Consider Avoiding Tesla

I won’t be buying Tesla stock anytime soon. Here's why. The Friday Filter #82.

Good morning investor 👋,

Welcome or welcome back to The Friday Filter—the quality investor’s market recap.

Most of the market was just about flat this week, and Tesla is on my mind. Tesla, I believe, isn’t a stock to buy right now, even after its 20% drop. It’s a no for me. Let me tell you why.

Let’s get into it. (11 min read)

Today at a glance:

The Filter;

I won’t be buying Tesla anytime soon

📄 In other news

📚 Resource of the week

I won’t be buying Tesla anytime soon

The Filter

By “buying Tesla,” I mean Tesla stock. I’m not against buying a Tesla because, fortunately, I’m a lover of technology, and Teslas, even with their flaws, are a technological amazement to me. Quality and mileage are a different story, but I haven’t heard many negatives about it.

I don’t currently own a Tesla, so I can’t recommend you buy one. But if you do, maybe buy one used. The prices fluctuate just as much as the stock.

And that’s my segue to stock price.

Tesla stock, unlike its cars (maybe), is not a buy.

After a massive feud between Elon Musk and U.S. President Trump online this Thursday (which, sadly, I won’t be talking about, but is the reason I decided to write this on Tesla), Tesla stock fell by 14% in one day (~$150 billion in market cap; the most for Tesla in a single day).

Usually, in times of downturn, when a stock goes down, we investors would look to capitalize. “Time to buy” is the usual response. But let’s take a step back and break this Tesla downturn down rationally.

For a quality investment—as in a stock you should be comfortable buying when it drops below fair value—there are four pillars to look out for:

Is the business competitively advantaged?

Is the business growing?

Is the business run by competent management?

This doesn’t deserve its own section, but for Tesla, the answer is yes. Elon Musk is an intelligent man. Great businessman. If he tried, he’s more than competent to lead the company. Problem is, he’s unpredictable, makes false promises he has historically never, or very minimally, kept, is a walking meme, and constantly props the stock price with stories over driving long-term results.

Is the business trading at a fair price?

Is Tesla competitively advantaged?

From 2015 to about 2022, Tesla was consistently the world’s largest car manufacturer in EV unit sales. Due to pro-EV policy worldwide particularly in China and America (its biggest markets), Tesla kept that advantage. There was honestly very little competition. The company had early-mover advantage, global brand appeal, and unmatched battery tech.

