Hello investors 👋,

Overexaggerated, but true story: Just last Tuesday, as I was driving into Barrie with my brothers, a white Honda turned my way as I drove through a green light. Using my supernatural reflexes, I swerved to the right, rotating the wheel faster than my eyes could blink, speeding on the gas to get ahead. With a Tim Hortons medium-sized iced coffee firmly gripped in my right hand during the whole occurrence, I dodged what seemed like an inevitable collision. My spidey senses saved me, but if they hadn’t, my car would have been totalled.

And there’s that word: totalled. Have you ever wondered what happens to totalled cars involved in car accidents or otherwise after insurance pays the owners?

I always have, and after this occurrence, I was officially curious. So, I turned my curiosity and near-death experience into an investment case write-up. Turns out, the answer to my question this whole time was a company named Copart.

PS: Today’s Deep Dive is a collaboration with Summit Stocks. Summit Stocks runs an amazing publication focused around stock deep dives just like mine, and he’s written today’s quantitative section (diving into the financials and valuation). I’d highly recommend checking out his newsletter. You can do that here.

Let’s get into it. (15 min read)

If you enjoy today’s issue, consider supporting me and my work by becoming a partner of J. Nicholas. I greatly appreciate it. Enjoy!

Today at a glance:

Salvaging An Opportunity

A Brief History

Copart Analysis

Future Troubles

Fundamentals,

Growth, Valuation

Salvaging An Opportunity

Say you grow up on a dairy farm in good old Arkansas, graduate high school in California, get drafted to join the United States Army, serve a one-year tour in the Vietnam War, and get wounded so badly you receive a U.S. Purple Heart for your service. What would be your next move? Would it be to move your family into a trailer home for a few years so you could purchase a junkyard to store totalled cars?

For Willis Johnson, the answer was yes.

A Brief History

After serving in the U.S. Armed Forces in the Vietnam War, receiving a Purple Heart in the process, Willis Johnson (left in the photo above) ventured out to start an online auction company. Not just any online auction company, of course, but an online salvaged cars auction company—an auction company made specifically for insurance businesses to sell totalled vehicles.

Johnson had previously operated a dismantling yard in Sacramento. From these few years of experience working with extremely damaged vehicles, he began to see an opportunity. Many salvaged or damaged vehicles that end up at a junk or dismantling yard are from insurance companies that can’t sell them wholly, so they break it up to sell the parts and hopefully make some money. Johnson noticed this, and after spotting this deficiency in the market, he decided to take the risk of creating a company dedicated to solving these deficiencies.

Thus, in August of 1982, Copart was born.

By leveraging his knowledge from the dismantling yard, Johnson was able to persuade insurance companies by creating a business model that directly addressed the problems they had with selling totalled vehicles. Johnson would even personally visit insurance offices to build connections and promote Copart.

During the earlier days, Copart relied solely on in-person auctions, where buyers would gather at Copart’s junkyard site to bid on the vehicles in the traditional auction way. As the demand for salvaged vehicles grew, and the business model proved to be successful, Copart expanded its presence throughout the California area, opening more auction sites and increasing its inventory thanks to further partnerships with insurance companies.

Then, when Copart went public on the stock market in 1994, everything changed.

Newfound capital from the public markets fell directly into Copart’s lap, allowing them to drastically expand their presence throughout the U.S., opening new sites nationwide. Years following the IPO, Copart aggressively expanded its footprint across America, building out auction sites in multiple states and becoming a significant player in the U.S. salvage vehicle auction market.

But the best came for Copart in 2001 with the launch of its online auction platform. Thanks to the beauty of the internet, this ability of an online auction allowed bidders from all around the world, as long as they had an internet connection, to participate in Copart auctions. From then on, Copart’s online presence in the auto auction market grew faster than their physical auction sites, until eventually, Copart became a 100% online auction house. That’s where it is today.

In 2010, Copart began its international expansion by opening its first auction site in Canada. Three years later, they expanded to the United Kingdom after acquiring a local vehicle auction company, allowing Copart to officially enter the European market. Up until today, Copart has continued to adapt and innovate as much as they can in their market, by investing further in technology, leveraging AI and data analytics to streamline the auction process, and even just by acquiring smaller companies.

Today, Copart is the largest total loss, damaged, and low-value vehicle auction services company in North America. Johnson, who at the time of writing owns 6% of the company, is currently worth $3 billion.

