🍋 Lethal Lemonade

Weekly Brief

Good mornin’ !! ⛷️

On this day. On December 8, 1980, British musician John Lennon—famous for his role in the Beatles and his successful solo career—was fatally shot by Mark David Chapman in NYC.

IN THIS ISSUE

✈️ Alaska Air swallows Hawaiian Airlines

🍋 Panera Bread’s deadly lemonade

🇺🇸 Joe Biden’s not running for re-election?

Image courtesy of Adam Glanzman/Bloomberg

🪒 Proctor needs a doctor

It’s been 18 years since Procter & Gamble purchased the shaving giant Gillette, but was that a bad decision? (short answer: it wasn’t)

P&G bought Gillette for a whopping $57 billion back in 2005, but it turns out that they have been eating a lot of value from it. (interesting analogy, I know)

According to a financial report, Procter is expected to devalue its Gillette business by over $2.5 billion in the next two fiscal years. All despite projecting a 5% growth for Gillette.

The total charges, between $2 billion and $2.5 billion after tax, will be recognised in fiscal years 2024 and 2025.

✈️ Alaska Air swallows Hawaiian Airlines

Alaska Airlines, the fifth-largest airline in America and twenty-fifth on earth, is buying Hawaiian Airlines for $1.9 billion, including $900 million of its debt.

The deal is meant to bring better choices for air service on the global stage, and to broaden destination choices. While it has been approved by Alaska and Hawaiian’s boards, the transaction is expected to close in 12-18 months due to regulatory approval.

Unlike the JetBlue-Spirit merger that got blasted by regulators because of its size, the Alaska-Hawaiian merger is not going to be much of a hassle.

Following the announcement, shares of of Hawaiian surged 200%, while Alaska fell 15%.

✍️ Blackpink renews contract

YG Entertainment’s shares rose nearly 30% after announcing a contract renewal with all four members of the K-pop group Blackpink.

The deal might be a potential end to the contract saga, which would back with previous market speculation.

While the terms of the deal are unknown, an earlier report suggested that this contract will only apply to the group, and not the individuals or their solo careers.

💳 Nuvei and Microsoft’s partnership deal

Montréal-based Nuvei Corp., a payment processing company with investments from none other than Ryan Reynolds, partnered with Microsoft on Monday for a deal to use Nuvei's payment tech in the Middle East and Africa.

The partnership aims to help streamline payments for Microsoft's Office and Xbox products through Nuvei's ‘compétence’ in local markets.

Nuvei's stock rose by nearly 5% on the TSX.

