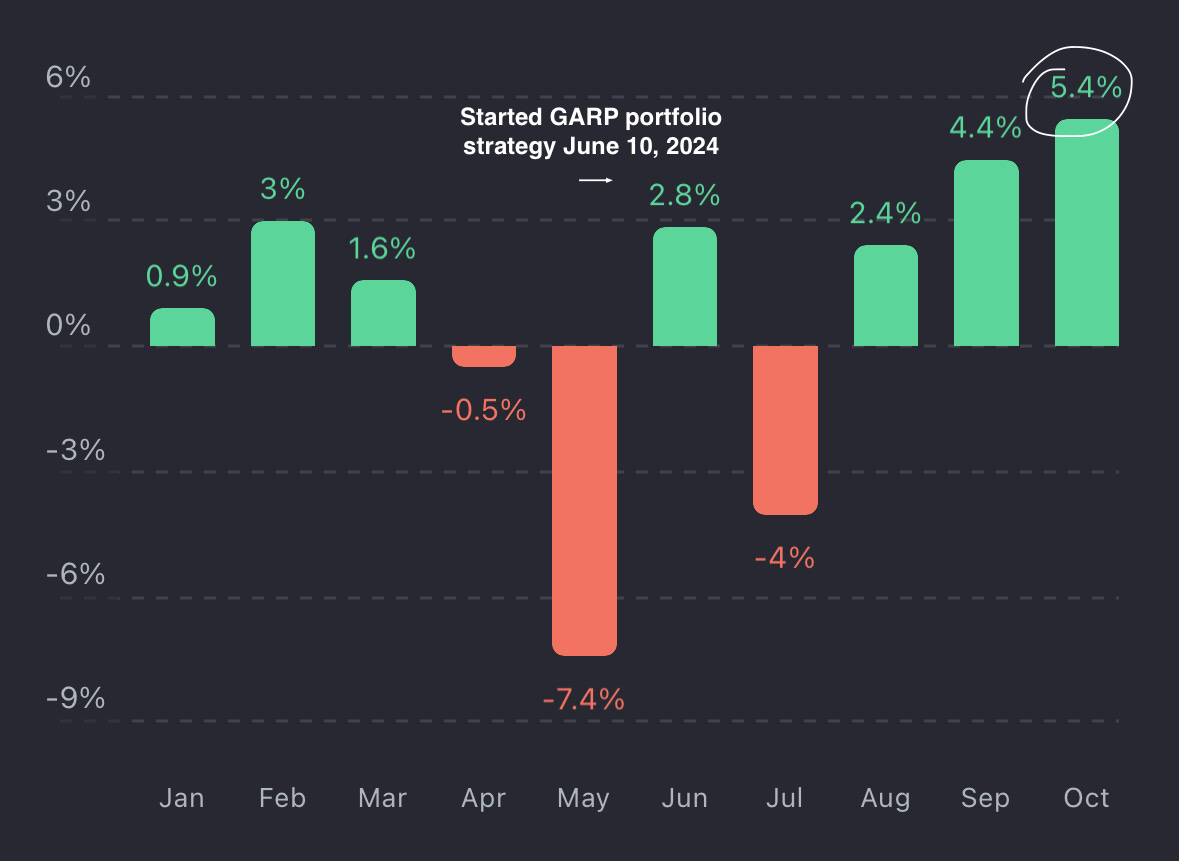

Since my switch to GARP back in June, my portfolio has returned 11.0%. In October, my portfolio rose 5.4%. While returns are interesting to measure on a monthly basis, I believe it’s worth noting that a month is short term, and returns are best measured in years; the long term. This is simply for visual purposes.

Watchlist

Here are the companies currently on my watchlist. These are businesses I would be confident enough adding to the portfolio with my current knowledge (at the right price, of course):

Adobe Inc.

ASML Holding N.V.

Booking Holdings Inc.

Coca-Cola Consolidated, Inc.

Costco Wholesale Corporation

Intuit Inc.

