Nvidia: The Leader of AI

Hello friends and enthusiasts! 👋

Have you ever heard the saying, ‘invest in what you know’?

The saying is primarily used by Warren Buffett and his late sidekick Charlie Munger, and it means to invest in companies you truly understand.

Buffett notoriously refused to buy technology stocks during the dot-com bubble because he had no experience in the sector. Instead, he continued to invest in companies he understood, ultimately avoiding the crash when the bubble burst.

Fast forward to 2024, and we find ourselves in another bubble. Except this time, it might not burst.

Nvidia: The Leader of AI

When Apple announced the Vision Pro VR headset last year, it seemed to have one major flaw right off the bat: the US$3,500 price tag.

In a short interview with Apple’s CEO, Tim Cook, about the Vision Pro, Michael Strahan, a host for Good Morning America, asked him about this hefty price tag. Here is the excerpt from the conversation:

Strahan: The big question for a lot of people at home would be the price. It’s $3,500. Cook: Yeah. Strahan: How long before it’s more accessible to your average customer?

How did he respond to this question?

Cook: Well, it’s tomorrow’s technology, today.

Fundamentally, Cook is saying that Apple priced the Vision Pro at what the value (or worth) of it is in the future.

Well, guess what else is priced like this? Every solitary share of Nvidia stock.

In today’s Deep Dive, we’ll be covering the rise of Nvidia, it’s valuation, and whether or not we are in an “AI bubble.”

Throughout two sections:

The AI Craze

Valuation and an AI Bubble

But first, what the heck is Nvidia, and what makes them important?

1. The AI Craze

Nvidia is a technology company known for its graphics processing units (GPUs) and chips. In addition to GPUs, Nvidia develops other technologies such as artificial intelligence (AI) learning platforms, as well as hardware and software solutions for AI tasks (e.g., image recognition, natural language processing, etc.)

Today we’ll be focusing on that last bit.

For years, AI has gradually started to creep into our lifes. When you search something on Google, when you scroll through Instagram, and even when you send a message to a family member and it autocrrects =autocorrects (yup, that’s AI). These are all using a form of artificial intelligence. Mostly algorithms.

But then came the AI chatbot revolution.

On November 30, 2022, OpenAI, a non-profit artificial intelligence research company, launched ChatGPT, an AI chatbot with the ability to respond directly to any inputs you give it.

It’s name ChatGPT came from ‘chat’ referring to chatbot, and ‘GPT’ meaning Generative Pre-Trained Transformer.

“That’s great, but what exactly is an AI chatbot?”

ChatGPT is glad you asked.

ChatGPT can pretty much do anything.

Help you learn a language? Check. Write the best chocolate chip recipe ever? Check. Write a novella? Check. Heck, ChatGPT can even pass the bar, and even exams from top business schools in America.

Within two months of being released, ChatGPT gained over 100 million users, laying the foundation for “Big Tech” to start adding AI into their products and services. But more importantly, to start releasing their own chatbots to compete.

Google released Gemini, which they plan to incorporate into Google Workspace. (Released on March 21, 2023.)

Microsoft released Microsoft Copilot, now part of Microsoft 365. (Released on November 1, 2023.)

Meta released Llama, a chatbot designed for…something. I still can’t figure it out. (Released sometime in February 2023.)

Amazon has been using AI for over 25 years, with their AI chatbot Amazon Lex being released in 2017.

(Apple has done absolutely nothing.)

These trillion-dollar companies poured billions of dollars into the AI space, pumping out chatbots like hens laying eggs. They were (and still are) racing to gain the most market share possible in this new sector.

But guess what these companies depended on to run these chatbots? Nvidia’s GPUs and artificial intelligence technology.

From this, there was now a serious need for Nvidia’s products.

From this, there was an AI craze.

Because of the increase in demand, Nvidia's annual revenue surged from $25 billion to $61 billion in 2023 alone which was reflected in its share price that rose over 260%. As of March 5, 2024, Nvidia is the third most valuable company on earth, with a market cap of $2.1 trillion, surpassing the worth of Google (GOOG), Amazon (AMZN), and Meta (META), the main companies responsible for this surge. (Oh, how the tables have turned.)

2. Valuation and an AI Bubble

Valuation

We [Berkshire Hathaway] will never buy in our stock at a silly price. We may make a mistake by not buying it at a cheap price. But we'll never make a mistake, I don't think, by buying it at a silly price. - Warren Buffett

Most technology companies trade at silly prices. Nvidia was no different.

