Weekly Brief #71

Nvidia’s AI dominance continues... Plus, Google acquires Wiz, Perplexity reaches a $18 billion valuation, 7-Eleven signs pact with Couche-Tard, Harvard announces free tuition, and more.

A huge welcome to the 11 investors who joined The J. Nicholas since last week! Haven’t subscribed yet? Join 883 intelligent investors by subscribing here.

Good morning investor 👋,

Welcome back to the 71st Weekly Brief.

This week’s performance:

S&P 500: +1.78% | Nasdaq: +0.96% | Dow Jones: +2.18% | TSX: +3.12% | Gold: +1.62% | Bitcoin: +1.57% | The Quality Fund: +1.59%.

Well, I can safely say that this week wasn’t filled with tariffs or trade wars. But we did have a Fed meeting that raised concerns over tariffs being the reason for behind not adjusting the policy rate. We also had a Nvidia conference (which we’ll be talking about today). Also, my second Deep Dive issue on stock research was released this week (completely free). You can view all my posts in this new stock research Deep Dive series, here.

PS: Last week’s giveaway is officially complete. I’ve sent the winner an email!

Let’s get into it. (9 min read)

In this issue:

🦾 Nvidia’s AI dominance continues

💰 Google acquires Wiz for $32 billion

🇺🇦 Zelenskyy agrees to partial ceasefire

FEATURED STORY

🦾 Nvidia’s AI dominance continues

Nvidia held its annual developer conference this week, giving us yet another glimpse into how far the company is ahead of its competitors in the AI space.

I don’t own Nvidia stock, but in our current market, every major announcement by Nvidia will impact your portfolio—whether in an ETF or just a holding of yours that’s somewhat tech-exposed. For big tech holders, Nvidia is extremely important because, as big tech companies (mainly cloud providers) ramp up their GenAI, robotics, and autonomous vehicle investments, it requires Nvidia hardware to power these.

I tried to condense the terms and the importance of each announcement, but the wording may be complex if you’re not as familiar with the GPU/AI chip space. This isn’t a great explainer write-up, so keep that in mind when reading. Another post is coming to help explain, next week.

Anyway, today I wanted to go over some key announcements Nvidia made in this conference, what this means for the future (something I’m extremely optimistic about), our portfolios, and most importantly, to admire the amazing technology our world is producing.

The highlights

First up in the announcements was Blackwell Ultra (NVIDIA GB300). This is the next-generation GPU for AI processing (primarily in data centres), the chips used in data centres to train data for large language models (LLMs) and other AI models. Also known as a supercomputer. It comes with the usual improvements, such as more memory, faster speeds, and so on. (This model can perform 70x more FLOPS (Floating Point Operations Per Second) compared to H100 (more on H100s in this post).

