About

My name is Jacob. Jacob Nicholas Barnas. Hence the name of this newsletter, “The J. Nicholas,” and my profile name, Jacob B.

I’m a young (depending on your definition of young), enthusiastic Canadian stock market investor and independent analyst.

In other words, I’m a nobody. Unironically.

I have no incredibly well-written introduction or speech on why I decided to do what I want to do, and no prepared LinkedIn profile to share with you at this time. I also have no ulterior motive for writing this newsletter, and no “how to get rich investing in the stock market” course, or a private Discord server at the cost of $500 per month providing nothing but fluff.

What I do have is curiosity, skills I want to continue building, and a portfolio of high-quality, high-conviction compounders.

Since 2021, after watching a video from the YouTuber Graham Stephan labelled “How to Invest for Beginners,” I have consistently grown my interest in the stock market. I continued watching YouTube videos for the longest time after that point to grow my knowledge on finance and markets until I came across a video by Brandon Beavis in 2023, where he was rating the holdings in his portfolio.

As it turned out, Beavis co-owned a social investing app called Blossom Social, and I wouldn’t know it at the time, but this app would change my life.

I consider Blossom such a valuable part of my journey because of its community that propelled my curiosity. After I made a post, seeing the opinions of others as they commented, made me reevaluate myself and my opinions. Even when I was wrong, I would learn something from a book or YouTube video, or read news, and that would be enough for me to want to share that learning on Blossom.

I would post, and some people would like it, while the rest would be in the comment section, either praising me or fully trying to prove that I was wrong or had made a mistake. There I was, ego-fighting with strangers online who were trying to teach me concepts I knew nothing about. Too petty to admit I was wrong, and too ignorant to know I was being petty.

Like any social media, sometimes you get lucky. I got lucky.

