Weekly Brief #47

Amazon is undervalued, here’s why... Plus, OpenAI now worth $157 billion, Texas AG sues TikTok, Microsoft expands data centres in Italy, U.S. dockworkers go on strike, PepsiCo acquires Siete Foods.

Welcome to the 13 investors who joined us since the last Weekly Brief! If you’re reading on the web and haven’t subscribed, join 435 curiosity-driven, enthusiastic stock market-addicted mortals by subscribing here.

Good morning investors 👋,

Happy Friday and welcome or welcome back to the 47th Weekly Brief.

I know it’s been a long wait, but I finally have some very exciting stock analyses planned to come out over the next couple of months. The release date schedule is planned for every Wednesday, and they will be sent out weekly alongside Weekly Brief, which is published every Friday. Deep Dive issues on Google, Costco, Shopify, Amazon, MercadoLibre (finally, I know), Constellation Software, Alimentation Couche-Tard, and Uber, to name a few.

However, that’s not the only great news…

Over 7 months ago, I contacted non-profit organizations to see if they would like to partner with this newsletter. This wouldn’t be a profitable partnership for me, but it would help develop a cause for this newsletter which I think is crucial. Back then, there were two organizations that got back to me: The Princess Margaret Cancer Foundation (The PMCF) and the Canadian Mental Health Association — both incredible institutions by the way.

The reason I’m talking about this now instead of 7 months ago is that this partnership was based on affiliate commissions coming from the “Book of the Week” section in Weekly Brief. I even ended up signing a formal agreement with The PMCF, dedicating to donate a percentage of these commissions, but I failed to meet the sales requirements on my Associates account, and Amazon terminated the account before anything could come of it.

But this week, I decided to create a new Associates account. Meaning as of today, and hopefully for the foreseeable future, when you buy a book from the Book of the Week section in Weekly Brief, 80% of the total commissions earned will be sent straight to The PMCF. Cancer has hurt a lot of people in my life, and there’s a high chance many of you reading this can unfortunately relate. Like millions, if not billions, around the globe, I want that hurt to end, and The PMCF is an organization I believe can help us get there.

I love reading, and I believe many should do it more, while absolutely dreading cancer and the immense amount of loss it brings, with a passion. This partnership is a way to kill two birds with one stone. So every time you get this email, take some time to check out the Book of the Week. If it doesn’t interest you, don’t buy it. If it does, know that not only will you enjoy that book and support me, but you will also contribute to and support a great cause.

To kick off this newsletter’s cancer fundraiser if you will, I’ve personally decided to donate $30 directly to The PMCF. It’s not a mind-blowing amount of money, sure, but keep in mind it doesn’t have to be a mind-blowing amount of money to have an impact; it just needs a little communal effort. And quick reminder: I’m not usually someone who enjoys donating money. I actually prefer not to. There’s some psychological wire in my brain to save every dollar I earn. But I hope by incorporating donations into something that provides value like a good book, the perception of giving for a cause without return becomes a lot more feasible.

Also, quick segue, huge thanks to the six people who subscribed to the paid membership from the announcement last week. I was not expecting that amount of support. If you don’t already know, last week I announced a profit-sharing model where paid subscribers to this newsletter will receive a share of 30% of this newsletter’s profit, paid in cash monthly, and will get access to exclusive monthly updates and reviews on my stock portfolio and the business side of this newsletter on top of the already free stock analyses and weekly market recaps. I’m currently running a massive discount on the membership for first-time members, so feel free to check that out if it interests you in any way. I appreciate it.

I’m very excited for the future of this newsletter (and everywhere else I publish content), and I can’t thank you all enough for being a part of the journey. Good things are coming, I can feel it (spidey sense, trust me). Thank you for your continued support, and enjoy today’s issue!

Let’s get into it. (12 min read)

In this issue:

📉 Amazon is undervalued, here’s why.

🤖 Meet OpenAI, now worth $157 billion

🇺🇸 U.S. East Coast dockworkers go on strike

FEATURED STORY

📉 Amazon (stock) is undervalued, here’s why.

I love Amazon. I believe it’s a one-of-a-kind, stable, predictable wide-most business — one of the best out there. It’s currently about 20% of my portfolio, and I get a sizeable amount of smack from saying it’s currently undervalued (at least I did last time). And look, I get it. It’s kind of confusing to hear someone say a stock is undervalued after rising 40% in the past year.

But there’s so much more to it than that from what I see.

Most of big tech became big tech because of a superior business model or product. For Microsoft, it was Windows. For Apple, it was the iPhone. Amazon was Amazon.com. Meta was Facebook (and then eventually synonomous with social media). Google was Search. Nvidia is now AI GPUs.

When you have a dominant product consistently being used and bought by billions, you’re going to hit saturation eventually. This will happen to every solitary big tech company (or I guess now Mag 7 company) with time. Growth will slow in their main products, it’s inevitable — you can only grow so big with a globally dominate product or service. Currently, most of these main products are still growing, but looking decades ahead, these companies realize they need diversification to uphold growth. (Revenue diversification has been a working growth strategy for these companies in the past decade alone.)