Near its peak last year, NVDA was trading at a P/E ratio of close to 300 on the NASDAQ. In practice, this means that if you invested $100 into Nvidia at that price, it would have taken 300 years for Nvidia to make you back that $100. That is what Buffett calls a silly price.

However, as we discussed earlier, Nvidia is not priced at today’s value; it’s priced at tomorrow’s value. At least that’s what investors are currently pricing it at. For example, that 300 P/E ratio last year equals a 70 P/E in today’s value.

“Past results to not guarentee future performance.”

Nvidia is a once-in-a-lifetime stock, don’t get me wrong. No company can compare to the absolutely absurd growth that Nvidia has experienced, and I don’t believe we will see another stock quite like Nvidia in our lifetimes.

Anyway, what is my opinion on the valuation?

I think Nvidia is trickily valued, because Nvidia is a tricky company.

If Nvidia can keep smashing earnings, then today’s price is a steal. But there has to be a certain point where they cannot double their revenue, don’t you think?

Who knows though, that’s why it’s tricky. Maybe they will end up consistently smashing earnings, and maybe they will keep doubling their revenue. Only time can tell, and it will, always. (Don’t forget, Nvidia has a 90% market share in the AI GPU space. This will help them out for the next few years until a competitor emerges. (If that happens.))

AI Bubble

This surge in prioritizing AI has led the market into a tricky spot. For example, before Nvidia’s last earnings release, the market was red. As soon as they released, the markets went green.

And as a reminder, it’s not affecting the market as a whole, but instead, a majority of tech stocks, which makes it scarily similar to the dotcom bubble of the late 1990s. (Remember that during this bubble, companies with little more than a website and an idea saw their values skyrocket before crashing down.)

This AI boom is a sign of a bubble.

Here is my honest opinion on AI in the markets:

Some AI companies may be overhyped and overvalued, but the potential of AI to revolutionize businesses and society as a whole is incredibly strong. In the coming months or years, we might see adjustments and corrections as the market matures to the sound of AI and differentiates worthwhile businesses and businesses riding the AI hype wave.

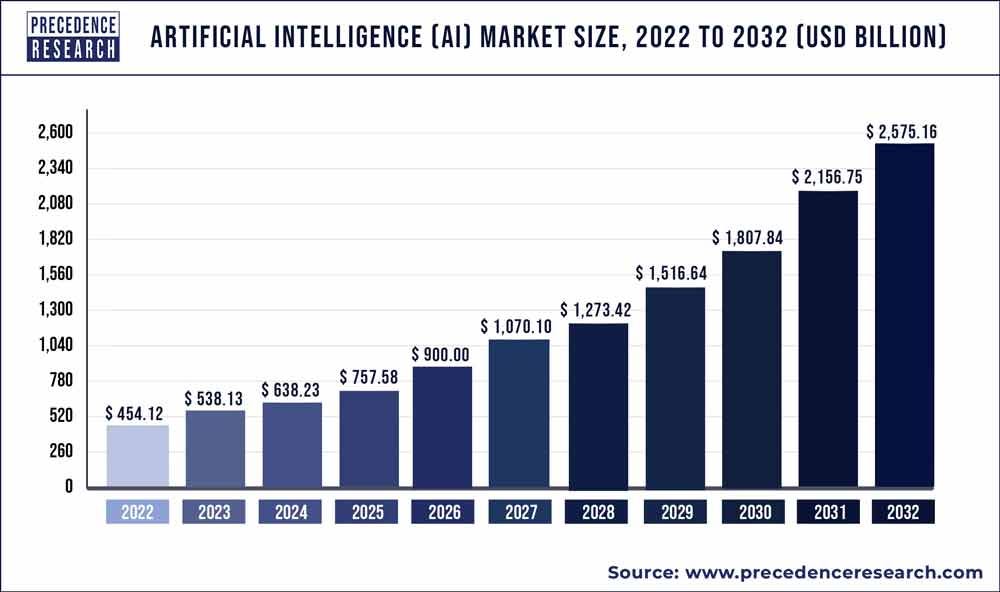

However, as long as AI continues to grow, which it undoubtedly will, so will the stocks related to it. AI is not just a trend; it’s a technology that is already integrated into various industries. So, while we might be in an AI bubble, it probably won’t burst like the 1990s, and instead will slowly deflate.

I’m going to leave it at that.

That’s all for today! Make sure to check your inbox on Friday for another Weekly Brief.

As a thank you for reading until the end, I have a free preview of my ‘how to calculate fair value’ PDF linked below for you to read.

Again, thank you for reading, and happy Wednesday!

☕️ - Jacob xx

❤️