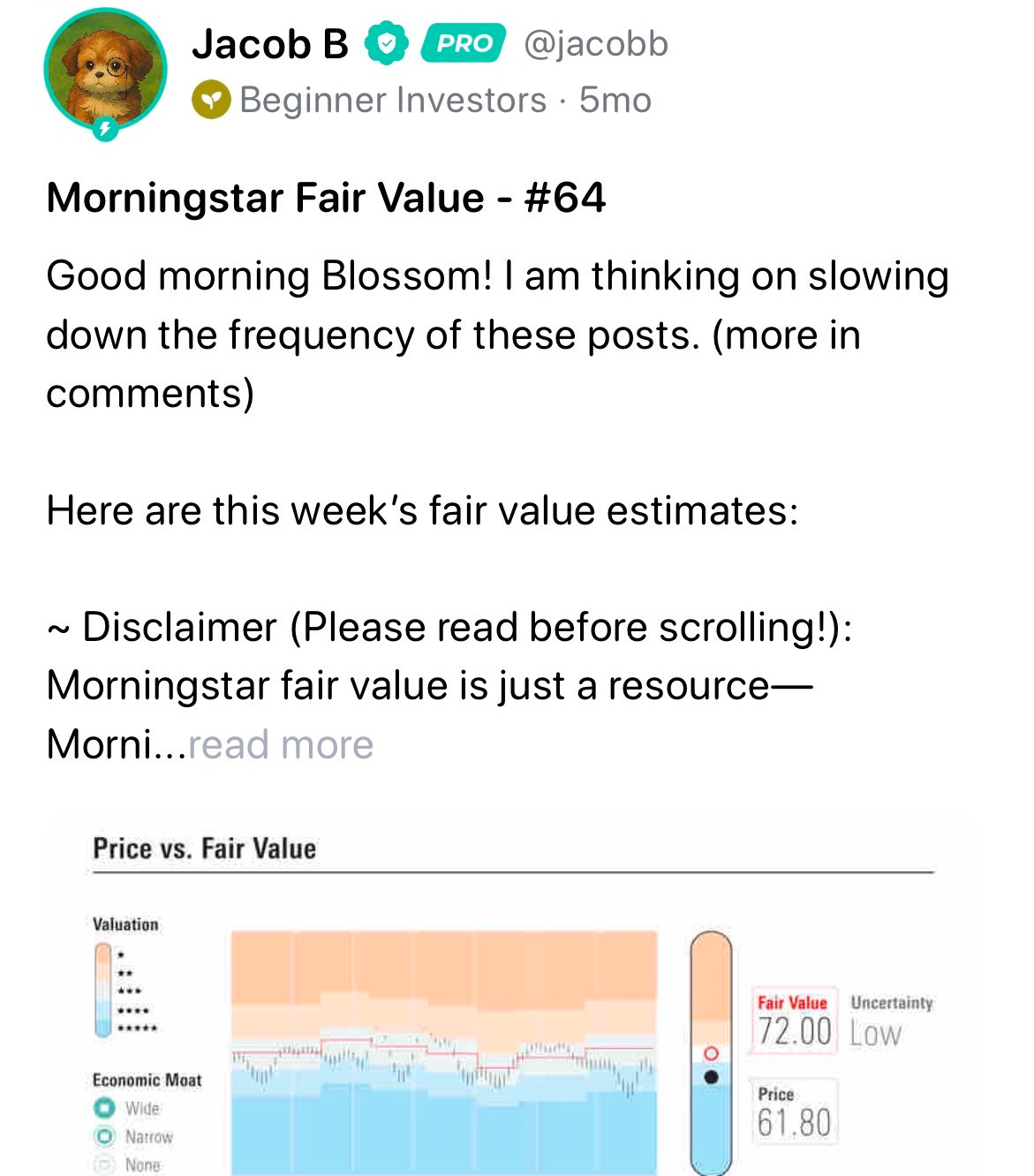

Only eight days after I joined Blossom, I shared a few lines of “Morningstar fair value estimates” that I came across after watching an Andrei Jikh video (another YouTuber). Morningstar is an investment research firm that publishes its own valuation of a stock’s fair price, using “proprietary” methods that factor in growth, competitive advantages, etc.

To this day, I have no idea what these methods are.

I treated these fair value estimates as a life-changing discovery when I first came across them, and apparently so did most of Blossom as soon as I clicked post.

I mean, take a look at how I responded to a comment that asked how to calculate fair value:

In less than a day, the post earned 100 likes, with people commenting and asking for more stocks they wanted me to share next time. For 64 consecutive weeks following this post, I would go on to spend an hour or two every Tuesday after market close, scouring Morningstar for fair value estimates my followers wanted me to share, manually estimating the “discount” and “premium” of certain stocks into a template I made in Apple Notes, then to Blossom.

Over the course of these 64 weeks, my Morningstar posts would go on to receive North of 2,500 likes, hundreds of comments, and hundreds of thousands of views in aggregate. On a platform with only a few hundred thousand users, this was a huge achievement. People would come to these posts because it was something they couldn’t find themselves. They would write thank you, and I would be back again next Wednesday, at 9:30 EST sharp.

Something I haven’t mentioned before is how I never paid for Morningstar’s service during this time. For the first two months, I paid for the then CA$50 per month service, but I eventually found a workaround to extend the free trial period, allowing me to avoid paying week by week. I won’t be explaining what this workaround was to avoid being served at my doorstep, but it’s incredible to look back on. In hindsight, I do not endorse or recommend you copy this behaviour.

My curiosity didn’t stop me from continuing to learn about other topics on the stock market, and with time, I became captivated by the aspect of research and analysis, posting about my findings and asking questions on Blossom in between my Morningstar posts.

Later into this continued curiosity I would write and publish my first-ever stock analysis on a company called Dollarama. This post too, would become “Blossom viral,” scoring 150 likes within the first couple of days, and officially fuelling my optimism to continue learning how to research.

Eventually, after around a year and a half of consistent Morningstar posts, I decided to stop. I realized irregardless of the disclaimer I had at the very beginning of the posts, people were becoming increasingly more dependent on my posts, and as a result, the estimates I was sharing. Even I (who was just learning about stock research) began treating Morningstar’s reports on companies as a determining factor in my thesis.

While it likely wouldn’t have hurt me to continue posting those, the idea that I was subtly influencing others to avoid research and blindly follow a single research firm’s estimates didn’t sit right with me.

So, I pivoted.

I fully shifted my focus to writing about investing insights and strategies based on the great investors I admire. I began writing and posting my research, “stock analyses,” on Blossom. This pivot followed me to my newsletter, a place I had been publishing weekly market recaps since the beginning, and where I began writing consistent stock analyses and investment insights. Like on Blossom, but more nuanced and detailed.

My newsletter would become a place of research done for investors. Not Morningstar reports that mask your analytical skills, but 12-15 hours of stock research condensed into a 50-minute read or less.

Every hour I spend researching is one more hour I spend continuing to learn and improve on what I know. I will, one of these times, misunderstand a metric or write about something wrong. But I will always admit when I do. Then I will correct the mistake, learn, and continue with the next analysis.

Everything I know is self-taught.

I read, I watch, I listen, and I continue to implement and improve what I know in-real-time by posting content on this newsletter and Blossom, while sharing my personal portfolio and all the decisions I make. Doing so has let me improve my wisdom vastly more than the average person could have within just a 4-year timeframe since watching that first Graham Stephan video, and only 2 years since joining the Blossom platform. I’m very grateful to have had that opportunity.

Anyone over the age of 18 with access to an internet connection and a valid piece of government identification can open a brokerage account and begin investing in the stock market. Anyone—absolutely anyone—can achieve returns in the stock market with constant learning. No matter your current education or background. I myself, don’t have a degree in finance or business as I publish this writing. That sentence will scare away some, but hopefully inspire many more.