POLITICS

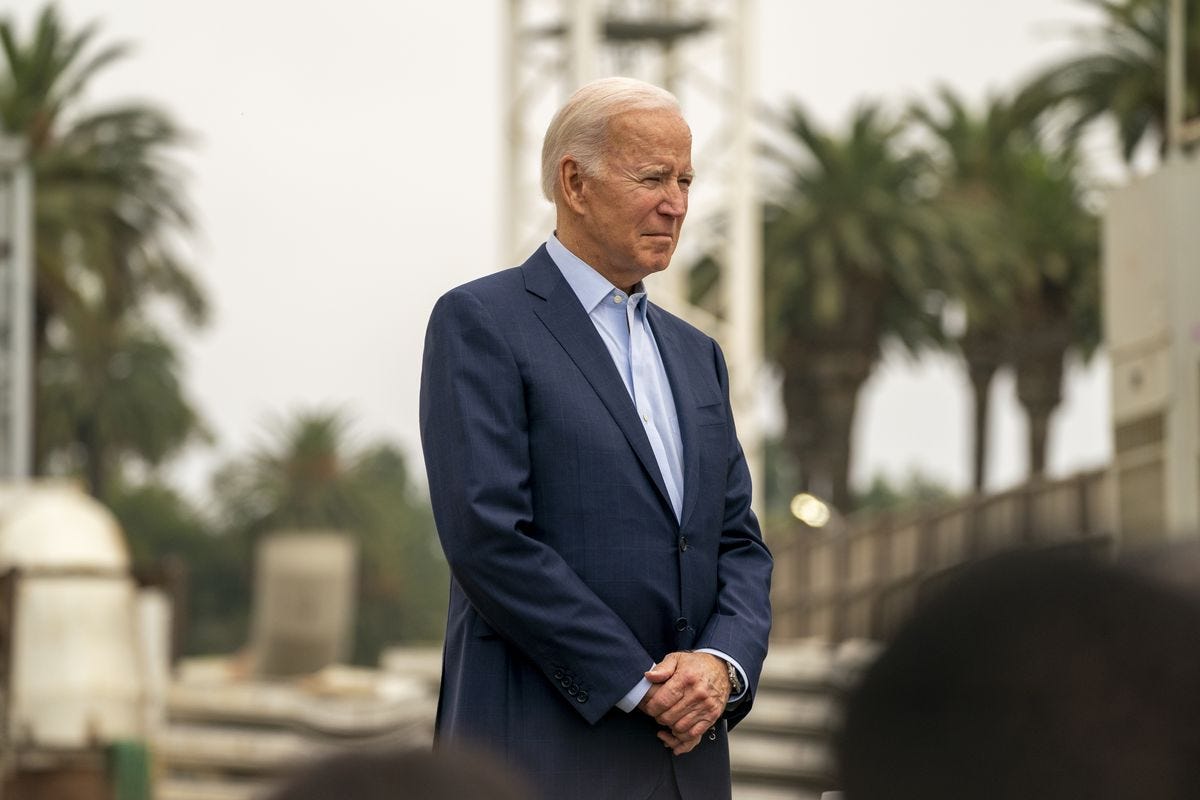

Image courtesy of Getty Images

🇺🇸 Joe Biden’s not running for re-election?

Yeah no, he’s definitely still running.

During a Boston fundraiser, he told donors that he ‘was not sure’ if he would have run for re-election in 2024 if Trump didn’t. He tried to later downplay the remark by saying he would still run even if Trump wasn’t, but it didn’t fool news outlets.

Speaking of the President, he just went on a $15 million donation spree and has so far spent over $45 million on ads in the key battleground states. According to CNBC, the total amount for the 2024 election will cost a whopping $10 billion on advertisements alone.

That’s 10 times the already ghastly record of $1 billion in the 2020 election.

🤖 Elon Musk’s $1 billion AI startup

Elon Musk does a lot of interesting things, and , he always tries to do more interesting things to top his last interesting thing. If that doesn’t make sense, then you’re on the right track to learning about Elon Musk.

Today’s ‘interesting thing’ from Musk is his AI startup called X.AI, which plans to (this is not a joke) ‘understand the true nature of the universe.’

A recent SEC filing of X.AI showed that Elon plans on raising up to $1 billion in an equity offering and has already received $135 million from four investors. The company has already launched a chatbot named Grok last month, which is now supposed to be a new competitor with ChatGPT and Google’s Bard.

Musk purchased GPUs for X.AI earlier and maintains leadership in multiple companies, including X (formerly Twitter), Tesla, SpaceX, Boring Company, and Neuralink