The diversification stream strategies of the Mag 7:

Microsoft diversified into subscriptions, cloud computing, gaming, and advertising via LinkedIn.

Amazon diversified into streaming, third-party logistics services, robotics, LLMs, subscriptions, cloud computing, advertising, and physical grocery.

Apple diversified into accessories (AirPods, Watch), online subscription services, streaming, and now augmented/virtual reality.

Alphabet (Google) diversified into subscriptions, LLMs, cloud computing (I see a trend here), and software and tech hardware (Pixel products, Android).

Meta diversified into LLMs and augmented and virtual reality.

Nvidia… still just a chip company with little to no current diversification.

Tesla… still a car company with little to no current diversification.

Each of these companies has a story for future growth — a story of the new businesses they are going to enter to produce future growth for shareholders and uphold their multiple. Out of these stories, I believe Amazon is the one with the least implementation of these valuable diversification strategies, by far.

My reasoning

I was scrolling through Twitter this week (I’m never calling it X, sorry) and came across a post sharing a letter from Jeff Bezos to Amazon shareholders after the dot-com bubble burst in 2000. Amazon stock lost over 80% of its value that year. (I’d recommend giving this letter a read, even if you don’t own Amazon. For those who do own Amazon shares though, I would definitely recommend you read it.) When I eventually read through it, something in particular caught my eye:

“We’re a company that wants to be weighed, and over time, we will be — over the long term, all companies are.“

“…we have our heads down working to build up a heavier and heavier company.”

This caught my eye because it’s almost exactly what Amazon is today under Andy Jassy’s leadership, if you read Jassy’s letters. Amazon is a long-term bet, and as of today, over the long term, a bet on Amazon looks to be a good one in my eyes.

Here’s why:

AWS, with cloud computing and the growing demand for it thanks to AI, LLMs, and the influx of the age of data (which Amazon has a lot of), along with Amazon’s growing advertising business, which is on track to reach $185 billion in annual revenue by 2029 (larger than Meta). Or even better, Amazon’s advancements and investments in robotics.

There are so many unimplemented growth opportunities for Amazon, and that’s on top of an already established, predictable, wide-moat company with growing diversified businesses. With all of this in mind, I believe that at Amazon’s current price tag — a forward P/E of 32 and a 5% forward FCF yield among other current metrics — all of it is well worth it at the current price. I might be wrong, sure, but if I’m wrong on this bet, it would almost exclusively be in the short term, and I’m fine with that. Over the long term, say 10 or even 20 years, I believe buying Amazon will be a very profitable and easily predictable bet. Amazon always executes, and they do it well. Amazon is a very forward-focused company, and there’s a lot of growth to look forward to. I personally believe Amazon’s fair value is around $210–220. (I got that number from using an OCF-adjusted DCF model, but also factoring in future diversification opportunities and FCF expansion.)

I feel Amazon is to me what Apple is (or was) to Buffett, in a way. It’s what Chipotle is (or was) to Ackman. Of course, my thesis can change very quickly, but as of now, in short, I’m bullish on Amazon, and I think it’s undervalued. So sue me1.

FINANCE

a. 🤖 Meet OpenAI, now worth $157 billion

As of this week, OpenAI has officially closed its $6.6 billion funding round, valuing what was once a tiny startup, at a whopping $157 billion. Thrive Capital led the round with a $1.3 billion investment, followed by Microsoft with $750 million and others like Khosla Ventures, Nvidia, and SoftBank, who each invested $500 million. Despite Apple being in talks to invest, it did not end up doing so.

This deal is one of the largest private funding rounds ever, making OpenAI one of the top three most valuable private companies in the world, alongside SpaceX and ByteDance (owner of TikTok). OpenAI plans to use the funds to “advance AI research and expand computing power.”

Related articles:

b. 🤝 PepsiCo acquires Siete Foods

PepsiCo has agreed to acquire Siete Foods for $1.2 billion, a company I had never heard of being a friendly Canadian here in Ontario, to “expand its better-for-you food offerings.” Founded in 2014, Siete produces tortillas, salsas, snacks, and more, all inspired by Mexican heritage. PepsiCo CEO Ramon Laguarta praised the Garza family’s passion for the brand and anticipates growing PepsiCo’s multicultural portfolio with Siete's products.

The deal is expected to close in the first half of 2025, pending regulatory approval. Siete CEO Miguel Garza expressed excitement for the brand’s next chapter under PepsiCo — excitement which is understandable, given that they’ve now become centi-millionaires just eight years after founding the company. Which is… wow, I’m starting a tortilla chip company.

BUSINESS

c. ☁️ Microsoft expands data centres in Italy

This Wednesday, Microsoft announced it will be investing €4.3bn in Italy to expand its cloud and AI data centre infrastructure, and will also train over 1 million Italians in digital skills by 2025. This investment comes after many other investments in Spain and Germany, all helping to push Microsoft’s focus on Europe’s digital transformation.

On the training side, Microsoft will collaborate with partners, universities, and government institutions to upskill workers in AI, focusing on “responsible development.” Microsoft’s investment aligns with its European data boundary requirements, which requires data storage in the EU to stay within a certain EU boundary. According to Microsoft, the adoption of AI is projected to boost Italy’s GDP by €312bn over the next 15 years.

