Weekly Brief

Weekly Brief

Good mornin’ !! 🎉

Berkshire Bids Farewell 👋

Warren Buffett's Berkshire Hathaway recently filed its Q3 Securities and Exchange Commission report, revealing a reduction in stakes in various companies and two complete exits.

General Motors was completely sold off, along with Activision Blizzard, due to Microsoft's recent purchase of US$68.7 billion or US$95 per share.

UPS, HP, Chevron, Johnson & Johnson, Procter & Gamble, Amazon, Mondelez International, Markel, and Globe Life were among others that were trimmed and exited.

Berkshire's cash position reached a record US$157 billion by the end of September, driven by high-interest rates and strong operating earnings from its portfolio of business holdings.

The company also disclosed a secret holding to the SEC. 🧐

Markets Rise, U.S. Inflation Data Released

Stocks around the globe surged on Tuesday after U.S. inflation data for October exceeded expectations.

The MSCI World Equity index rose by nearly 2%, the S&P 500 by almost 2%, the Dow Jones by 1.4%, the TSX Composite by 1.6%, and the Nasdaq Composite by 2.4%. 📈

The pan-European STOXX 600 also experienced a 1.3% jump, while treasury yields dropped, and the U.S. dollar index fell by 1.5%. 📉

Russia’s Potential Decree 📜

Western investors in Russian companies are fearing a potential decree that could force them to sell shares to the Russian government at a minimum of a 50% discount.

The potential decree is said to be Russia’s goal of gaining control over Russian companies, following sanctions from Western allies regarding the war in Ukraine.

Dollar Drops, Rates Cool

The U.S. Dollar dropped by over 1% on Tuesday, as mentioned above, with the U.S. inflation data indicating a potential signal that the Federal Reserve may be finished with rate hikes.

“The dollar index, a measure of the U.S. currency against six peers, slid 1.55% to 103.980, on track to its biggest single-day percentage decline since Nov. 11, 2022.

The U.S. currency also was poised for its largest declines since November 2022 against the euro and British pound.

The dollar slipped 1.73% against the euro to $1.089, 1.82% against the British pound to $1.250 and 1.52% against the Swiss franc to 0.888.”

- Reuters

————————————————————————————————————

President Xi Meets President Biden 🇺🇸 • 🇨🇳

China’s President Xi Jinping met with Biden in California on Wednesday in an effort to decrease tensions. The U.S. and China agreed to resume military-to-military communications, according to President Joe Biden.

Following the meeting, President Biden referred to the Chinese President as a ‘dictator’ while answering a question from a CNN journalist.

“Well, look, he’s a dictator in the sense that he is a guy who runs a country that is a communist country based on a form of government totally different from ours.”

China dismissed his words on Thursday, stating that it was "extremely wrong" and "irresponsible political manipulation."

Canadian PM Justin Trudeau Surrounded by Protestors

Protesters surrounded a Vancouver restaurant on Wednesday, calling for a cease-fire by Prime Minister Justin Trudeau in the Israel-Hamas conflict.

A hundred police officers were deployed, resulting in one officer injured and two arrests out of the 250 protesters.

“There was a fear for the Prime Minister’s safety,” said the VPD.

You can watch the video here.

