Weekly Brief #39

There goes $6.5 trillion...Microsoft partners with Palantir, Google ruled an illegal monopoly, Berkshire halves Apple stake, Mars in-talks to aquire Kelloggs, Kamala Harris picks running mate.

Good morning investors 👋,

Happy Friday and welcome, or welcome back, to the 39th Weekly Brief.

Stock market roller coaster: This week, the stock market (S&P 500) experienced its worst day since 2022, and its best day since 2022, dropping by 3% on Monday until three days later, recovering and surging 2.3%. (It was a roller coaster. More on why this happened below.)

Let’s get into it.

In this issue:

📉 Market’s incinerate $6.5 trillion

🧑💻 Microsoft partners with Palantir

🇺🇸 Kamala Harris picks running mate

FEATURED STORY

📉 Market’s incinerate $6.5 trillion

Over the past month or so, the S&P 500 has dipped 6%, the Nasdaq 11%, the TSX 4%, and the Nikkei over 17%. On Monday, U.S. markets experienced their worst day since 2022, contributing to a global stock market sell-off close to $7 trillion.

What caused this? Absolutely no one can tell you 100%, but there are some great explanations I’ve come across that might clarify what happened. I thought I’d share these explanations in a listicle format because (1) I am legitimately too tired and brain-dead to think of a full story this week and (2) it is currently 1:00 AM as I write this, and I’d like to get a good night’s sleep. Possibly a mix of both. Sleep deprivation from writing a newsletter — never thought that would be in a sentence, did you?

Anyway, here are some reasons that could have led to the sell-off:

Reason 1: The U.S. Jobs Report showed that jobs grew by just 114,000 in July, below the 180,000 estimate by Dow Jones. This rise in unemployment led investors to fear a U.S. recession, causing a sell-off.

Reason 2: After a Hamas leader was assassinated by Israel, Iran spoke of a retaliatory attack. Concerns over a rising escalation in the Middle East conflict potentially caused investors to sell.

Reason 3: Nvidia, the GPU and chip company manufacturing the AI chips powering current stock market speculation, announced a delay in the production of its newest Blackwell GPU model. Since Nvidia is essentially the backbone of the current stock market, news like this scared investors and potentially caused a sell-off.

Reason 4: Last Wednesday, the Federal Reserve decided to hold rates steady, which, paired with the jobs report, made some investors fearful that this restrictive economic policy would hurt economic growth and cause a recession, leading to a stock market sell-off.

Reason 5: Over the past few months, the Japanese Yen has lost a lot of value compared to the U.S. Dollar. Most of this is attributed to the Bank of Japan keeping interest rates near zero, which led to high inflation and a devaluation of their currency. Some investors and traders saw this as an opportunity and took advantage of it by borrowing low-interest debt in Yen, converting that debt to dollars, and buying U.S. stocks with the converted cash, earning the difference in returns. This is called a carry trade. When Japan decided to raise rates this week, all the investors’ carry trades became less profitable, leading to a sell-off in carry trades to pay off these Yen-based loans. (This involved investors selling their U.S. assets, converting those assets to Yen, and paying off their Yen loans. Causing a stock market sell-off in both of those markets.)

Those were some of the reasons I found. Long story short, it was a roller coaster of a week. But, I do have good news… the stock market has meaningfully recovered from the losses on Monday. (And by the way, thanks for reading. Here are some free PDFs and Excel templates as a thank you. (Maybe even consider buying me a coffee if you feel like it. I promise you, the prices are not as bad as Starbucks.)

FINANCE

💰 Berkshire halves Apple stake

Warren Buffett sold nearly half of Berkshire Hathaway’s stake in Apple during Q2 of this year, now revealing a record cash pile of over $270 billion. Even though Buffett has said in the past that he doesn’t trade based on macro factors, this specific trade has raised concerns about a possible recession.

Despite the sell-off, Apple remained Berkshire’s largest stock position, worth over $84 billion, down from $174 billion at the end of 2023. Buffett began selling in Q4 of last year but praised Apple at Berkshire’s meeting in May, saying it would likely remain the company’s top position. His reason was due to taxes, although that’s a story for another day…

🔍 Google ruled an illegal monopoly

Google lost an antitrust case this week against the US Department of Justice after a federal judge ruled that the company had built an illegal monopoly over online search and advertising. The ruling found that Google violated antitrust laws by striking exclusive agreements with device makers like Apple and Samsung, paying billions to ensure its search engine was the default.

Google faces penalties, fines, and even a potential breakup of the company. Google plans to appeal, delaying any immediate impact. In the meantime, Google also faces another antitrust lawsuit targeting its digital advertising practices. (Keep in mind that even if Google weren’t the default on Samsung or Apple, consumers are likely to use Google anyway.)

BUSINESS

🧑💻 Microsoft partners with Palantir

Palantir, a data-analysis company, has partnered with Microsoft to offer services for classified networks in U.S. defense and intelligence. This collaboration will integrate Microsoft’s large language models via the Azure OpenAI Service within Palantir’s AI Platforms in government and classified cloud environments.

Co-founded by Peter Thiel and backed by CIA venture funds, Palantir supports various government agencies and private companies, including those involved in Ukraine’s war efforts. Despite its broad client base, Palantir posted its first annual profit only in 2023. The company’s commercial business has surged, with its share price up over 75% in 2024.

🍫 Mars in-talks to aquire Kellogs’s

Mars, this week, entered advanced talks to acquire Kellanova, potentially valuing the company at around $30 billion, according to the Wall Street Journal. The deal could rank among the largest transactions of the year.