Related articles:

d. 👨⚖️ Texas Attorney General sues TikTok

Texas Attorney General Ken Paxton is suing TikTok for allegedly violating a new state law, the Securing Children Online through Parental Empowerment Act, which protects minors’ personal data on social media.

The Act prohibits social media companies from sharing or selling minors' data without parental approval. Paxton claims TikTok has not complied to this Act, accusing the company of selling minors’ data and displaying targeted ads. TikTok denied the allegations, stating it provides safeguards like “family pairing” and does not sell personal data where prohibited by law.

Related articles:

POLITICS

e. 🇺🇸 U.S. East Coast dockworkers go on strike

Workers at East and Gulf Coast ports in the U.S. went on strike Tuesday after negotiations between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) broke down. Around 45,000 workers walked off the job at 12:01 a.m., marking the most significant strike for the union since 1977.

This work stoppage affected 36 ports including the Port Authority of New York and New Jersey, and could significantly impact the U.S. economy (considering these ports alone handle about 50% of U.S. imports and exports). JP Morgan analysts have said the strike would cost the U.S. economy about $5 billion per day.

The ILA (listed above) represents workers who manage the unloading of cargo ships and their strike centres around two main issues: pay and technology. The union is demanding a pretty significant pay raise and increased retirement contributions, as well as a say in the role of automation in their industry. Reports suggest the ILA requested up to a 77% pay bump, while USMX offered 50%. The ILA’s goal is to avoid having automated machines replace human operators, increase pay, and prioritize job security and quality control. (Future Jacob edit: As of the time of writing, the ILA has reached a deal to suspend the strike until January to negotiate a new contract.)

📚 Book of the Week

⭐️ For every book purchased using the links below, 80% of affiliate commissions are donated to The Princess Margaret Cancer Foundation2.

Total donated to date: $30.00

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

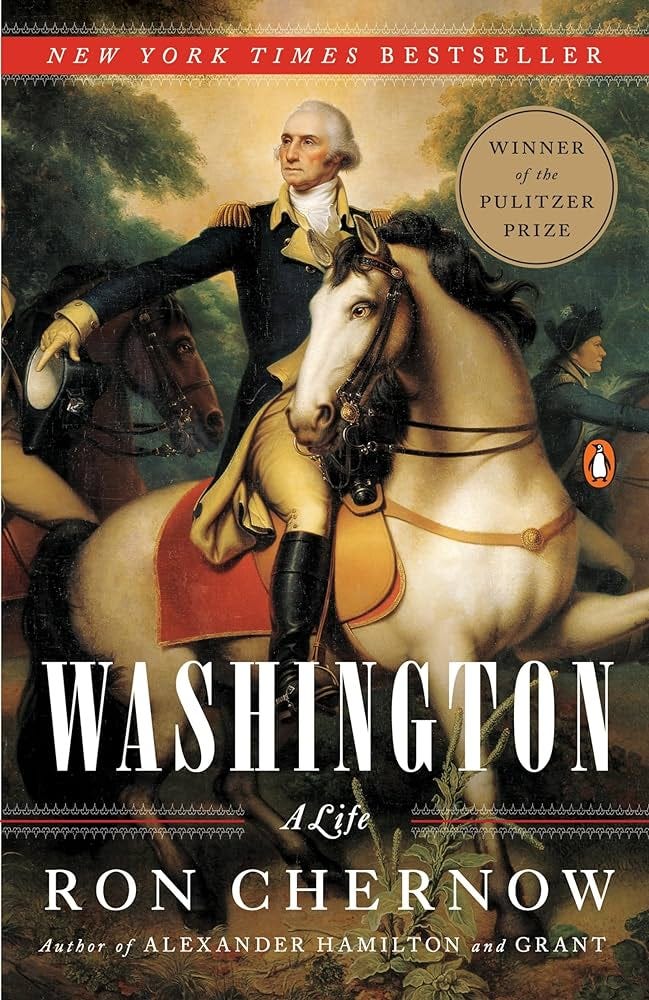

Washington: A Life — Ron Chernow

Book Description:

Celebrated biographer Ron Chernow provides a richly nuanced portrait of the father of our nation and the first president of the United States.

With a breadth and depth matched by no other one volume biography of George Washington, this crisply paced narrative carries the reader through his adventurous early years, his heroic exploits with the Continental Army during the Revolutionary War, his presiding over the Constitutional Convention, and his magnificent performance as America’s first president.

In this groundbreaking work, based on massive research, Chernow shatters forever the stereotype of George Washington as a stolid, unemotional figure and brings to vivid life a dashing, passionate man of fiery opinions and many moods.

Thank you for reading today’s Weekly Brief! If you enjoyed or learned anything, please spread the word. (Remember, none of this is financial advice, please do your own research.)

— Jacob xx

All my links here.

For legal reasons, this is obviously joke.

Only applicable for books purchased on Amazon.ca. The commission percentage is 5.50% of the total retail price for physical books and 10% for Kindle books. All donation dollar amounts in Canadian dollars.