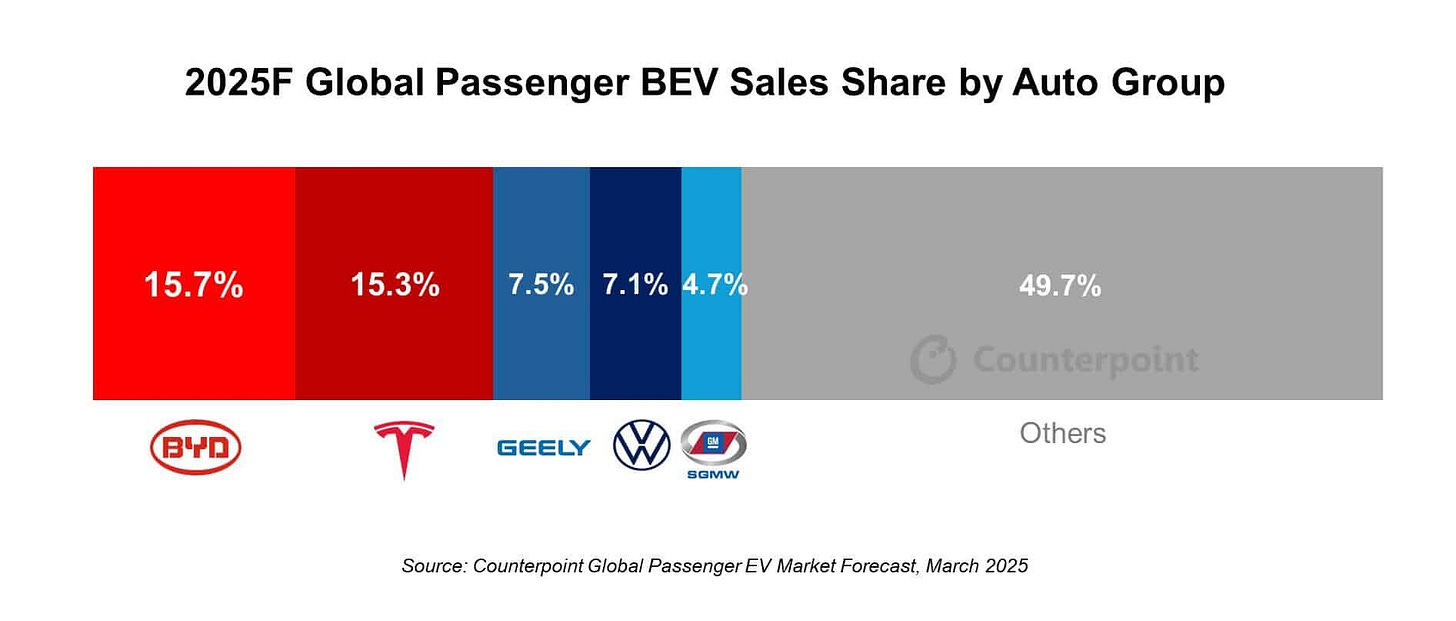

Then, fast forward to 2023, and BYD (a Chinese car manufacturer) overtook Tesla in total EV units sold (mostly hybrids), and eventually fully electric sales (BEVs).

The rise of BYD is one of subsidies. Billions of dollars’ worth of subsidies.

This has contributed to the rise in dominance of China’s EV car manufacturing industry. And this, plus European competition, has turned Tesla’s moat upside down. Or should I say? Ran over.

Early-mover advantage? Now irrelevant.

Global brand appeal? Weakened by Musk’s politics and tariffs from the West into China (though both of these issues may change who knows).

Unmatched battery tech? China is now on-par in cost and efficiency (leading in some cases).

All of this made things worse for Tesla and led to its “collapse” in the face of Chinese competition especially. Including when in 2024, Tesla delivered ~37% of its cars to customers in China, which is a huge part of their business that they’re now losing in share of.

Tesla isn’t over, it’s still a leading manufacturer globally as I write this. But it has no wide moat anymore if it ever had one. If it has any moat, it’s minimal. That, or I don’t see it. I wrote about the China EV leadership before:

As the world becomes ever so green, EVs are the future—whether we like it or not. It will take a while for us to completely adopt EVs, but they’re coming nonetheless. And China, of all places, has been the leader of this adoption—giving its carmakers large subsidies and squeezing Western [European, American] Japanese, and Korean automakers’ market share on a global scale. This problem is becoming much worse as Chinese automakers look to expand beyond the Chinese market.

Governments across the West have been placing large tariffs on Chinese automakers to stifle this growth, among other things, but it’s not working well, at least not for legacy automakers. […]

Is Tesla growing?

