Weekly Brief #57

Trump’s power play is out (or is it?)... Canada cuts key benchmark rate, UnitedHealthcare CEO's killer, found, Albertsons calls off Kroger merger, Que., N.L.’s $24 billion energy deal, and more.

Good morning investors 👋,

Welcome back to the 57th Weekly Brief.

So, good news: I’m not sick anymore — no headache or potential migraine (this is when you clap). But even better, the man who murdered UnitedHealth CEO Brian Thompson was found, charged with murder, linked with forensic evidence, and is set for trial. What a great, unrelated course of events to start your day. Also, thank you all for the support of my Brookfield analysis. It’s now my most popular issue, and many of you shared it with others to get there!

An analysis on a Canadian e-commerce stock with 20%+ growth is coming next Tuesday exclusively to paid subscribers. If you haven’t already, be sure to claim the free trial to the paid membership at the bottom of today’s post so you can access it once it’s released. Why upgrade? I’m glad you asked.

Let’s get into it. (10 min read)

In this issue:

🇨🇦 Trump’s power play is out (or is it?)

👨⚖️ Brian Thompson’s killer, found

⚡️ Que., N.L.’s $24 billion energy deal

FEATURED STORY

🇨🇦 Trump’s power play is out (or is it?)

A couple of weeks ago, Trump made a massive statement on Truth Social, saying he’d impose 25% tariffs on all imports from Canada and Mexico to the U.S. until the aforementioned countries stopped all illegal immigration and illegal substances from crossing into the States.

