Hello friends and enthusiasts! 👋

Happy Wednesday, and welcome back to the second edition of deep dive. I couldn't stand the name 'ABD,' so I changed it in case you were wondering. Sorry, not sorry, and I hope you enjoy today’s issue.

Let’s get into it.

Behavioural Finance

In every human comes a brain. An amazing organ responsible for the everyday decisions of your life.

Back in grade eight, I remember learning about the different duties that the brain would need to fulfill. Involuntary and voluntary actions. Exactly as it seems, involuntary would be something you can't control but needs to happen anyway; think of the heart or the lungs. Your heart beats without you needing to think about it, same with your lungs and breathing.

This leads to the topic of today’s newsletter: behavioural finance.

Similar to your lungs or your heart, behavioural finance is (in a way) the result of your brain having involuntary actions, but with your finances. Things like overpaying on a credit card and panic selling during a market downturn are all rooted in the psychology of your brain.

Today’s deep dive will cover a few examples of behavioural finance explained throughout three topics:

Investing (emotions over rationality).

Personal finance (do you really need that?).

How to use it to your advantage (reverse psychology).

Starting with emotions over rationality.

Emotions over rationality

One of the most common acts of financial idiocy is from decisions impacted by emotions. Emotions are an important part of our way of life, but when talking about finances (investing specifically) rationality should be first in mind.

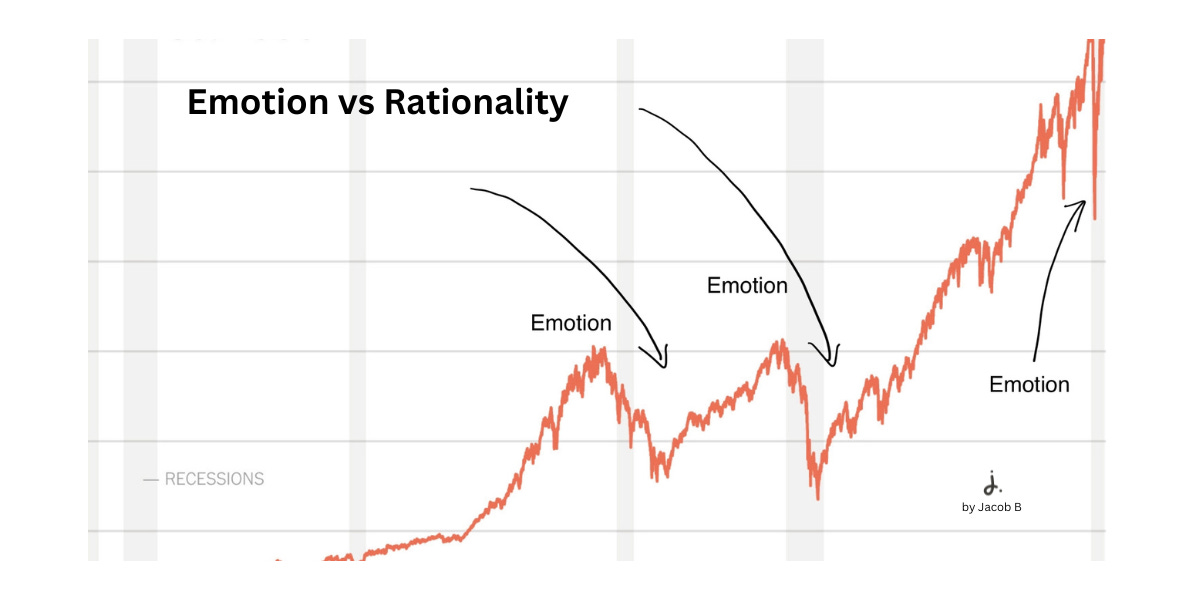

The graph above is of the S&P 500. The arrows are indicators of when a market downturn happened, usually due to recessions.

When the market goes red, there is an emotional instinct wired in your brain to want to sell. The fight-or-flight response is a great example of this.

Let’s say you're in a forest. You are lost and have no idea what to do. Suddenly, you hear wolves howling. It’s scary and stressful, and in this type of situation, your brain will activate fight or flight. Your heart starts beating faster, your blood boils, and you take less time between each and every breath.

You think about your family, your dog, and how you never said goodbye one last time. Then you wait…and you wait…and wait a little longer. But after hours pass, nothing happens. It turns out, there were no wolves, and the entire time, your house was just five trees behind you.

In a situation of life or death, your brain has the instinct to activate fight or flight. Your brain is doing this to help you, but allowing it to control you like this could hurt you more than help you.

Picture yourself hyperventilating, having goosebumps, and being on the verge of having a cardiac arrest. Take a guess if you would ever be able to think clearly in that situation. Spoiler alert: you wouldn't be able to. Your brain is focused on everything except the rational thought of escaping the situation, and your head gets clouded.

Multiply this example by a million or so, apply it to the stock market, and now you have a great understanding of how not to invest.

Everyone selling off during a market downturn is placing themselves in this hypothetical forest, with a fear of all their hard-earned cash eventually vanishing to zero and never coming back. Their emotions are taking advantage of them.

Not one single time in the history of the S&P 500 have you ever lost all your money (assuming you never sell). This could be applied to 90% of all major index funds.

Don’t be that person standing in a forest, and definitely don’t be that person who sells during a downturn. Your brain is meant for challenge, so use it to your advantage to think rationally and get yourself out of that forest.

Something to remember is that the most effective way to succeed in the stock market is just by leaving your money in the stock market.