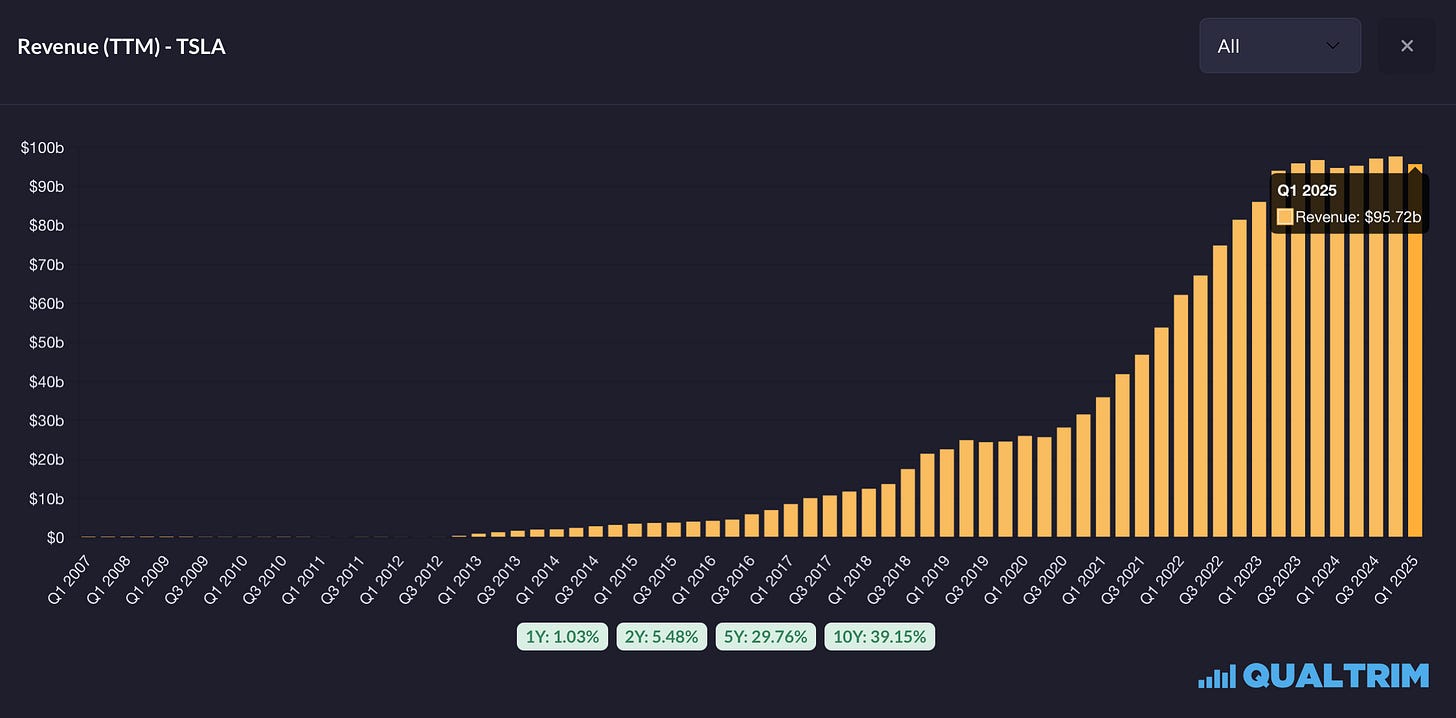

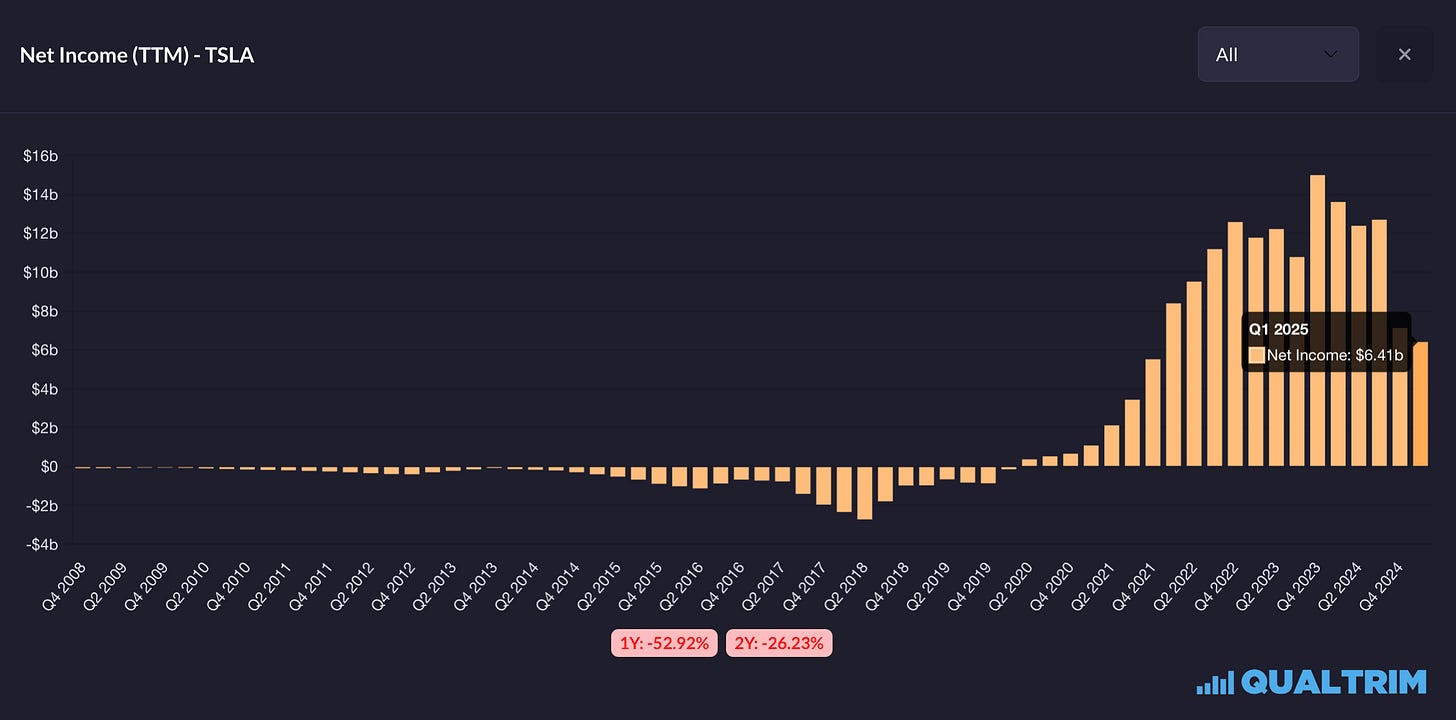

Yes, but barely. Revenue and total cars delivered have stagnated in growth over the past eight quarters (1.03% revenue growth and -1.5% growth in cars delivered, respectively), and net income/GAAP profitability has dropped by over 50% in the past year due to this slowing demand leading to price decreases etc.

Tesla has three revenue segments (percentages based on Qualtrim numbers, though it might vary):

Automotive (~77% of revenue)

Energy Generation & Storage (~12% of revenue)

Solar panels, solar roof, and Powerwall revenue

Services & Other (~11% of revenue)

Vehicle servicing, repairs, insurance, charging revenue, merchandise, and more

The other two segments, which make up around 23% of total revenue, are growing at a decent rate (33% and 24% YoY, respectively as seen below).

These other two segments are presumably much less capital-intensive, higher-margin, and are the branches of a sort of ecosystem based on the Tesla fleet.

However, even assuming these continue to grow and halve over the next five years (which is a fair, conservative pace of deceleration) and Automotive averages out to 1.5% annually, combined these segments would only make up ~32% of revenue by 2029-30. (Meaning a 3.5% total revenue CAGR over the next 5 years.)

And I say only because this means even in 5 years, the bulk of Tesla’s business will still hinge on their losing global share of the BEV market. These high-growth segments aren’t looking to be the saviour.

“But what about Robotaxi, Jacob?”

Great question, because this is a different story. Robotaxi could definitely “save” Tesla if it works out. And as of the time I write this, Tesla is expected to test their first robotaxi service with limited users on June 12, 2025. The announcement for global robotaxi vehicle production is said to start in 2026, but I’ve also heard that this may end up being delayed to 2029.

Here’s my hot take: When analyzing business growth, I believe it’s irrational to assume any extra growth based on robotaxi for Tesla.