Copart Analysis

While Copart does operate internationally, its most prominent and important market is North America, and that’s what we’ll be focusing on today. When I first heard about Copart, one of the main things that caught my attention was the setup of the business model. Much like a card network, such as American Express, Copart operates with an extremely low-capex business: a capital-light model.

For most of Copart’s revenue (85%), it does not actually own the product sold to obtain it. Like Uber, which doesn’t own its fleet, DoorDash, which doesn’t actually employ its dashers, Airbnb, which does not own the homes, and probably the best example being Visa, Mastercard, and American Express, which don’t do anything besides link transactions together. All of these companies don’t have to fork out capital to run their main operations. They build the platform, grow the user base, and sellers flock to that user base to sell the particular business’s product for them.

That’s a simplified way of looking at things, but it’s precisely why these are some of the best businesses in the world. These companies can consistently produce amazing amounts of free cash flow without problems because they have no deep expenses used on producing the product. I.e., capital light.

Copart doesn’t own the cars sold on its platform (at least not a sizeable majority of them); it simply facilitates a platform for sellers to sell on said platform and takes commission(s).

Many, many commissions.

Each car sold on the Copart platform comes with many fees throughout the process, both for sellers and buyers. For sellers, Copart charges a listing fee and a commission (a percentage of the vehicle’s sale price). Typically, this is $25–85 per listing and 5% to 15% of the final sale price, depending on the value of the vehicle (the higher the sale price, the lower the percentage rate and vice versa). However, this doesn’t include cleaning, transportation, storage, and all the other services Copart provides on top of purely hosting the platform.

For buyers, before you’re even allowed to bid on the platform, you have to make a roughly $500 deposit and upload a form of ID. This is completely refundable if you lose an auction, but it is put in place primarily to funnel high-quality and serious bidders who are ready to make a commitment. After you win an auction, Copart charges a fee on top of the winning bid. If you’ve ever bought from an auction before, this is standard practice and is usually called the “buyer’s premium.” These fees are normally a percentage of the final sale price (which again decreases as the price of the vehicle goes up). Finally, standard for all successful winners on the platform is a $79.00 gate fee, but fees like processing and shipping (if they decide they don’t want to pick it up themselves) are here as well.

Something to note is that Copart also sells a Costco-like membership with perks for lower fees and additional features on the platform, but I could not find specific revenue numbers or membership subscriber counts aside from on Wikipedia, so I left it out. Nonetheless, it’s still notable.

By charging both the buyer and the seller, Copart maximizes its revenue from every transaction while offering value to both parties through its platform and services, without “overcharging” one end. On average, taking into account both the seller and the buyer of a specific vehicle from an auction, Copart takes about 15–25% for every sale on the platform. That is one amazing commission revenue percentage for an e-commerce business.

For the storage of the cars themselves, Copart purchases the land instead of leasing, which is yet another attribute of the capital-light nature of the business. Not only is Copart not actively spending money on inventory (because it has virtually no inventory), but it owns land to store inventory, and it operates in an incredibly niche market where it thrives like none other.

Currently, Copart controls about a 40% market share in its respective industry, and to this day hasn’t strayed away from its totalled insurance vehicles past, and while Copart does not publicly release this information, it is widely known that a large majority of the cars sold on the platform originate from insurance companies. The remaining cars are from banks and financial institutions with repossessed vehicles, old inventory from car dealerships, charities selling donated vehicles, and last but not least, mere mortals like you and I trying to get the best bang for our buck on out vehicles.

From this data, we learn that long-term relationships with insurance companies are crucial for Copart. After all, they are the primary sources of totalled vehicles; the primary source of inventory for Copart. Ergo, having these strong relationships built over decades with these insurers gives a nice supply of vehicles for auction, providing Copart with a consistent revenue stream. Now sadly, car crashes are very consistent around the world, but subsequently, insurers are going to consistently provide Copart with cars they need to sell, which benefits both parties, but more importantly, Copart’s business. As Copart’s platform grows over time, the value to buyers and sellers increases—where sellers have access to more buyers, and buyers have access to a larger selection. This creates a positive feedback loop, making it harder for new entrants to emerge as disruptors in the market.

All of this put together forms and solidifies a wide-moat, heavy pricing power, geographically diversified business.

Future Troubles

With an increasing focus on sustainability and recycling throughout the globe, including major nations and world powers looking to prioritise recycling and reuse over disassembly and disposal, Copart will benefit from a circular economy—a system of constant reuse, refurbishment, remanufacture, recycling, and composting of all materials and products.