“Be fearful when others are greedy and be greedy only when others are fearful.” - Warren Buffett

Do you really need that?

I bought an Apple Watch Series 9 last week from Amazon.

That big, fat, juicy ‘10% off’ label caught my eye, and I couldn’t hold back, so I bought it. Then a day passed, and I realized that I just spent $600 on a watch. That realization eventually made me cancel the order.

I then went ahead and ordered an Apple Watch Series 7 for half the cost. It’s literally the same watch, apart from a 0.25% (made-up number) battery life increase over the past few generations and a screen brightness increase.

The takeaway from this example, (besides my bad personal finance choices), is that you should always consider where your money is going.

The $250 I saved by buying a different generation of the watch can buy me 125 coffees at Tim’s, two shares of VFV, and it can even get me one cup of coffee at Starbucks (this is a joke).

Anyway, the point is to have a worry about your money and where it’s going. A dollar spent is a dollar spent, and that dollar spent was another dollar you could have invested for compound interest to do its work.

But if you are to learn anything from this section, just don’t impulse buy.

Most people probably know what an impulse buy is, and according to the stats above, a lot of people experience an impulse buy first-hand.

Let’s envision a scenario.

You walk into a Walmart. You see a sign:

“60% off all dairy products. Today only!”

Well shucks. You walked into Walmart to buy milk, and since dairy is 60% off, why not pick up some cheese while you're at it. And you know what, that cheesecake is looking even more delicious with a 60% discount.

You walked in hoping to pick up a bag of milk for $3, and your trip ended up costing you $50. You must have bought a lot of cheese to spend $50, but guess what?

…yOu jUsT sAvEd 60%!

Sorry to burst your bubble, but no, you did not just save 60%. You just spent $47 more than you should have.

This type of situation isn’t all that rare, since a ton of people experience impulse buying. The good news, is that none of this is your fault directly. It’s not your fault that the caramel vanilla cheesecake with a double crust happened to be 60% off. Blame Walmart for selling such distracting food items.

The bad news is that this is obviously a personal finance mistake on your behalf.

There was a study by the National Institutes of Health that covered the case of impulse buying, the psychological effects of it, and how it affects consumer behavior. Here’s what they had to say:

'Studies developed by Meena (2018) show that from a young age, one begins to have a preference for one product/service over another, as we are confronted with various commercial stimuli that shape our choices. Sales promotion has become one of the most powerful tools to change the perception of buyers and has a significant impact on their purchase decision (Khan et al., 2019). Advertising has a great capacity to influence and persuade, and even the most innocuous can cause changes in behavior that affect the consumer's purchase intention. Falebita et al. (2020) consider this influence predominantly positive, as shown by about 84.0% of the total number of articles reviewed in the study developed by these authors.'

This intrigued me because, other than it mentioning that sales promotions are a leading cause of impulse buying, it is saying that since you were an infant, your brain attached itself to a particular brand.

(Technically, this would mean that if you allowed your two-year-old child to use your iPhone, they will grow up to have an attachment to that particular phone brand. In this case, your child is being psychologically programmed to grow up and use Apple products, which is funny and very insane.)

So, next time you see that nice, juicy discount at a store, ask yourself these two questions: 'Would I buy this if it wasn’t on sale?' and 'Do I really need this?'

For the 'Do I really need this?' question, make sure it answers the HIM rule:

Will this thing make me happy?

Will this thing improve my life?

Will this thing make me money?

A 'yes' to any of these questions, would not be considered a bad purchase in my honest opinion.

In a money-driven world, things like this are bound to happen to you. This leads us to our last section (the fix to behavioral finance problems): reverse psychology.

Reverse psychology

According to Merriam-Webster, reverse psychology is 'a method of getting someone to do what one wants by pretending not to want it or by pretending to want something else.' For the purpose of this section, I’m going to twist the definition a little bit.

In this case, reverse psychology will be a tactic used to manipulate your own brain to change your current financial habits.

The sections above covered two of the most common psychologically embedded topics regarding finances: impulse buying and emotions while investing. Whether or not you’re subject to these, knowing how to successfully disregard them is very important.

I explained how to avoid these briefly at the end of each individual section, and before you go, let’s go over some essential quotes from this deep dive to leave you with a fresh understanding.

Quote #1:

“That big, fat, juicy ‘10% off’ label caught my eye, and I couldn’t hold back, so I bought it. Then, a day passed, and I realized that I just spent $600 on a watch. That realization eventually made me cancel the order.”

It’s sometimes hard to spot a bad use of money. I already had the intention of buying an Apple Watch, and at the end of it all, I still bought one; however, the mistake I made was not thinking over the price tag when I saw ‘10% off.’

After canceling my order, it took me three clicks to find a watch with the same features for nearly half the cost. When I impulse bought the original Apple Watch, my mind was not thinking of cheaper options. I thought I was getting a great deal. It turns out, I never did my due diligence, which is a mistake to always avoid.

Quote #2:

“In a situation of life or death, your brain has the instinct to activate fight-or-flight. Your brain is doing this to help you, but allowing it to control you in a situation like this could hurt you more than help you.”

In the forest example, you see a panicked person not knowing what to do, completely forgetting about the only way to get them out of the situation: which is thinking clearly.

The key takeaways here are to (1) think rationally in an emotional situation, (2) apply this with your investment strategy, and (3) to never ever sell during a market downturn (as this will benefit you in the long term).

That’s it for today, make sure to check your inbox for Weekly Brief on Friday.

Also, if you want some extra content, or would like to support me consider following me on Twitter.

Thank you for reading,

Jacob