INTERESTING

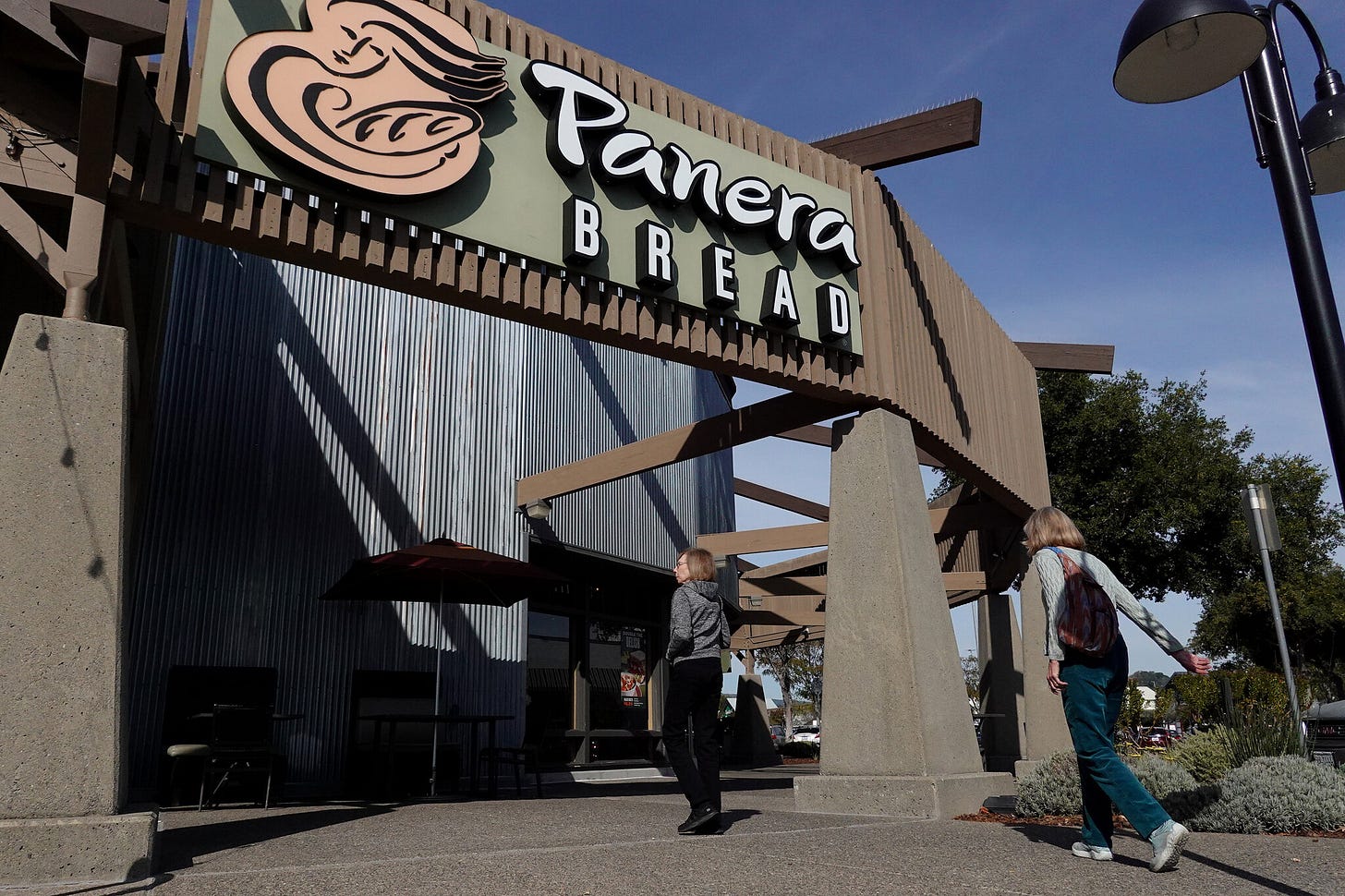

Image courtesy of Justin Sullivan/Getty Images

🍋 Panera’s deadly lemonade

Imagine a world where you could potentially die from drinking lemonade—oh wait.

Panera Bread released their ‘Charged Lemonade’ earlier this year, but later faced a lawsuit from the parents of a 21-year-old woman who died after consuming the product. Now, they’re facing another lawsuit because of a 46-year-old man who also passed away after drinking the beverage.

So, what’s in the drink that caused these deaths? Well, the lawsuits are centered around the amount of caffeine content (390mg) in the beverage itself. This could have been a cause to their deaths, as both individuals who passed away had heart conditions.

The catch is that the lemonade falls under the FDA’s recommended daily intake level of 400mg, but the lack of a warning to customers is what’s fueling the outrage.

Panera also recently filed for an IPO with plans on going public next year, so whether this will have an effect on that is in the hands of investors.

🏦 Canada’s banks get fined

This week, both the Canadian Imperial Bank of Commerce (CIBC) and the Royal Bank of Canada (RBC) faced penalties for not meeting money laundering requirements.

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) took action against RBC first, fining them a C$7.4 million fine, and just two days later, CIBC was also fined, but only for C$1.3 million.

This not only raises concerns about the regulations of these banks, but shows financial instututions in Canada that they need to comply or will be penalized.

recently, and if you read last weeks issue, you will know that C$7.4 million is an accounting error for RBC. However, the RBC fine is also the biggest fine in FINTRAC history.

Some could argue that this is a good thing, since both RBC and CIBC refused to give customer data away as ‘verification’ against money laundering. Others will say that this is positive because they should be complying.