Yet, in the same realm of environmental sustainability and electric vehicles (EVs), come autonomous vehicles. No matter if they’re in a gas-powered, electric, or hybrid vehicle, people will continue to drive recklessly, running through stoplights and whatnot, all around the globe. Because people are normally idiots. However, what will change (and it’s a long-term change) is transportation.

As technology advances, and as companies like Google, Tesla, and many other automakers push towards self-driving cars, this poses a risk to Copart and other online salvaged car auctions. While again, it won’t be for the very long term and might not even come to fruition as soon as people think, autonomy and computer-driven vehicles will almost certainly lower the number of car crashes around the world.

Copart’s business is largely supported by insurance companies and totalled vehicles. Right now, the recklessness of humans and their ability to drive cars is allowing for a consistent flow of insurance companies to list cars on Copart year after year. As funny as that sounds. However, as cars become more technologically dependent, run on computers that make fewer and fewer mistakes, and continually learn from their mistakes to improve and make even fewer mistakes, there won’t be as many totalled cars every year, which will affect Copart’s consistent flow, along with every other salvaged auction site.

But the good news is (I’m not sure if you noticed), this hasn’t happened yet.

We aren’t driving around with self-driving vehicles. At least not in my world. Today, in the year 2024, Copart is reaching all-time highs in revenue, and continues to grow as we speak (or I guess read). I believe that in 2024 and on, Copart and its outstanding management, along with the business they represent, with their immense track record of both buying back shares and producing consistently growing free cash flow every year to reward shareholders, will continue to be an excellent bet for the next decade, as it has been throughout history.

Copart’s revenue is broken down as follows (TTM1):

💼 Service Revenue: (84.1% of sales)

Revenue generated from fees charged to buyers and sellers on the platform during the Copart auction process. (listing fees, auction fees, storage fees, transportation etc).

🚗 Vehicle Sales: (15.9% of sales)

Revenue generated from the sales of vehicles Copart directly owns and sells on its platform.