Mastercard Incorporated

Microsoft Corporation

Ferrari N.V.

S&P Global Inc.

KKR & Co. Inc.

ServiceNow, Inc.

Brookfield Corporation

Business (Newsletter) Update

As I wrote in a Blossom post last week, I’ve decided to go full-time into my passion for writing online here on this newsletter. Over the next year or so—potentially longer, maybe shorter—I have set goals for myself and have written plans to stick to, in order to achieve said goals.

Business goals (in business terms):

Reach 1,000 paid subscribers on J. Nicholas. (I want this to be the main source of revenue, as I don’t enjoy putting ads on my content.)

From those paying subscribers, roughly CA$75,000/year in revenue will be generated. This would be about 6.5x my annual expenses, giving me plenty of room to invest and some room to spend.

Outreach: To grow the newsletter subscriber base, I will be posting on Twitter, Blossom Social, and this newsletter (more below).

Growth

In the month of October, this newsletter gained 83 subscribers, a 20% month-on-month increase from September. Of that number, roughly 61% (51 people) came from Blossom Social, 22% (18 people) came from Substack, 16% (13 people) came from newsletter recommendations and collaborations, and 1% (1 person) came from Twitter.

As I start up daily Twitter threads and get into putting out consistent content, the subscriber growth should accelerate at a higher pace from here and the subscriber growth shouldn’t be as concentrated on a single channel.

Thank you to everyone who subscribed in the past month. Welcome aboard!

Financials

Two lovely folks upgraded to the paid membership this month. There were no sponsorships in the same timeframe.

October 2024:

Revenue: $105.00

Processing fees: $14.15

Profit: $90.85

Currently, there are six paying subscribers to J. Nicholas, and two on free trials. That means this month’s partner payout is $4.54. If you’re in Canada and are a paying subscriber, you will receive this amount via e-transfer. In the U.S., you will receive it via PayPal. (This payout is now discontinued for new paid subscribers; read below on why).

Payout formula: 30% of [monthly profit] divided by [number of paid subscribers].

Year-to-date:

Sponsorships: $478.40

Memberships: $224.00

Total revenue: $702.40

Processing fees: $55.86

Profit: $646.54

Membership and monetization plan

A number of you filled out the survey from last week’s Weekly Brief for the Amazon gift card giveaway, and as I sifted through the responses on Sunday, the answers surrounding the “Would you upgrade to the paid membership?” question caught my eye. Many of you mentioned that you would love to upgrade but have almost zero idea what the “30% profit share” perk meant.

When I say “many of you,” that would be 41% of everyone who filled out the survey. That’s a majority based on the results, which was shocking to me. (For those who filled it out, I appreciate the kind responses.)

This got me thinking... if you all don’t understand the perks even after the many explanations throughout my posts, chances are many new people who subscribe won’t understand them either. Simply put, the perks were too complicated. That’s a no-no in business speak. In business, you want your product to be seamless to purchase; easy to understand with a clear point of value.

Well, I thought about it, and it seems as though I’m completely discarding the value of my paid content by giving paid members literal cash payments.

I thought it was innovative at first, but upon further reflection, it really isn’t. It’s like going to McDonald’s to buy a Big Mac, only to get a refund as soon as you buy it. At that point, you wouldn’t go to McDonald’s anymore because they sell the Big Mac; you’d go there because they sell free burgers.

I don’t want anyone to have that type of impact with my paid membership. I want you (the generic “you”) to become a member because you want that extra content. More importantly, I want you to become a member because you would enjoy that extra content, and learn from it, and maybe even because you’d like to support me—not because I’m giving you a monthly dividend so to speak. Plus, the administrative hassle of manually sending payouts to every single paying subscriber, which could be hundreds over the next year, gave me nightmares.

So, I’ve decided to update the perks.

I’m no longer including the “profit share” model in the paid membership.

From now on, as you may have noticed in the content schedule above, the membership will now purely be a pathway for extra exclusive posts. I don’t want to cause any confusion, so here is the breakdown of what free subscribers get and what paid subscribers get:

Free subscribers:

Weekly stock analysis.