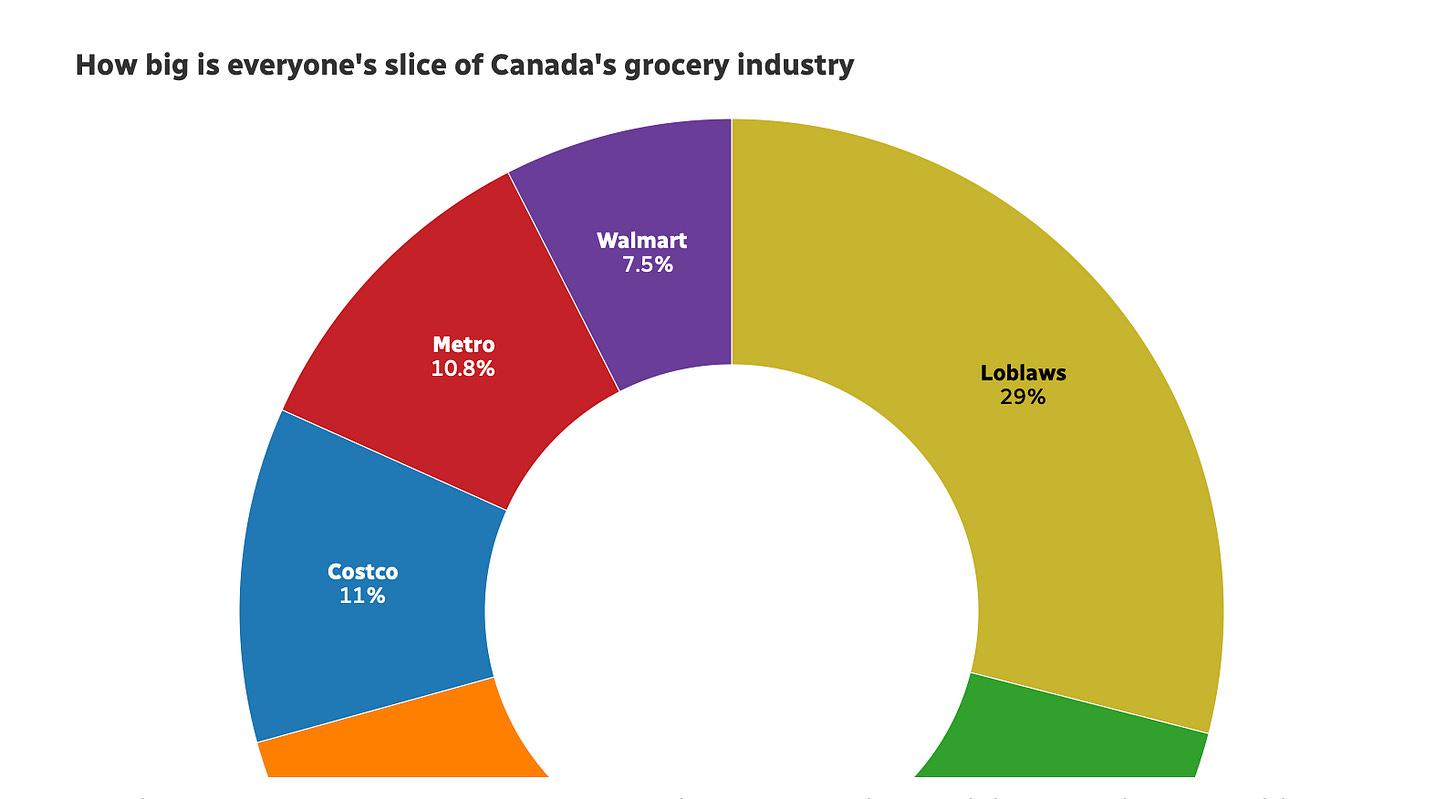

Image courtesy of CBC

🛒 Loblaws is worried about grocery prices…

The head of Canada's largest grocery chain, Galen Weston, is now concerned about food prices due to a new grocery code of conduct that the government wants them to sign.

Weston, the President of the Loblaws group, told the House of Commons that his company, along with other Canadian retailers, have been unfairly blamed for food prices.

While some grocery chains, like Metro and Sobey’s, support the code, Loblaws and Walmart are resisting, worrying about potential increases in business costs that could raise prices. Long story short: the code is supposed to help lower prices, but Walmart and Loblaws believe it will raise them.

This comes after Weston resigned from CEO at Loblaws earlier this year for raising prices during the pandemic and accepting a compensation of $11.3 million.

💰 Is Mastercard a copycat?

On Tuesday, Mastercard announced a 16% dividend increase and approved an $11 billion share repurchase plan.

This is severe deja vu for Visa investors, as only a few months ago, Visa raised its dividend by the exact same amount and authorized a share repurchase plan double the size of Mastercard’s.

Is Mastercard copying Visa’s moves for gains, or are they playing catch-up? You can decide.

☕️ Goodbye Mc, Hello CosMc

This week, McDonald’s finally opened its first beverage-focused store spinoff called CosMc, as a rival to Dunkin’ and Starbucks.

The company says this is a test to see if it should expand, and it plans on opening 10 CosMc branded stores in 2024, with one in Chicago and the rest in Texas.

If CosMc goes well, McDonald’s hopes on opening 900 stores in the U.S. and 1,900 in international markets, such as Canada and Germany.

📚 Book of the Week

The Psychology of Money

“One of the best books about finance ever. It’s original, easy to read, and teaches you much more than even business school could about wealth, and keeping it.”

— Jacob B, founder of J. Nicholas

Book Description:

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people.

Money―investing, personal finance, and business decisions―is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together.

That’s today’s issue, thank you for reading!

Copyright © 2023 J. Nicholas by Jacob Barnas. All rights reserved.