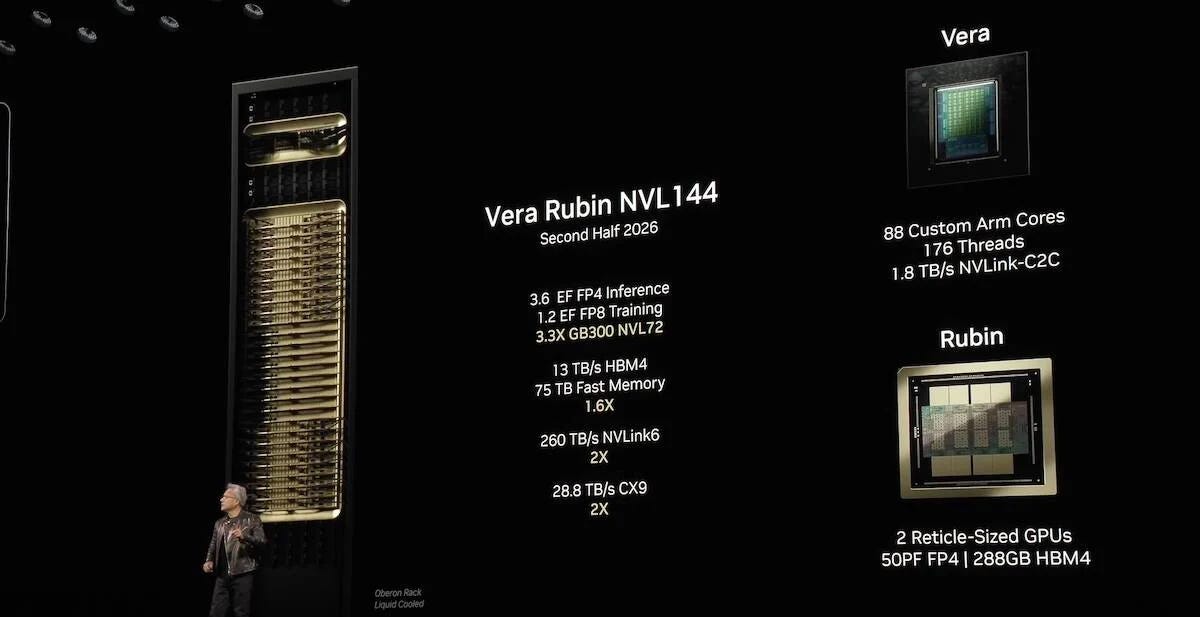

Next is Vera Rubin, a powerful chip and server system designed to speed up data transfers for AI systems that need to communicate between multiple processors. The Vera Rubin system is set to launch in 2026, with a follow-up, Vera Rubin Ultra, planned for 2027. Looking even further ahead, Nvidia mentioned Feynman, the architecture that will replace Vera Rubin in 2028. (You know a company is in a healthy market position when they can release a new generation product, but also plan when they’ll release their next-generation product ahead of time.)

Nvidia also introduced the DGX Personal AI Computers (a threat to Apple’s Mac), powered by Blackwell Ultra chips, which are aimed at developers who need a powerful machine to run AI models.

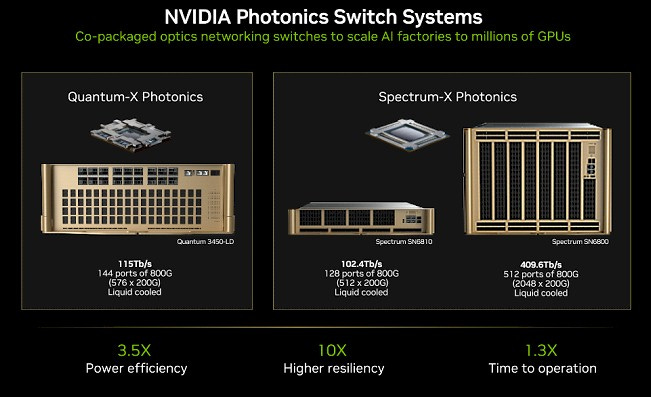

Then there’s Spectrum-X and Quantum-X, Nvidia’s new photonics networking chips, designed to connect AI systems across multiple sites with lower energy consumption. These chips are crucial for companies running massive AI operations at scale. The Quantum-X chips are coming later this year, followed by Spectrum-X in 2026.

Nvidia also partnered with GM to build a self-driving car.

And last but not least, for robotics (the photo above), there’s Isaac GR00T N1, an open foundational model for humanoid robots. First in the world, by partnering with Google DeepMind and Disney Research.

I find it fascinating to see such rapid innovation coming our way. The future is awesome, right?

AI models continue to improve and grow, reasoning gets better, and now humanoid robotics are being developed. All thanks to Nvidia’s chips. There’s so much to say, but so little time to explain. I highly encourage everyone reading this to watch the presentation themselves in their free time. You can do so here. It paints a very bright future, especially if you’re not into cynicism. As for my portfolio, I’ll be honest and keep this short: It won’t make much difference in the near term. My companies, like Amazon and Google, will continue to buy these chips, grow their models, and advance their ventures in robotics and self-driving, all while designing cheaper alternatives to Nvidia GPUs for self-sustainability and better customer value long term. Amazon is already using their own chips—Trainium models—in its offerings.

The thing is, Nvidia still holds a dominant share in the AI chips sector.

I do not own Nvidia because of the cyclical nature of the business it operates in (semiconductors), and because of its high revenue concentration and reliance on big tech, among other things. But, if there’s one company that’s shaping the future of artificial intelligence, it’s Nvidia. They supply the advanced chips, and they’re ahead by a long shot. Have a great weekend.

FINANCE

a. 💰 Google acquires Wiz for $32 billion

Google announced an agreement to acquire Wiz this week—a recent startup cybersecurity platform—for $32 billion in an all-cash deal. This is the largest M&A of 2025 thus far and the largest buyout in Google’s history.