————————————————————————————————————

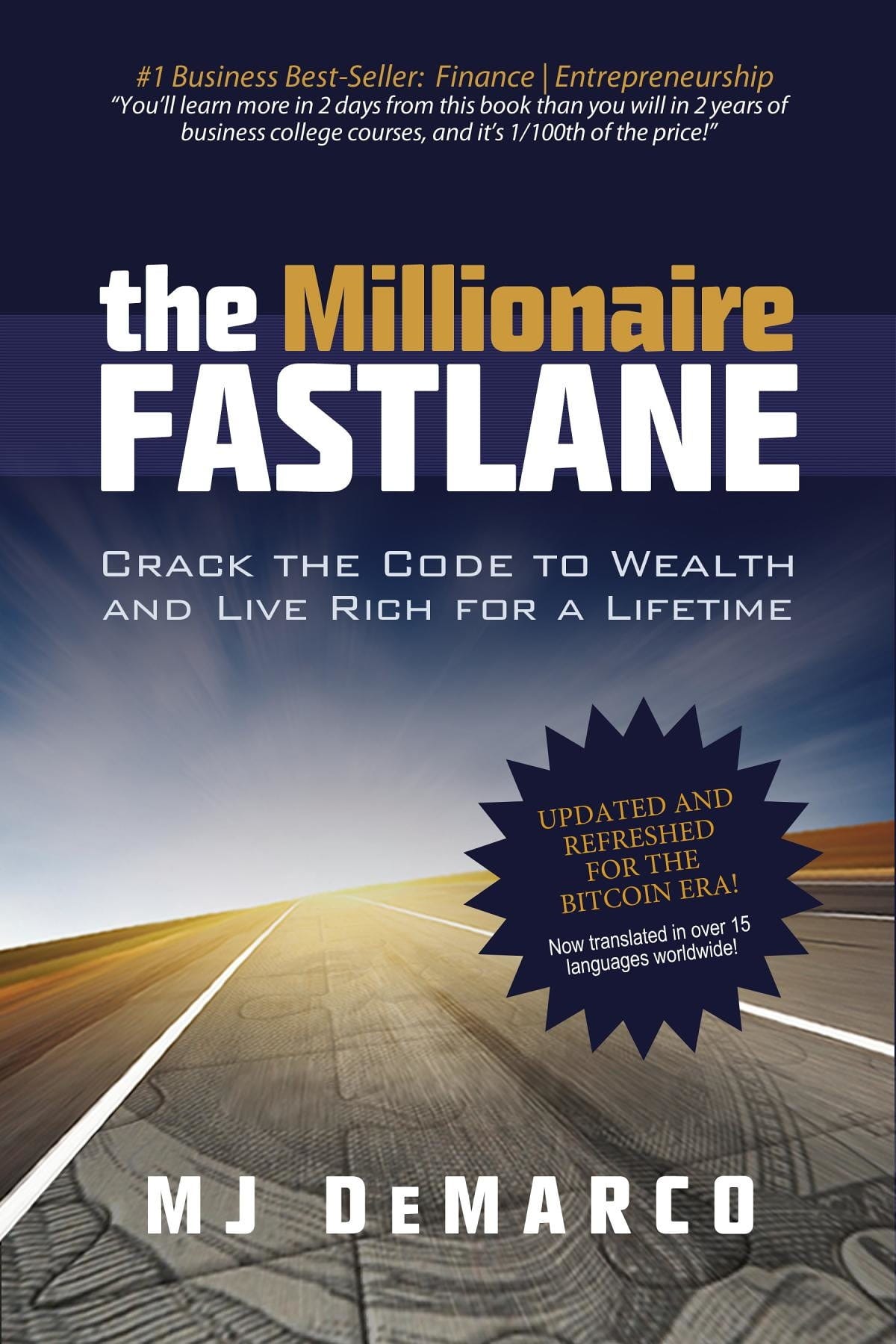

Book of the Week

The Millionaire Fastlane: Crack the Code

to Wealth and Live Rich for a Lifetime

“Drive the Slowlane and you will discover your life deteriorate into a miserable exhibition about what you cannot do versus what you can.

For those who refuse the lifetime subscription to mediocrity, there's an expressway to extraordinary wealth capable of burning a trail to financial freedom faster than any road out there.

And shockingly, this road has nothing to do with jobs, 401(k)s, indexed-funds, or a lifestyle of miserly living in a tiny house.”

————————————————————————————————————

That’s it for today — thanks for reading!

Think we can improve? — Let us know.

Related Articles

Did you enjoy the information in this email?

We have a strong feeling you’ll like these…

Reuters

Berkshire sheds General Motors,

Procter & Gamble, as it builds cash

Bloomberg

Dollar Tumbles Most in a Year as

Traders Bet on End of US Hikes

Copyright © 2023 J. Nicholas by Jacob Barnas. All rights reserved.