Quantum Chips, Explained

Quantum chips, explained... Plus, Apple’s $500 billion U.S. investment, Stripe valued at $91 billion, Amazon unveils Alexa+, Ito family drops 7-Eleven parent buyout bid, and more.

A huge welcome to the 11 investors who joined The J. Nicholas since last week! Haven’t subscribed yet? Join 837 intelligent investors by subscribing here.

Good morning investor 👋,

Welcome back to the 68th Weekly Brief.

This week’s performance:

S&P 500: -4.13% | Nasdaq: -7.04% | Dow Jones: -1.33% | TSX: -1.61% | Gold: -2.16% | Bitcoin: -10.54% | The Quality Fund: -2.51%.

The market entered a noticeable downturn this week, with the Magnificent 7 venturing into what is technically a correction (down ±10%). Needless to say, other than share prices, nothing has changed. I do not plan on selling any of my positions soon. In fact, I may even buy more if this downturn lasts. Be sure to follow me on Blossom to see any trades, or subscribe to paid and join the Discord for updates on my rationale behind future and current positions/trades.

Today we’ll be covering Amazon’s release of its quantum chip—now the third Big Tech giant to release a quantum chip in the past three months. Since two of my holdings have officially entered the quantum chip race, I believe it’s time we bonk our heads together and understand what that actually means.

Let’s get into it. (10 min read)

In this issue:

💽 Quantum chips, explained

🏪 Ito family drops 7-Eleven buyout bid

🇺🇦 Ukraine agrees to U.S. mineral deal

FEATURED STORY

💽 Quantum chips, explained

Quantum chips, also called quantum processing units (QPUs), are specialized hardware used in quantum computers to perform calculations based on the principles of quantum mechanics. (Quantum mechanics is the real-life version of what you see in Ant-Man movies—it’s a branch of physics that studies the behaviour of matter and energy at the smallest scales.)

QPUs are the heart of the quantum computer, just like the CPU is the heart of a classical computer, and so on.

What is quantum computing?

Unlike classical chips or semiconductors, which use binary bits (0s and 1s—a sort of light switch—to calculate problems), quantum chips use qubits, which can exist in multiple states at once due to a phenomenon known as superposition. This means that, unlike a normal computer that processes information sequentially—“de, da, de, da” (1, 0, 1, 0)—a quantum computer can process “de and da” (1, 0) simultaneously. It can perform multiple tasks at the same time instead of one after another. That’s superposition, and it allows quantum computers to solve certain problems much faster than traditional computers.

Note: Quantum computing isn’t useful for everything, but the benefits in fields such as AI and machine learning, pharmaceuticals and drug discovery, infrastructure optimization etc., are enormous.

So how does this work? To achieve superposition, quantum computers manipulate and compute with qubits—which can be quantum particles such as electrons, photons, and charged atoms (or superconducting circuits, something that mimics quantum behaviour). You read that right. As you sit here reading these words, somewhere, someone is working on harnessing the quantum properties of the smallest building blocks of our universe—the particles that make up atoms—to create a working computer capable of performing complex, advanced calculations.

A few key points:

Quantum computers look nothing like normal computers.

Since heat disrupts quantum states, most quantum computers need to operate at temperatures near absolute zero (-273°C, -459°F). (Liquid helium is used to keep them cold, and a layer of gold is placed around the computer to hold those temperatures.)

Quantum systems are so fragile that even the tiniest vibrations—even a stray electromagnetic wave—can disrupt them. They’re kept in vacuum chambers and shielded from outside interference to avoid this.

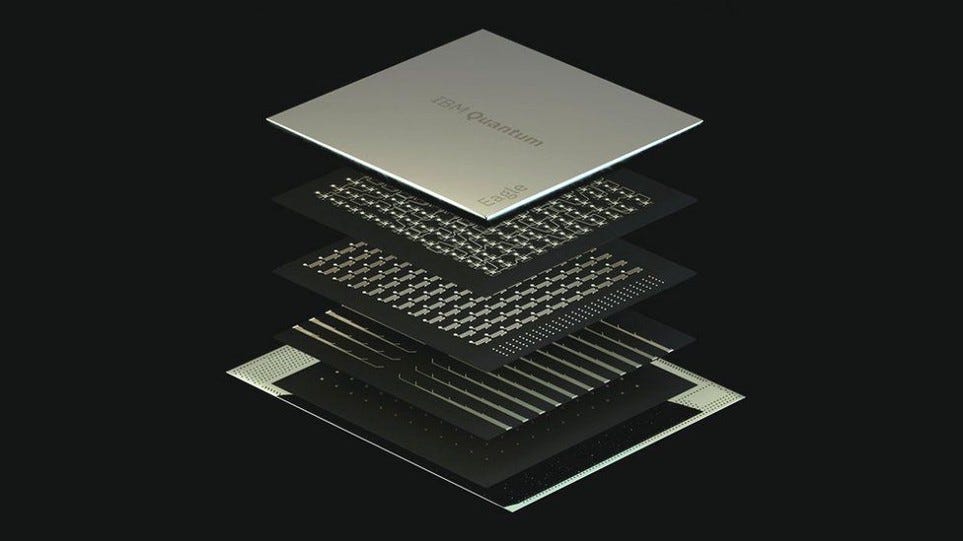

Here’s what one looks like (up close):

Straight out of science fiction.