After closing, Wiz will join Google Cloud to enhance security and multicloud capabilities for the platform. There was a lot of controversy around this acquisition when it was announced, mostly due to the fact that Google paid somewhere in the realm of 60–100x sales for Wiz when “it could have issued buybacks instead.” However, as cloud computing trends continue and Google tries to distinguish itself from its competition, having Wiz’s platform is a great benefit. Most cybersecurity companies do well in the long term, so this buyout is a long-term play by Google. The deal is subject to regulatory approval.

As a shareholder, I approve. Google needs growth. This is valuable for the future growth of the business.

Related articles:

b. 🤝 Perplexity AI hits an $18 billion valuation

Perplexity AI is in talks to raise around $1 billion in funds at an $18 billion valuation, doubling from its previous $9 billion figure in December 2024. Perplexity is a startup (backed by Nvidia) that offers AI-powered search tools. It aims to capture the growing demand for AI agents.

Perplexity competes with Google’s Gemini and OpenAI’s ChatGPT, along with all the other mainstream LLMs, and recently semi-announced a new web browser, Comet, with advanced features like task execution and complex query understanding. The company has faced accusations of plagiarism but still remains one of the top challengers to Google’s search dominance, according to those who claim Google is losing said dominance at a significant rate to these LLMs.

BUSINESS

c. 🏪 7-Eleven signs pact with Couche-Tard

7-Eleven’s owner has signed a confidentiality agreement with Alimentation Couche-Tard (the Canadian owner of Circle K, which you may be familiar with) to discuss the potential sale of some U.S. stores, as a way to address antitrust concerns regarding Couche-Tard’s proposed buyout of the company.

The agreement is limited to U.S. stores and does not involve the sale of Seven & i Holdings as a whole (the parent company of 7-Eleven). Couche-Tard CEO Alex Miller confirmed they are currently working on a divestment package with Seven & i. Couche-Tard continues to keep its buyout offer on the table, which was last reported at $47 billion. Will this become a never-ending back-and-forth M&A deal, like the one with Paramount? We’ll see.

Related articles:

d. 🏫 Harvard announces free tuition

Harvard University announced this week that, starting in the 2025-2026 academic year, students from families earning up to $200,000 will pay absolutely no tuition. For those earning less than $100,000, all expenses, including food and housing, will be covered at no cost. (If you’re accepted into the school, that is.)

This plan is to make Harvard more affordable, particularly for middle-income students. This new free tuition policy qualifies nearly 90% of U.S. families. Harvard has the world’s largest endowment of any university, currently over $51 billion. The interest from this fund alone could cover the expenses of all students for hundreds of years. (Similar programs are being introduced at other high-cost elite schools, like MIT and UPenn.)

POLITICS

e. 🇺🇦 Zelenskyy agrees to partial ceasefire

Donald Trump and Volodymyr Zelenskyy had a “very good” phone call on Wednesday, their first since the heated “you should say thank you” situation three weeks ago in Washington. Zelenskyy called the conversation “positive, substantive, and frank,” and said he agreed to a partial ceasefire Trump discussed with Vladimir Putin.

The details of the ceasefire aren’t 100% clear, but reports are saying it would cover energy infrastructure, and for about a month (though again, details are not official). Russia’s stance only includes energy, not infrastructure. Which is a large distinction to have in the case of war. European leaders, including French President Macron, are closely monitoring the talks.

Related articles:

📚 Book of the Week

For every book purchased using the links below, 100% of affiliate commissions are donated to charity. (Amount donated so far: $36.42.)

My full bookshelf: Here.

The Wealthy Barber - David Chilton

Book Description:

“Over One Million Copies Sold.

The common sense guide to successful financial planning. In this engaging tale set in hometown, Canada, our financial hero Roy, the wealthy barber, combines simple concepts, common sense, and an insight into human nature to sahpe the shaggy financial affairs of Dave, Sue, Tom and Cathy. And he does it not by hectoring them about budgeting but by giving them a set of practical, easy-to-implement guidelines.”

Thank you for reading, partner. If you enjoyed today’s issue, feel free to share it with friends and family. I’ve placed a button below for you to do so (right underneath the paid membership line (see what I did there).

All the best,

Jacob

All of my links here.

My best work is members-only. Don’t miss out on exclusive insights and benefits—upgrade today, join the community.