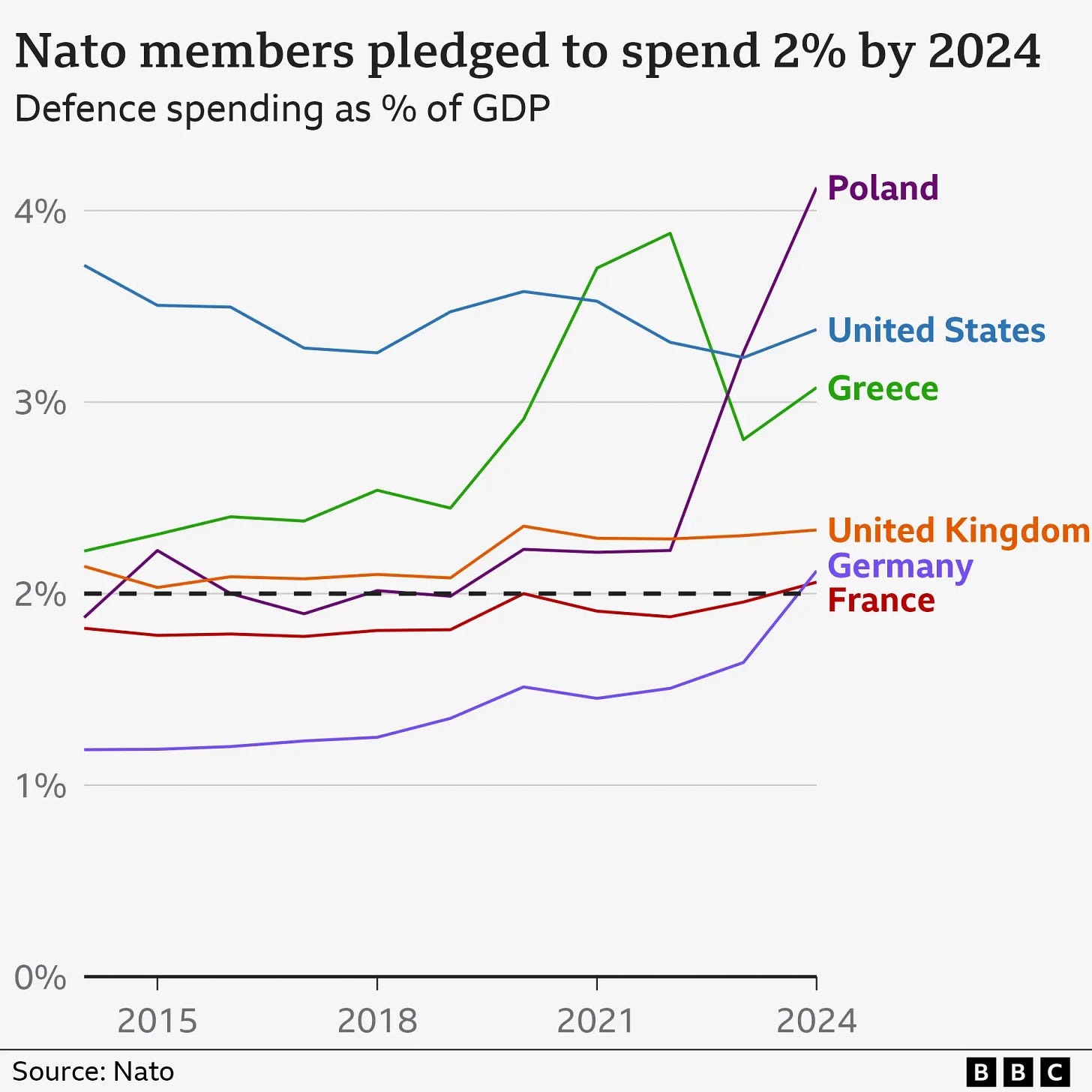

Consequently, being a Canadian economic nerd, I wrote about this and its potential impacts in Weekly Brief #55. I ended this write-up by saying Trump is purely using this as a negotiating tactic to scare Canada, like he did with NATO and military spending, threatening to pull American military support for Europe if they didn’t meet the 2% of GDP military spending requirement that all NATO members are obligated to meet.

This worked. I mean, many more NATO members reached their 2% spending target, and some even exceeded it during and after Trump’s presidency, and many more planning to. He isn’t even president yet, and it’s still working. Italy, for example, is currently begging the EU for support to help it reach this target before Trump’s inauguration. This is what the tariff threat to Canada and Mexico is supposed to replicate. Succumbence by power.

I believe Canada should 100% allocate more resources to border security. I mean, there’s no downside. Borders need to be addressed. That’s a fact. But the U.S. leveraging its position to abuse neighbouring countries and put them in a fetal position is not right in my eyes. This is my only problem. But then again, that’s what a President Trump does for global affairs. He’s good for America and its concerns, but more than terrible for everyone else. Even to America’s closest ally (quite literally), Canada.

I don’t particularly like repeating myself, and since this certain issue has been on my mind throughout the week, I wrote my thoughts on Blossom yesterday. Many of you who subscribe to me here don’t follow me there, so I think sharing my thoughts here will be valuable regardless (Blossom and my newsletter are symbiotic, so definitely follow me there if you follow me here):

A few weeks ago, Trump said on day one of his presidency that he would place 25% tariffs on all imports from Canada and Mexico into the United States and would only remove it upon the “complete stop of illegal immigrants and drugs coming into the United States from these borders” (paraphrasing). Which would very likely be in violation of USMCA, which prohibits blanket tarrifs (with the exception of national security, which I assume Trump will use as the excuse for the legality of the tarrif).

Canada is in a weird position. Its economy piggybacks off the U.S., and no matter how hard Canada tries to act tough when the U.S. clenches its fist, we can’t do anything. We just can’t. I want to support a retaliatory tariff or response; in fact, I want one, but then what? What does that actually do for Canada? It does nothing but increase tensions with the country that by itself supports the economy of Canada.

My simple question for all of you: Do you think it’s better to bend the knee to the States’ demands and start investing heavily in combating illegal immigrants and drugs coming into the States from Canada? Even though less than 1% of illegal immigrants in America are related to Canada, and less than 10% of illegal drugs?

Is it well-spent Canadian taxpayer money trying to make one of the strongest borders in the world just a little stronger to combat problems that are not on a large scale causing said problem? If no, then how do we actually stop and solve this threatened 25% tariff that could in theory “kill” our economy?

Alberta has decided to bend the knee to the States to minimize risk, investing $29 million in strengthening the Alberta-Montana border. Ontario has taken the complete opposite route and said it would consider cutting all energy off to the States as a relation to this tariff (what a stupid thing to say). These are so far the only provinces that have spoken out.

Canada is in a terrible economic position because of its dependence on the States. I’m in huge favour of strengthening our oil infrastructure nationwide and selling to the world. America is a key friend and ally to us and it should always stay that way, but holding our country back from its potential by placing energy production caps and allowing ourselves to get used by the States is in technicality, making our country poor(er).

If negotiations don’t go through right, tariffs are what need to happen eventually. Not a cut on exports completely as Doug Ford suggests, which would hurt Canada much more than the States, but a similar 25% tax on oil exports to the States. This would cause short-term cost pressure and would be the only real kick to get back to negotiations. America cannot find oil as cheap or as easy to export than Canadian oil.

… that is, unless they use this retaliation tarrif to ramp up domestic production as yet another retaliation, which again hurts Canada. Not to mention, lowering the incentive for America to buy our oil just hurts Canadian oil providers that sell 80%+ of their product to the States.

You see our situation here? This is what I mean when I say we can’t win. We need America to buy our oil today. It’s our most valuable export that happens to be a majority exported to that country. Meaning we can’t leverage it to “win” a trade war, and we can’t put pressure on the States. It hurts our producers, increases American incentive to produce more domestically, and eventually ruins us and our economy over the long term. Doing this would be a very short term gamble with immense drawbacks if it doesn’t work right. (full post: here)

I’d like to hear your thoughts on these questions and this issue — from both Americans and Canadians. Is Trump’s power play1 over as Canada and Mexico consider and prepare for retaliation? I see no harm in investing further in border security, including addressing issues with Mexico, which is responsible for most of the problems Trump wants resolved. But what do you think of these tariffs, and how should we respond? Reply to this email or comment below.