In short, this technology is very important. Very valuable. Every country wants it. However, there’s just one problem with quantum computing. Other than being insanely complicated—it costs a lot of money.

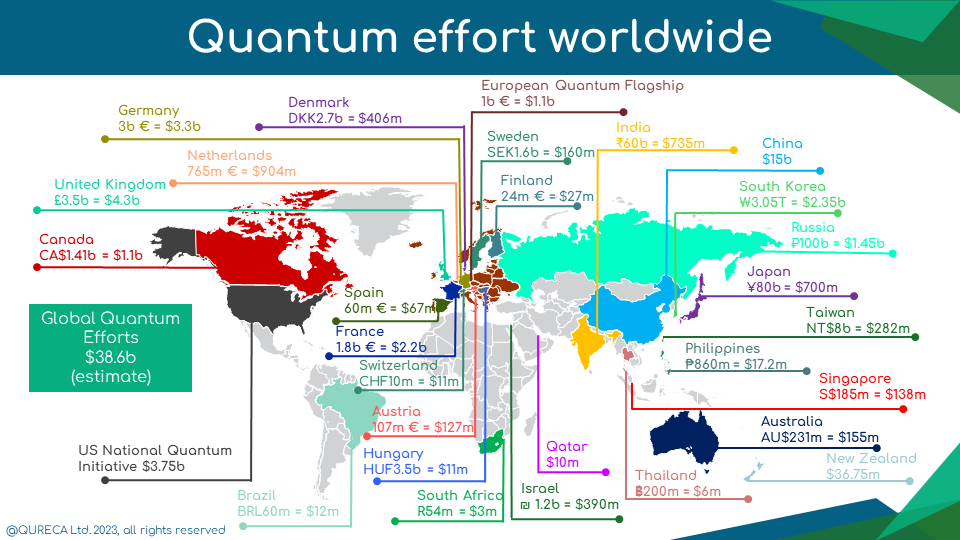

The cost of researching quantum computing has meant that governments and large Big Tech behemoths have been the only major investors in this technology since it started gaining traction. Currently over $55 billion per year is spent globally on quantum research, the majority of which comes from China. As I write this, quantum mechanics is still an experimental technology, and no one knows for certain when we’ll officially have quantum computers.

Then comes the final question…

Why is big tech releasing QPUs?

The answer is profit, shareholder value, and boosted stock prices, obviously. He who owns the technology owns the world. But he who supplies the chips controls the world. As we’ve seen with Nvidia’s dominance over AI GPUs in the past few years, computing and processing power is everything.

Quantum computing is said to be the future of computing. It’s also expensive and limited to production and manufacturing by a handful of wealthy multinational tech companies. These same companies are going to capitalize on that arguably unfair advantage. Not only will these companies have an advantage over the processors, but also over the computers themselves. And as this technology evolves, that’s how it should technically stay based on today’s levels.

Since the end of 2024, three of the infamous Magnificent 7 companies have released their top-of-the-line QPU models. The same three companies are in the process of developing their own working quantum computers as well.

Google: Willow

Microsoft: Majorana 1

Amazon (released this week): Ocelot

“Five years ago, I could have told you, ‘I think I could build a quantum computer and could build it practically.’ Today, I can say with confidence we are going to build a quantum computer.” — Oskar Painter, Head of Quantum Hardware, AWS

Big Tech is the ultimate investment of the future—Amazon and Google more specifically. GenAI, autonomous vehicles, quantum computing, biotech, cloud computing, and more. While we cannot 100% guarantee profitable success across the board, these are investments that could generate huge future value for shareholders. Cloud computing and certain GenAI products though, have very high likelihood of profitable investments.

At the moment, I would not invest in Amazon, Google or Microsoft just for quantum computing. Though it sure is a great addition to already amazing businesses.

Moral of the story: Quantum computing is another fascinating technology. We should all be optimistic about the future, but everything is too uncertain and newly developing, so we should also be cautious. No one knows if a Big Tech company will be a leader in quantum, in the future. It sure looks like they will, because they are today, but China is the one investing the most. It’s an ongoing battle for dominance.

I’m personally staying away from small cap quantum stocks, and I will be watching as this technology develops, while owning quality businesses, that happen to be leaders in the space.

Have a great weekend.

FINANCE

a. 🍎 Apple’s $500 billion U.S. investment

Apple announced a four-year $500 billion U.S. investment plan this week, including a Texas AI server factory and 20,000 research and development jobs focused on Apple Intelligence. The spending also covers supplier purchases, Apple TV+ content, and manufacturing. The company also launched chip production at TSMC’s plant in Arizona, and plans to open a manufacturing academy in Michigan.