Fundamentals, Growth, Valuation

~Written by Summit Stocks~

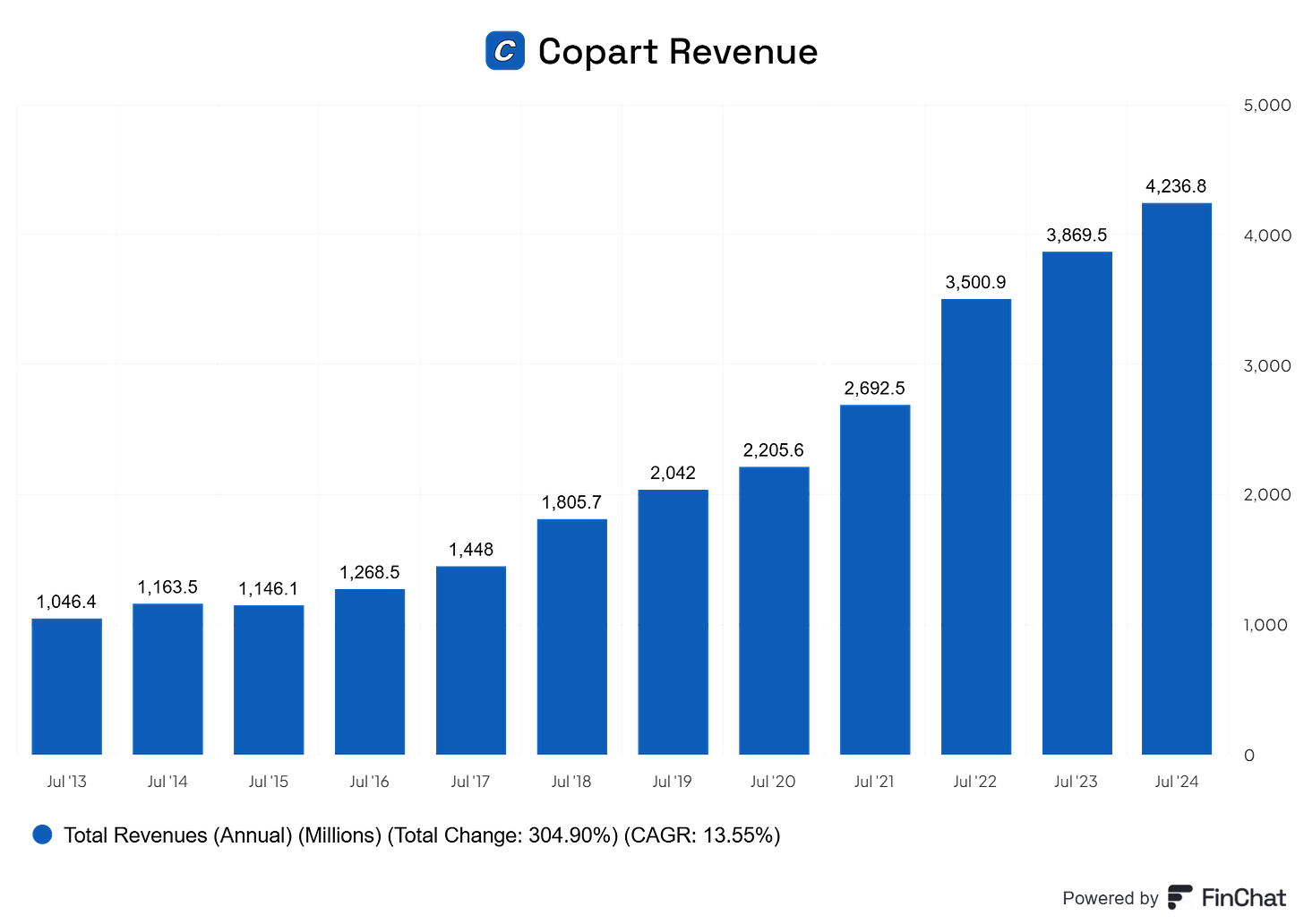

Copart’s revenue growth over the past decade has been impressive, with a compound annual growth rate (CAGR) nearing 14%. Notably, growth has accelerated since 2020, reaching a 17% CAGR between 2020 and 2024.

Copart attributes this acceleration starting in 2020 to a decrease in volume that was more than offset by higher revenue per car. The latter likely occurred due to the COVID-19 pandemic, which slowed new car production, increasing demand for used vehicles. In recent years, management has emphasized how a shift in the mix of vehicles sold has increased both volume and average auction selling prices. The reopening of economies worldwide also contributed to the significant revenue increases.