FINANCE

a. ✂️ Canada cuts interest rates

The Bank of Canada (BoC) cut its policy rate by 50 basis points to 3.25% this week, marking its fifth consecutive cut this year and the second half-point reduction. This makes Canada the most aggressive rate-cutter among G10 central banks this year, fuelled mainly by uncertainty around tariffs from Trump and inflation stabilization. More rate cuts are expected.

According to BoC Governor Tiff Macklem (paraphrasing) as inflation levels out, rate cuts are becoming increasingly necessary to support economic growth. He mentioned the lowering of immigration targets and the temporary GST/HST holiday as “key factors affecting growth and inflation.”

b. 🛒 Albertsons calls off Kroger merger

Albertsons said na na na, goodbye2 to its $24.6 billion merger with Kroger on Wednesday, a day after a judge temporarily blocked the deal. If that wasn’t enough, it seems almost immediately after, Albertsons filed a billion-dollar lawsuit against Kroger for breach of contract. Quite ironic, I’ll say that much.

The merger would have been the largest in U.S. grocery history, but faced immense opposition from the Federal Trade Commission (FTC) and an Oregon court, which ruled it would harm competition.

Related articles:

BUSINESS

c. 👨⚖️ Brian Thompson’s killer, found

Ladies and gentlemen, here’s 26-year-old Luigi Mangione, the guy charged by police this week for the killing of UnitedHealthcare CEO Brian Thompson outside a New York City hotel on December 4, 2024. Evidence linking him to the crime includes fingerprints, DNA, a notebook with handwritten notes, and a 3D-printed gun matching the shell casings found at the scene.

The notebook reportedly contains Mangione’s plan to use a shooting instead of a bomb, along with his hatred for corporate America and the American healthcare system. Mangione’s fingerprints were found on a water bottle and protein bar near the scene, and a phone near the site also had his prints. His mother also filed a missing persons report days before the shooting.

Related articles:

d. 💽 Google breaks quantum records

Google unveiled Willow on Monday, a quantum chip that completed a task in 5 minutes that would take today’s fastest supercomputers 10 septillion years. That’s (wait for it) 10,000,000,000,000,000,000,000,000,000. Willow marks a huge breakthrough in quantum computing. Oh, and did I mention Google also made great evidence that we’re living in a multiverse?

I’m going to be writing a Deep Dive issue on quantum computing sometime in the future, including concerns over how it will break internet encryption as we know it, and how the technology could revolutionize fields like medicine, battery technology, fusion energy, and so much more. So stay tuned, and thanks for sticking around.

POLITICS

e. ⚡️ Que., N.L.’s $24 billion energy deal

Newfoundland and Labrador and Quebec have reached a 50-year electricity supply agreement, ending what was a decades-long dispute. The deal is valued at approximately C$34 billion ($24 billion) and will boost hydroelectric power in eastern Canada by creating a new run-of-river station at Gull Island and an expansion of Churchill Falls’ generating capacity, creating the second-largest hydroelectric complex in North America.

The projects will cost C$25 billion, with C$20 billion of that being financed by debt. Hydro-Québec (owned solely by the Quebec government3), which holds a stake in both projects, will purchase about 80% of the power generated.

The original dispute stemmed from an agreement made in 1969, where Newfoundland and Quebec entered into a contract (which ends in 2041), allowing Quebec to buy almost all the electricity from Churchill Falls for 0.2 cents per kWh. Today, Hydro-Québec exports electricity at around 10.3 cents per kWh. There was major unfairness here, and Newfoundland only generated $20 million per year from this deal. The new deal however, is still not finalized, but if or when it is, will increase Newfoundland’s revenue by C$1 billion annually by 2041.

Related articles:

📚 Book of the Week

⭐️ For every book purchased using the links below, 100% of affiliate commissions are donated to charity. (Amount donated so far: $31.11.)

My full bookshelf: Here.

The Essays of Warren Buffett - Lawrence A. Cunningham

Book Description:

A modern classic, The Essays of Warren Buffett: Lessons for Corporate America is the book Buffett autographs most and likes best.

Its popularity and longevity over three decades attest to the widespread appetite for this definitive statement of Mr. Buffett’s thoughts that’s uniquely comprehensive, non-repetitive, and digestible. New and experienced readers alike will gain an invaluable informal education by perusing this classic arrangement of Mr. Buffett’s best writings.

Thanks for reading. Feel free to reply to this email or comment on the web if you need anything — I always reply. If you enjoyed today’s issue, feel free to share it with friends and family.

All the best,

Jacob

All my links here.

For legal reasons, all past, present, and future posts from this newsletter are not to be considered or understood as financial advice. Please consider these posts as a source, not a judgment.

Hockey reference, but also fits nicely with Trump’s “power policies,” and his leveraging of the United States’ global dominance as a negotiation tactic.