Weekly market update (Weekly Brief).

All the posts free subscribers receive, plus the full paid archive.

A monthly “Partner Update” (this post) discussing my portfolio from the past month and the business growth of the newsletter.

A weekly Deep Dive issue on a particular money-related subject I feel like writing about that week.

After a few weeks of learning the ins and outs of Substack’s payment model, the final pricing of the J. Nicholas paid membership is $8 per month or $75 per year. There is also a ‘founding member’ tier for those who want to support me further, which Substack enables by default. I won’t be updating the prices from here.

Since I am now spending most of my time writing on this newsletter and growing it into something I can live off of, then eventually, J. Nicholas needs to generate revenue. With media content, there are usually just a few options to generate revenue:

Get sponsors/advertisers to pay for slots in your content to reach your audience.

Paywall the content.

Sell a product to the audience.

Out of these three, the most predictable path would be to paywall or start a paid membership for some or all of my content. The most profitable would be advertising, and the most flexible would be to sell a product.

I love the idea of building a community with all of you, and having advertisers infiltrate that isn’t something I want long-term. I don’t particularly like advertising on my content, even if it would, in practice, make me the most money. For the “selling a product” route, in the distance future, I’d love to write a book. Overall though, the paid membership model works the best, and that’s why I’ve picked it. My goal over the next year will be to focus on creating a good enough value proposition for all of you across all platforms, posting valuable content to garner a need for the justification of paying for the membership, to ultimately gather 750-1,000 paying subscribers.

In business, to be successful, you want to create value for your customers. In media, or in this case online writing, the only way to survive is to create value in a way no one else can. I’m not the only one writing portfolio reviews or stock analyses or market recaps in an email newsletter—many people are doing this. Meaning, if I were to all of a sudden charge everyone for reading this newsletter, the likelihood of every single one of you unsubscribing is through the roof. That is, if I simply write a market recap, or simply write a stock analysis every week.

In that case, there’s no value, because someone could replicate it. All you have to do is read another newsletter that provides the same content, but for free.

So for this newsletter, if I really want to build it into a business, I need to build trust. I need to build loyalty. I need to craft such a powerful value proposition that no one in the world could ever replicate. A value proposition so powerful that if I were to charge you all to read my content (which I never will, by the way), you would have absolutely nowhere else to go because there wouldn’t be anywhere else that could replicate what I do.

This is why I’m not just writing market recaps, and it’s why I’m not just writing stock analyses. Instead, I’m writing weekly market recaps, and weekly stock analyses, and weekly deep-dive write-ups, and monthly portfolio reviews—all of it. All in one newsletter. To my knowledge, no one else is doing this.

Not many people have the long-term drive to provide their time for free to others without immediate return. Thankfully, I do. I understand the value of loyalty and trust. I understand consistency. I understand reward with due effort. This is why I provide 95% of my content for free: I believe spending my time giving others value, without the cost of their time or money, is the best way of obtaining monetary return for myself. Because that builds trust, and trust isn’t something to laugh about, especially as I push towards turning this newsletter—my passion—into a business.

That is my value proposition.

For those looking to subscribe to paid, or for those who didn’t quite understand the paid membership’s perks, hopefully, this clears things up, and hopefully I’ve made it easier to understand so you can feel confident enough—certain enough—to make a decision and potentially upgrade. For those who are in university or college and mentioned in the survey last week that they would love to upgrade but cannot because of costs, send me an email, and I’ll give you a free 1-year subscription to paid (upon proof of enrollment, a school email for instance).

Thank you all for your support, and thank you for reading.

Good luck in your journey Jacob ! Just want you to know that you were my only reason to stay on blossum wich i now left because too much noise. Love your thinking about investing! I dont have a friend that love investing so much as i do so its sometime difficult to feel alone with my ideas. Happily, i have a lot of friends in the great books i read. Have a good day and keep up your good work!

Love it! And a great take on Google and Amazon!