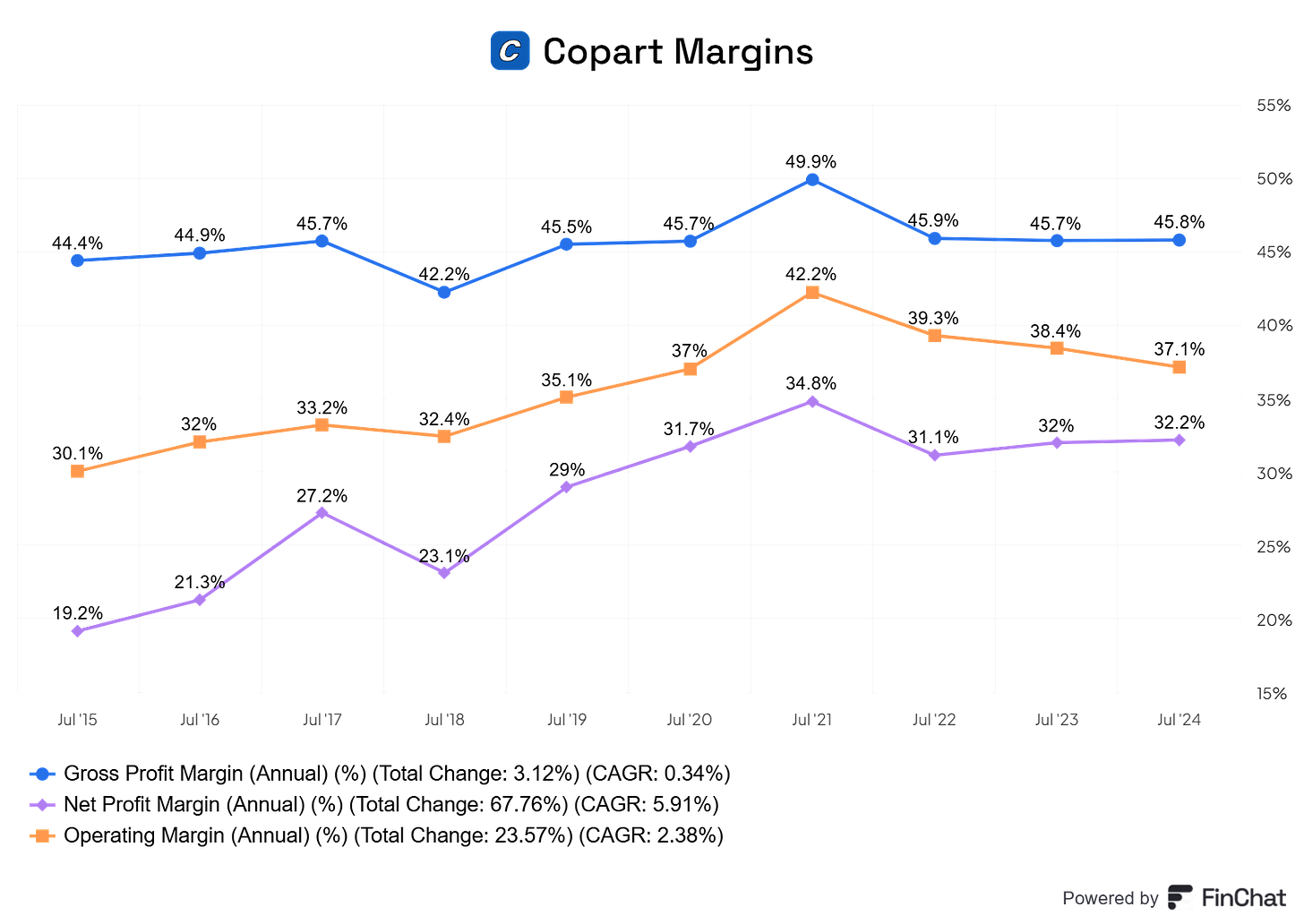

Next, Copart has become increasingly profitable. While gross margins have remained flat—indicating limited pricing power—operating and net margins have expanded significantly.

Several factors likely contributed to this:

The change in vehicle mix, leading to higher auction selling prices and higher fees without having to increase operational costs.

Economies of scale and improved scalability may have positively impacted margins.

Overall cost efficiencies implemented across facilities.