In 2023, Kellogg Company split into two independent companies: Kellanova, which includes brands like Pringles and Pop-Tarts, and WK Kellogg Co., which includes all of Kellogg’s cereal brands. Kellanova has faced declining sales due to high snack food prices but reported growth in North America in Q2 2024 and resumed investments in its brands.

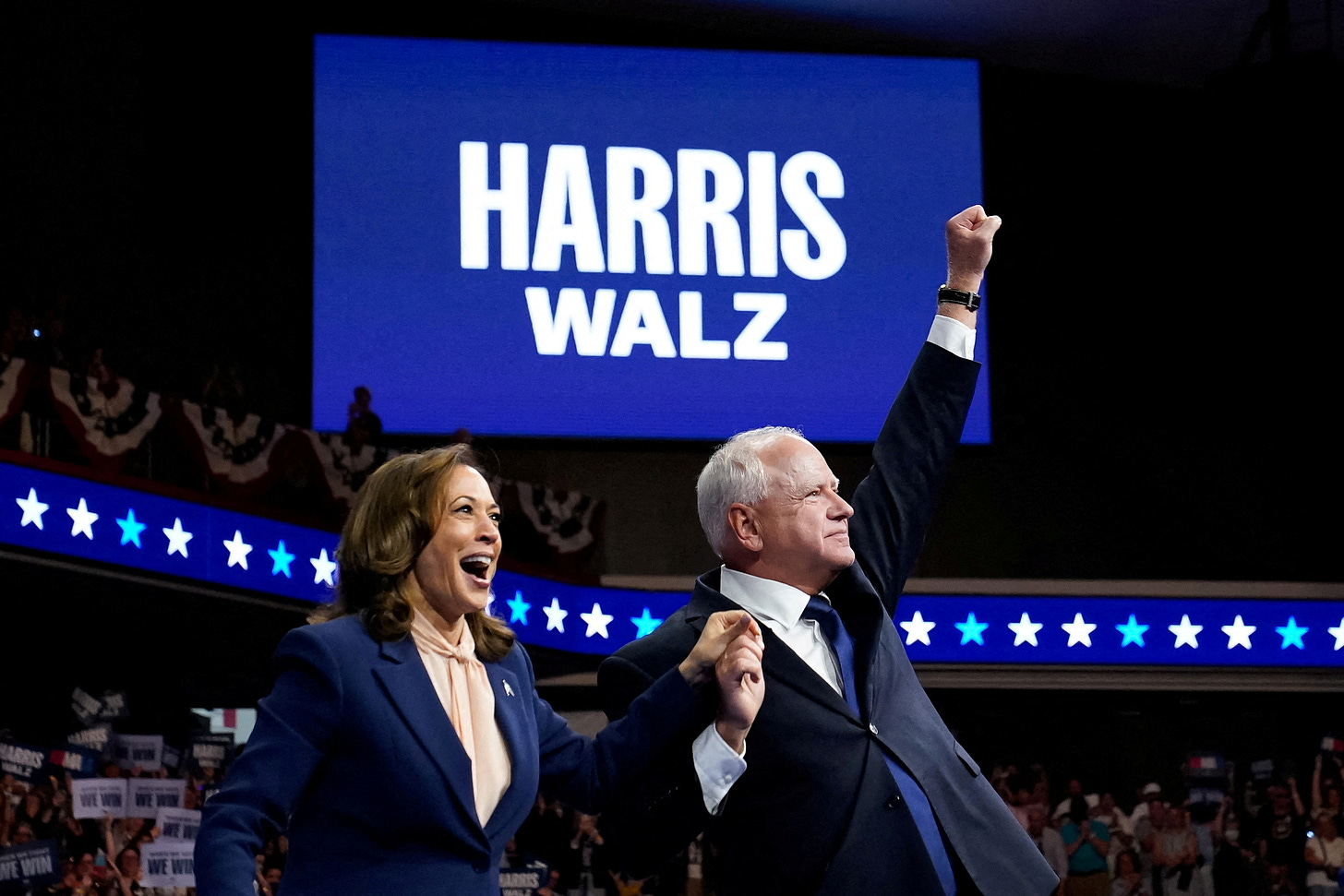

🇺🇸 Kamala Harris picks running mate

Kamala Harris, now the frontrunner for the Democratic presidential nomination, has selected Minnesota Gov. Tim Walz as her running mate.

Walz, a former Minnesota governor and military veteran, aims to boost Harris’s campaign in crucial battleground states. The announcement comes amid a challenging political climate, including former President Trump’s assassination attempt and President Biden’s campaign suspension.

In other news, Kamala Harris and Donald Trump have agreed to a presidential debate on September 10, 2024. The Harris-Walz campaign has raised an additional $20 million since the announcement (the vice-president announcement, not the debate).

📚 Book of the Week

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

Relativity: The Special and the General Theory — Albert Einstein

Book Description:

Relativity: The Special and the General Theory is a groundbreaking scientific work written by Albert Einstein, one of the most renowned physicists of all time. Published in 1915, the book revolutionized our understanding of space, time, and gravity. Relativity remains a cornerstone of modern physics and a testament to Einstein’ s intellectual brilliance.

Provides a comprehensive exploration of both the special theory of relativity and the general theory of relativity. Concepts are explained in a logical and concise manner, enhancing the reader's comprehension. Offers readers a fresh perspective on the fundamental principles that govern our reality. Delve into the mind of Einstein and understand the ideas that reshaped our understanding of the universe. Allows readers to engage with the timeless concepts that underpin our current scientific understanding.

✩ This newsletter, along with my weekly Morningstar fair value estimates and PDFs, will always be free of charge. Your support, whether through a donation or by reading this newsletter and following along, is greatly appreciated.

Thank you for reading today’s Weekly Brief! If you enjoyed or learned anything, please spread the word.

— Jacob