“Oh, but the market is forward-looking and future growth matters.”

Yes; but when any promise in the past by a company has not been fulfilled, and given that you can’t predict the future, how can you value that? You just can’t. Even with my Uber thesis on autonomous vehicles, or Amazon with robotics, I only value and analyze the growth of these businesses using current fundamentals and business segments. These other growth vehicles I treat as a sort of side dish that I didn’t have to pay for. It still holds substance obviously, just lesser.

Is Tesla trading at a fair price?

I’m going to completely avoid multiples here for the valuation, and I’m going to use the default DCF metrics I would use for any potential new holding (e.g., a 13.5% discount rate).

For this first DCF, I’m going to be optimisic. I’ll add the $32 billion in net debt, and I won’t subtract the ~$2 billion in stock-based compensation from the FCF number. I’ll also give the company a 25x FCF multiple “because of its fast-growing service businesses,” and a 10% CAGR for growth.

And so, with these (what I’d consider) highly generous numbers, the fair price I calculated is about $207 billion, or $58.81 per share. Based on current prices as I write this, that’s about 388% overvalued without any margin of safety.

But now, let’s be critical.

Tesla is not growing at 10% annually and probably won’t over the next 5 years unless Robotaxi really takes off. At most, 5% growth is the highest I’m going to say Tesla could achieve annually under the current setup assuming revenue doesn’t budge much, and FCF catches up eventually. And by subtracting stock-based compensation from the FCF and slightly lowering the multiple to 20x (we’ll give flexibility for the service business), we get a fair value of $115 billion, or $32.67 per share—or about 778% overvalued based on the current share price, and again, without a margin of safety.

We can go back and forth with a DCF, crunching numbers on Tesla.

