A Small Cap AI Infrastructure Stock Growing 20%+

Sterling Infrastructure stock analysis: a quality infrastructure small cap growing from secular AI trends

Hey investors 👋,

CNBC and Twitter will have you believe the only companies benefiting from the secular trend of AI are big tech. Those big multinational, multi-trillion dollar American technology companies spanning semiconductors, cloud computing, AI research, and inference. Of course, AI growth is not just benefiting those companies; it’s benefiting every physical infrastructure and clean energy company that can provide big tech with power.

Some of them are large caps, many of them small caps.

Today, I found a small cap outside of big tech, a physical infrastructure company benefiting from AI spend and more, and it’s rapidly taking its share of the pie.

Meet, Sterling Infrastructure.

(24 minute read.)

Sections:

Business model & analysis

Risks & competitive advantages

Leadership quality

Stock price & financials

Growth aspects

Valuation and fair value

Final thoughts

Business model & analysis

Sterling Infrastructure, Inc. is an American infrastructure construction developer offering services to build data centres, e-commerce distribution centres, highways/roads, residential/commercial buildings, and more.

Revenue breakdown

Sterling Infrastructure earns its revenue from three categories (%’s as of Q2 2025):

E-Infrastructure Solutions (50.5% of revenue): Construction and development of data centres, distribution centres, advanced manufacturing plants (i.e., semiconductor fabs, EV battery), and other critical digital infrastructure.

Transportation Solutions (32.0% of revenue): Construction and development of highways, airports, bridges, rail and any public transportation infrastructure.

Building Solutions (17.5% of revenue): Residential (multi-family housing) and commercial building and/or concrete pouring.

Revenue breakdown by country:

U.S. (100% of revenue)

Business model

Sterling Infrastructure builds things. Important things that rich tech companies pay for that they need, things we pay for that we need, and things governments pay for on our behalf that we also need.

“Things” in this context would translate to data centres, distribution centres, semiconductor fabs, EV battery assembly and manufacturing plants, other critical digital infrastructure, roads and highways, as well as residential and commercial homes and office buildings.

Sterling as a whole can be summarized by categorizing its segments: It has the high-growth profitable segment of AI physical infrastructure, the stability of public transportation jobs, and the flexibility of consistent concrete contracts nationwide. Above all, Sterling’s largest segment, “E-infrastucture,” is its most important revenue source today and for the foreseeable future.

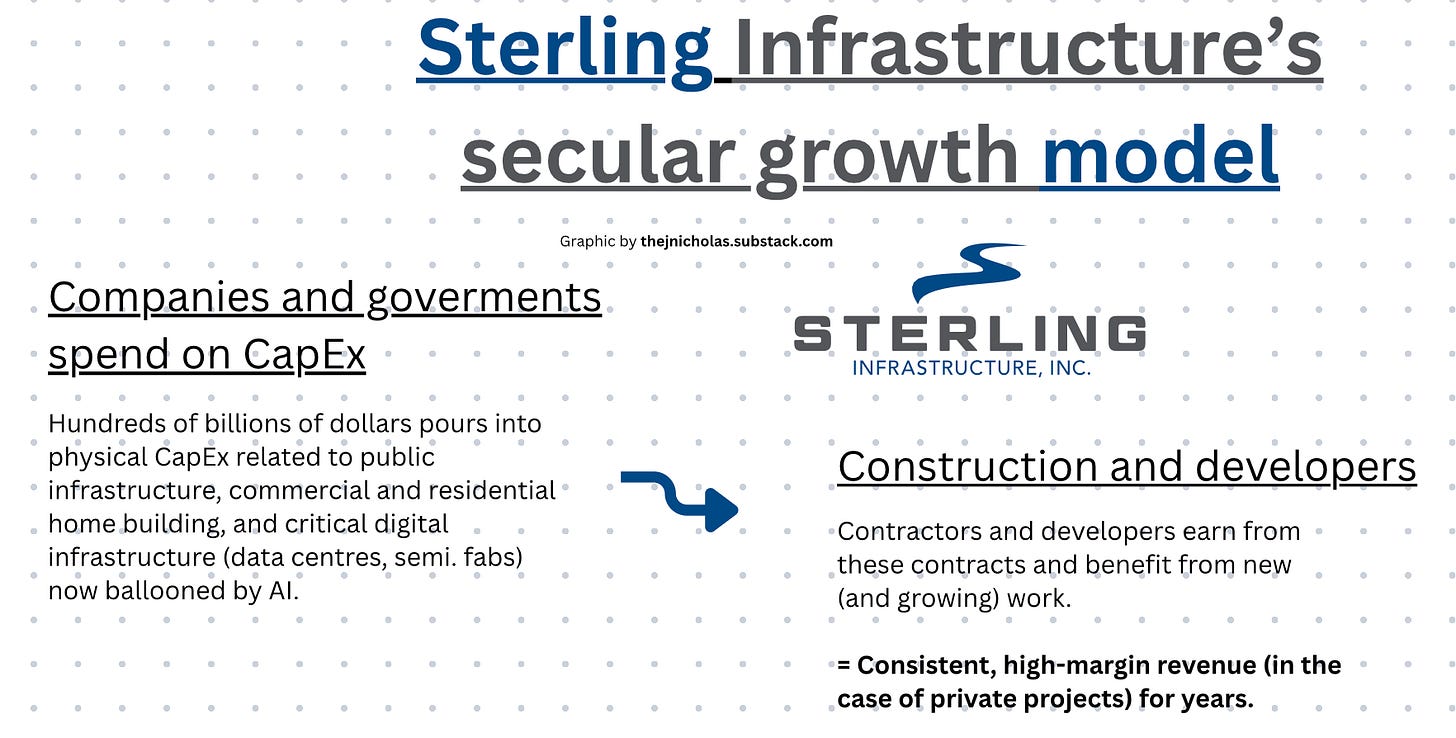

Ever since ChatGPT’s launch in 2022, hundreds of billions of dollars have poured into physical CapEx related to Al. Much of this spend is directly sunk on expensive Nvidia GPUs for training AI models and powering data centres, but around 10% of the overall CapEx is being spent on the physical build-out of large-scale infrastructure projects.

Google, Amazon, TSMC, Microsoft, and the like do not build the plants or data/distribution centres they end up owning by themselves. They contract the projects they need to companies like Sterling Infrastructure to do the dirty work.

Clearing, grading, plumbing, pouring concrete, etc. Literal dirty work.

The benefit of secular trends like this trend of AI is that they very rarely end abruptly when they start (hence, “secular”). This leads to consistent revenue for companies like Sterling even in the case AI-related spend slows (which I already believe is unlikely at a large scale; too much capital has been burned).

Companies need to spend on physical digital infrastructure as a rule for the growing global digital traffic.

A growing world economy and population = more needed server capacity.

Artifical intelligence adds to this rule by a large factor. And for America specifically, multiply it by a couple more factors.

Data centres and semiconductor fabrication sites are crucial aspects of technology as a whole, not just AI.

AI is simply fuelling the need (with the help of government support in the case of semiconductors).

Due to ongoing demand and consistent spending from these large technology companies, construction contractors (and sub-contractors), as well as developers and architect firms, etc (locally and nationally) are benefiting immensely.

However, it’s not every local and/or national construction and development company that’s benefiting; it’s every construction and development company with a longstanding reputation, resources, and connections. Sometimes one of the latter, but many times a mix of the three. These are the companies that large multinationals eye down.