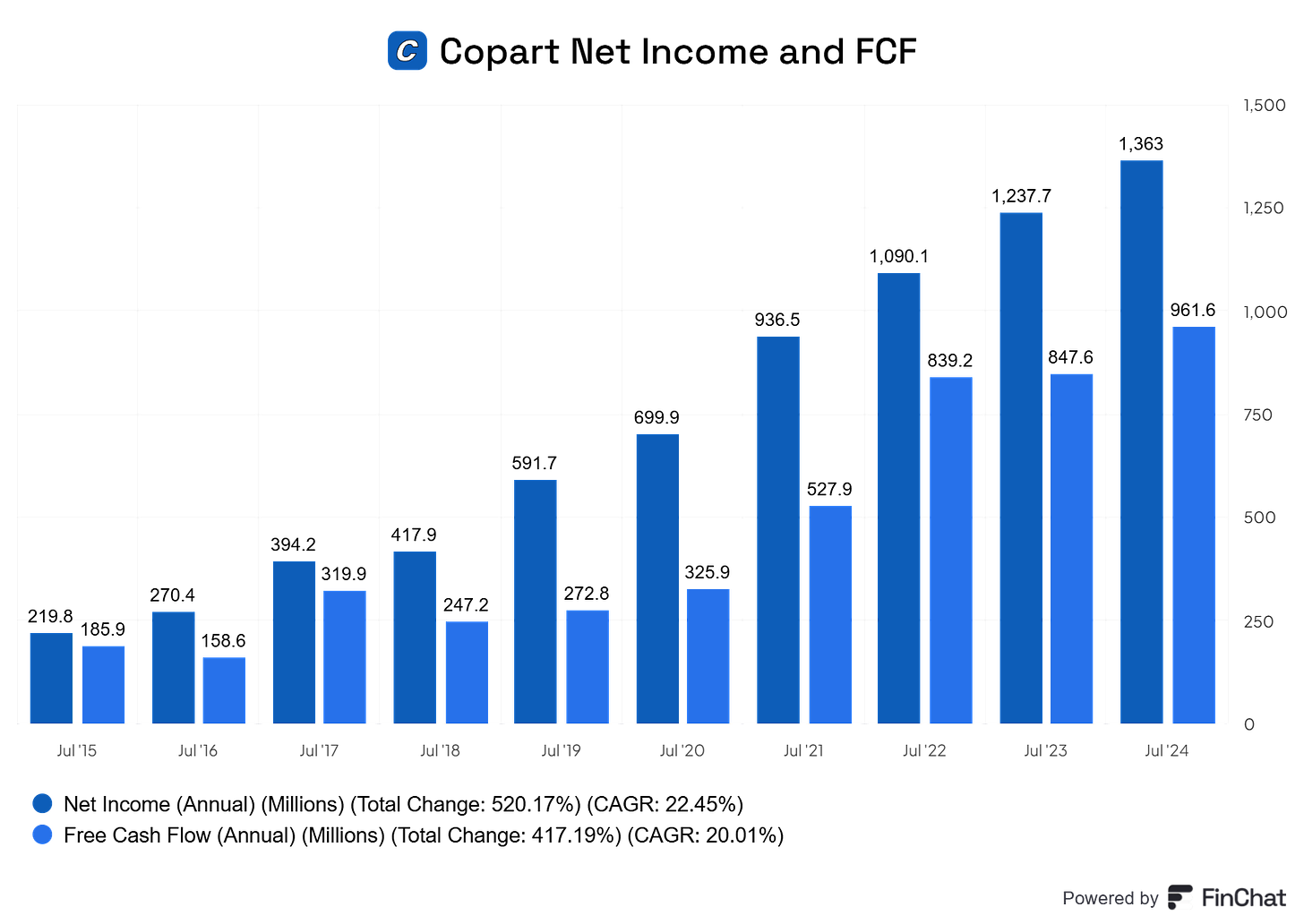

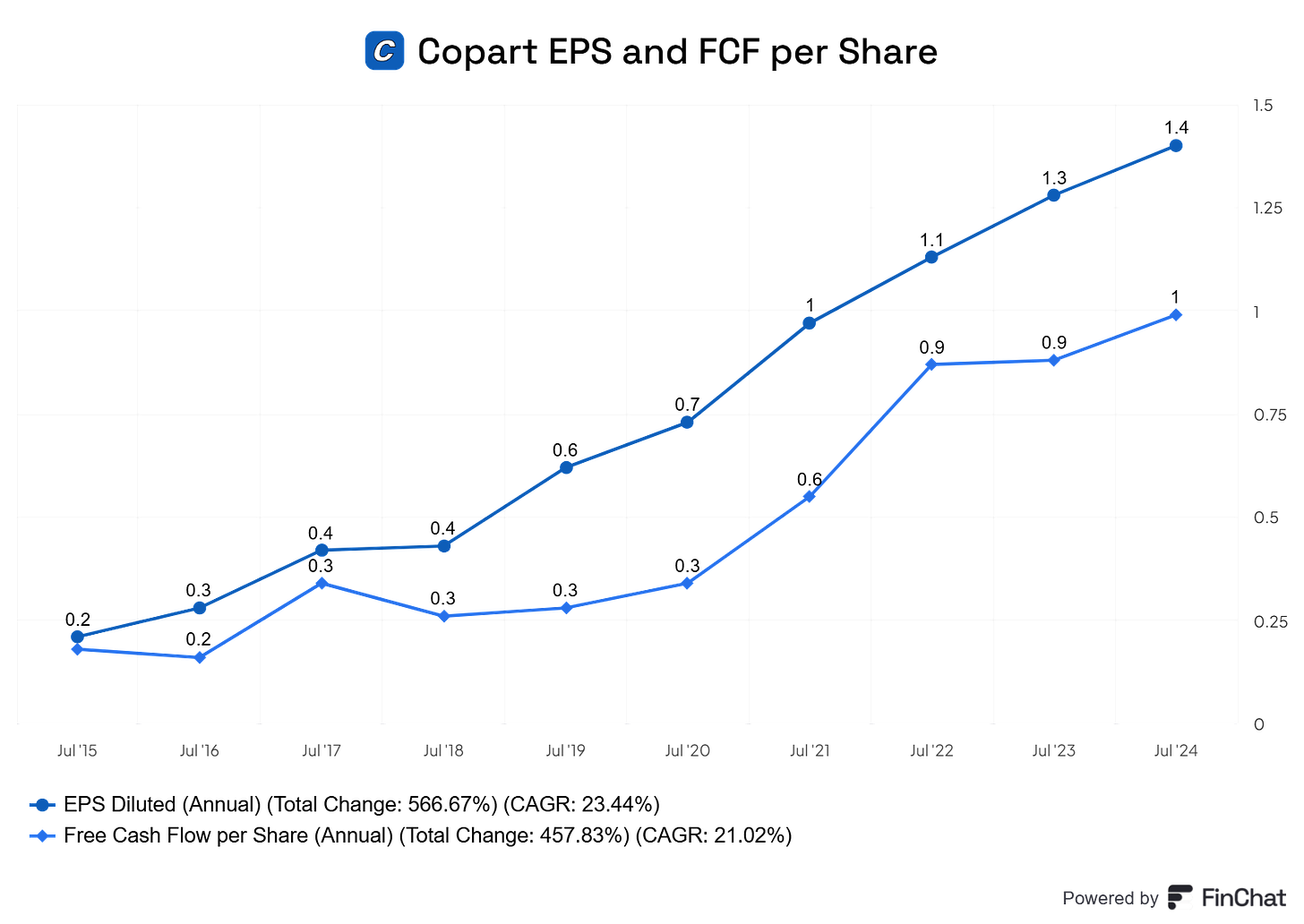

Copart’s net income grew at a 22% CAGR, while free cash flow compounded by 20% annually. As seen in the exhibit, free cash flow is consistently lower than net income, driven by relatively high capital expenditures that far exceed depreciation & amortization. This suggests the company is still heavily investing in growth.