We can argue whether I’m “too conservative” or “too optimistic” in the calculations. Truth is, none of it would matter much anyway. There’s nothing else to it other than: Tesla is expensive.

If Robotaxi doesn’t work out, then it’s undoubtedly overvalued, and the company is not something to invest in.

But say you want to take the bet that Robotaxi and robotics will provide billions—or even trillions—of dollars in revenue by the end of the next 5 years… then by all means, buy Tesla. I don’t doubt the company will achieve some sort of tech advancement in the future. Like I said when I started, I like their cars. And I’m not praying for its downfall.

But rationally, as an investment, it doesn’t seem great for my portfolio.

The business is hurting, and its market position has weakened. It’s too political, and even when Elon’s politics are aside, the industry is by nature, not only capital-intensive, but full of regulation and policy changes. Its top-line growth is stagnating, with a bottom-line decline and high dilution in FCF. Its service business is unlikely to make up for the large automotive revenue of the company. And lastly, the stock is egregiously expensive.

It just doesn’t make sense to buy. At this point, buying really seems like a gamble. Maybe the gamble will pay off, and that’s awesome. If it does, I’m fine to miss the boat. But chances are, even if things go to plan, at this valuation, Robotaxi and robotics are unlikely to provide sustainable returns for shareholders in the near term. Maybe I don’t know enough? Not sure, but I’d rather not buy the overpriced car company with false promises. I’d like to sleep peacefully thank you very much.

So, I’m not buying right now. But I wish the company and its shareholders huge success. That’s it, that’s my spiel. Happy investing.

a. 📄 In other news

xAI, now with an increased valuation

Speaking of Elon, his premier AI company that also recently bought Twitter (which he also owns) in a weird “water drinking water” situation, is now reportedly worth $113 billion.

Amazon invests $10 billion in North Carolina

More for AI infrastructure! This news itself isn’t exactly new (we’ve known Amazon is spending over $100 billion in capex this year (the most of any company ever) but the specifics are what’s new. (There was also $5 billion in Taiwan.) Still bullish on Amazon.

Amazon plans to use robots in Rivian vans

Yes, another Amazon headline, but a very optimistic one for everyone: Amazon plans to test humanoid robots in Rivian vans (a company it owns ~20% of) for package delivery in the U.S. I don’t expect this to rapidly change things anytime soon, but it’s a cool peek into the future.

Bank of Canada keeps rates steady

The key benchmark rate remains at 2.75%. I have mixed feelings about this, but I’m going to wait it out before voicing my opinion. Things might change, and very soon.

b. 📚 Resource of the week

I wrote a post on Blossom Social this Thursday about how strategy is oh so important, but why so many people confuse strategy with a single box on a checklist to their investing identity. It’s more than that; it’s malleable.

Interestingly, it was Charlie Munger who got Warren Buffett away from this particular mindset of “doing one thing one way.” In fact, as I was responding to a comment on said post, I looked things up (using Google, of course) and I found this video. For Buffett, his unmalleable style so to speak, was “buy dirt-cheap stocks even if low quality.” There’s even a Substack about this.

Even though both tend(ed) not to categorize themselves, all they cared about was buying quality stocks at a fair price to their worth. Were they value investors? Were they growth investors? The logical answer is: who cares. But the factual answer is: none of the above.

From the video, even Munger thought that point-blank categorizing himself was a weird thing as he avoided a direct answer to the interviewer’s question on whether he and Warren Buffett were value investors.

A few quotes from the video:

“… there are various ways to look for value investments…”

“… I think it’s a bad use of the language to think there’s a difference between value investing and other good investing…”

“…There’s various ways to fish for value investing [to find business at a ‘value price’ relative to its value]…”

It’s not about growth or value investing or [insert whatever]. Rational retail investing is buying a stock at a fair price. But everything else can be subjective. This video again, indirectly, proves my point. And it’s an interesting thing I’ve learned this week.

—-

Thanks for reading today. Hope to see you soon (only figuratively; I’m not spying on you, I swear). Cheerios, friend.

All of my links here.

From the archives:

How to find a quality stock:

Quantum chips, explained:

As someone who never sees himself investing in (or buying) Tesla, l have always felt that Tesla's only moat was government subsidies which have made my commute hell by transforming all the smug Priuses into smug Teslas now.

Plus every investor should look at companies that over deliver and under promise instead of the other way around.

Great post