Apple already spends over $150 billion annually for investments in the U.S., so this is likely just a political move. Especially considering that China—where most of Apple’s products are manufactured—you may remember—is set to face aggressive tariffs under Trump’s new administration.

b. 💳 Stripe valued at $91 billion

Stripe announced a tender offer to employees and current shareholders this Thursday, valuing the company at $91.5 billion—a 41% increase from last year (equivalent to nearly triple the market’s return in the same timeframe). Stripe is a private company and has been rumoured to announce an IPO soon, but this may be a sign an IPO is far away.

Patrick Collison, CEO of Stripe, and his brother and fellow co-founder John Collison, also confirmed that Stripe is now profitable and expects it to continue. Long-time followers of this newsletter and my writings will be familiar with Stripe. I consider it one of the best businesses in the world and use its products daily. I am patiently awaiting an IPO.

Related articles:

BUSINESS

c. 🤖 Amazon unveils Alexa+

In one of the most anticipated smarthome tech announcements of the past two years, Amazon officially unveiled Alexa+, an AI-powered upgrade to its digital assistant lineup, at their 2025 devices event. For the first time ever, Alexa will require a subscription to use—$19.99/month, or free for Prime members. (← this is the key here) The new Alexa will first roll out on Echo Show devices (those with the screens), and is set to launch for early access next month.

I could go on and explain in words what this new update can do—how it’s powered by generative AI and can book reservations, order groceries, organize handwritten notes, and quiz users on study materials. Or how it comes with a ChatGPT-style chatbot website. But words don’t do well in explaining these types of products. Watch the presentation above for more. Exciting stuff.

“Alexa+ is that trusted assistant that can help you conduct your life and your home… Removing complexity for our customers with products that make every single day better and easier [is what Amazon does]. I think you’re going to love it.” — Amazon, in a recent blog post.

d. 🏪 Ito family drops 7-Eleven buyout bid

After a back-and-forth fiasco similar to the Paramount buyout saga I covered a few months ago, Seven & i Holdings, the Japanese parent company of 7-Eleven, which first considered being acquired by the great Canadian company Alimentation Couche-Tard (Circle K), has failed its third buyout offer.

After Couche-Tard’s second revised offer “wasn’t a large enough sum,” the founding family of Seven & i attempted to buy out the business. We learned this week that this family, the Ito family, could not afford the $58 billion in capital needed to acquire the company. The only offer left on the table is Couche-Tard’s revised $47 billion bid. Seven & i is currently evaluating this offer. If accepted, that would be Japan’s largest takeover.

The only hurdle left after acceptance? Antitrust regulators.

Related articles (7-Eleven buyout saga):

POLITICS

e. 🇺🇦 Ukraine agrees to U.S. mineral deal

Ukrainian President Volodymyr Zelensky is scheduled to meet U.S. President Donald Trump in Washington this Friday to sign an agreement on sharing Ukraine’s mineral resources. This comes after Trump called Zelensky a dictator and seemed to blame Ukraine for starting the ongoing war. He has since corrected himself on both of those points (indirectly and directly).

The minerals deal is backed by Ukraine’s government, and while many details are not yet public (more info on the deal should be public as this issue is sent out, as it will be signed by then), I can confirm (via the BBC) that the deal will include an “investment fund for reconstruction. Trump believes this is a viable way for the U.S. to receive compensation for its ~$175 billion in aid since the start of the conflict, and Zelensky seems to be fine with that proposition—as long as it lays the groundwork for peace negotiations and comes with security guarantees.

Both sides say a ceasefire is close, but Russia will not concede any annexed land if a ceasefire were to be reached.

📚 Book of the Week

For every book purchased using the links below, 100% of affiliate commissions are donated to charity. (Amount donated so far: $36.42.)

My full bookshelf: Here.

The Myth of the Rational Market - Justin Fox

Book Description:

“The financial crisis of 2008 and subsequent Great Recession demolished many cherished beliefs—most significantly, the theory that financial markets always get things right. Justin Fox’s The Myth of the Rational Market explains where that idea came from, and where it went wrong.

As much an intellectual whodunit as a cultural history of the perils and possibilities of risk, it also brings to life the people and ideas that forged modern finance and investing—from the formative days of Wall Street through the Great Depression and into the financial calamities of today. It’s a tale featuring professors who made and lost fortunes, battled fiercely over ideas, beat the house at blackjack, wrote bestselling books, and played major roles on the world stage. It’s also a story of free-market capitalism’s war with itself.”

Thanks for reading. Feel free to reply to this email or comment on the web if you need anything—I always reply. If you enjoyed today’s issue, feel free to share it with friends and family.

All the best,

Jacob

All of my links here.

Serious about high-quality stock investing? My best work is members-only. Don’t miss out on exclusive insights and benefits—upgrade today.