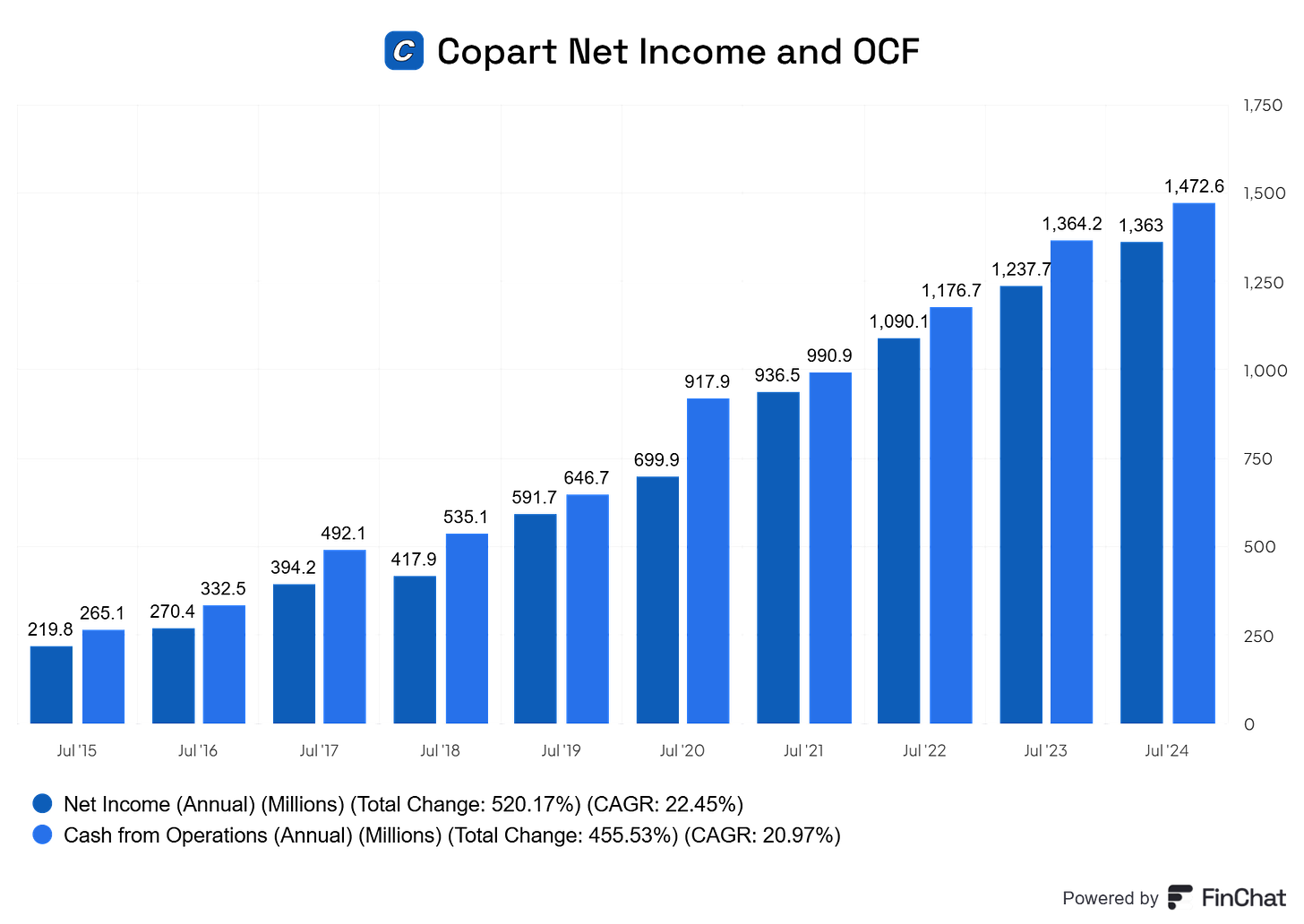

When comparing net income to operating cash flow—removing capital expenditures—the graph paints a different picture.

Copart is highly efficient at converting net income into cash, though this efficiency is masked by its growth-related capital spending. This shouldn’t be a concern for long-term investors.

On a per-share basis, Copart’s cash flow and profit growth closely tack overall growth. While the company repurchases shares, it doesn't do so on a scale that significantly impacts per-share growth.

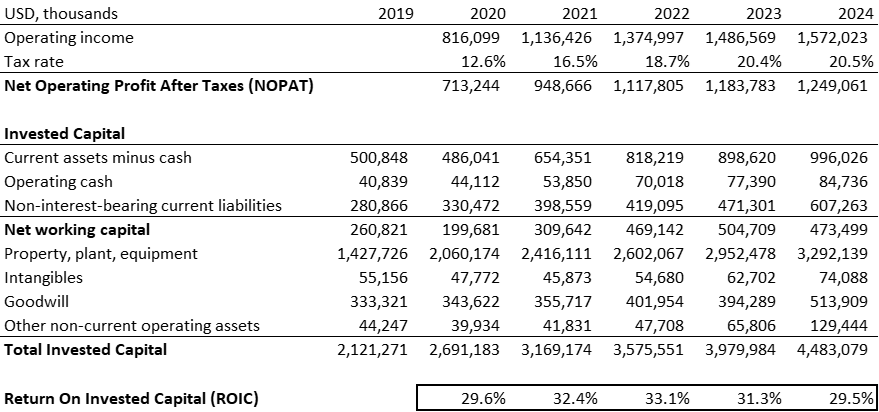

Moving on to Return on Invested Capital (ROIC), there isn’t a lot to say, except that it’s strong. Copart’s ROIC is consistently around 30%, with the majority of its invested capital tied up in property, plant & equipment—most of it likely being salvage yards.

The balance sheet is robust, with $1.5 billion in cash and equivalents and just over $100 million in debt. The company has minimal to no interest expenses, signaling that debt is well-managed.

When it comes to valuation, Copart appears overvalued. The stock trades at:

A price-to-earnings (P/E) ratio of 37, which is actually a discount relative to its historic P/E.

A free cash flow yield of 2%, well below the S&P 500's average yield.

Finally, based on a discounted cash flow (DCF) valuation, Copart seems significantly overvalued. Assuming high-single digit revenue growth and a gradual operating margin expansion the coming years, Copart’s implied value lies around $21, compared to the current stock price north of $50. However, this gap could be attributed to the company's high-quality moat and strong track record, which aren't fully reflected in future cash flows. Additionally, Copart’s ongoing capital expenditures suppress free cash flow, meaning the stock's implied value would be higher if the company reduced its investments. But with a high ROIC, it makes sense for Copart to continue reinvesting in growth.

While the current price above $50 may seem steep, the $21 implied value from the DCF seems overly conservative, especially when taking the company’s consistency and strong track record into consideration.

Copart’s financials are solid across the board. The company has consistently grown revenue while boosting margins, and it generates significant free cash flow. Copart also reinvests heavily against high returns on invested capital. Its balance sheet is among the best I’ve seen, ensuring investors sleep well at night. This is a top-notch company that justifies a higher valuation.

Thanks for reading today’s Deep Dive! I’ll be back in your inbox this Friday for another Weekly Brief. If you need anything, feel free to reply to this email or message me on Substack. I always answer.

Happy investing, and again, thanks for reading!

🍵 - Jacob xx

All my links here.

Trailing twelve-month (TTM) data at the time of writing.

Awesome! Thanks again for the collaboration!