My analyses, insights and continued content are a way to improve myself time. But the beauty of the internet is that as I improve, if you read along, so will you.

The J. Nicholas, Blossom Social, and Substack Notes serve as a growing second brain for my philosophies and a record of my bumpy learning curve over the years. And it’s all public, no filter.

I know my framework. My way of thinking.

I will continue to learn.

A curious, enthusiastic individual stock investor and writer, always implementing, failing and getting things wrong; forever learning.

That’s me.

My strategy

“The first rule of investing is don’t lose. It’s that simple. Rule number one: never lose money. Rule number two: never forget rule number one.”

— Warren Buffett

I was originally an avid ETF investor (and still attest to such a strategy for the vast majority of people), but my endless need to learn made me interested in the act of researching and holding individual stocks. Now, I buy high-quality, competitively advantaged companies at a fair price, with the ability to generate a minimum 12% return for the long term (5-10 years or more).

The type of businesses I buy follow this checklist:

Business will generate a minimum of 12% returns annually over the next 5 years (fundamentals and price paid).

Business has a sustainable competitive advantage without a high chance of losing it during the time I own it.

Business has consistently grown and increased its fundamentals over time.

Business has competent management with decent capital allocation skills.

Trading at a fair price.

My strategy itself can be described as a mix of Warren Buffett, Charlie Munger, Phillip Fisher, Benjamin Graham, and Bill Ackman. What I take from each is the following:

Warren Buffett (Berkshire Hathaway)

Only buy businesses that you understand, and that have sustainable competitive advantages (moats).

Treat every stock purchased as if you’re buying the entire company. Act like an owner.

Hold companies as long as the thesis remains intact.

Charlie Munger

Understand psychology, economics, and the industry at hand to avoid making narrow or uneducated decisions.

Avoid stupidity more than trying to be intelligent.

Invert, always invert.

Constantly learn and widen your circle of competence.

Philip Fisher

Go beyond filings and the company at hand. Research suppliers, competitors, and more.

Invest in visionary leaders with proven ability to scale.

Focus on companies with long runways for growth and high reinvestment opportunities.

Benjamin Graham

Buy at a price well below intrinsic value to protect against any inevitable human error and/or uncertainty.

Research and analyze financial statements deeply to understand every decision made affecting the fundamentals.

Stay rational regardless of market volatility.

Bill Ackman (Pershing Square)

Concentrate your portfolio. Increase or buy into large positions when your research gives you confidence (conviction).

Understand your investment thesis enough to simply and persuasively explain it to yourself and others.

Warren Buffett is the prime inspiration for the foundational principles of my investment strategy, but all of the inspirations above have contributed meaningfully.

Core books including Warren Buffett and the Interpretation of Financial Statements, Poor Charlie’s Almanack, Common Stocks Uncommon Profits, and The Intelligent Investor have gone a long way for me. But also podcast episodes with Bill Ackman and the like, annual letters from Pershing Square and Berkshire Hathaway, and all the many amazing Berkshire meetings with Munger and Buffett have been amazing sources for my knowledge.

People, especially younger investors, assume that because they got lucky on some overvalued tech stock, or because they started investing during the 2020s when the stock market’s been amazing, that they can continually make returns that go above the benchmark every year.

This is stupid, and as investors, “beating the market” in the traditional sense of watching annual returns is backwards. In fact, I’d argue it’s this kind of mindset that gets people buying (or selling) a wannabe educational course or some other piece of influencer bullcrap.

The research we do and the time we spend on it can’t be worthless.

As in, math says it’s ignorant to not place any goals on the effort of your research. But that doesn’t mean we should strive to beat the benchmark on an annual-to-annual basis. That’s a misconception.

Long-term, the markets will return 7-9% nominally in a good lifetime. That’s annual returns without adjusting for inflation.

As an investor spending time on research, your only two goals should be flexibility of returns or trying to achieve a higher long-term nominal return.

My strategy combines both of these two approaches, with a minimum 12% long-term CAGR goal.

I’m not competing with the S&P; I’m tracking my own goal and returns. “Will the market beat my annual returns in 2027? Maybe, but it doesn’t matter.”— That’s all there is to my tracking strategy. For most, it’s best to strive for flexible, quality-based compounding over the course of decades. That’s annualized (not annual) compounding.

Beating the market nominally long-term, not year-on-year short-term.

What this means in practice is simple.

If my portfolio goes up 7% in a given year and the markets rise 28%, my strategy won’t switch. As long as the math averages out to a 12% over the course of my investing timeframe, the portfolio was a success.

As investors, we should always look at the future. Years (plural) and decades. Comparing your returns to the benchmark annually makes it a game of winning in the short term. Investing isn’t a game of winning or a game of short-term. There’s no competition but yourself in the stock market long-term, and that makes it a game of not acting irrationally.

Even if the market rises 300% in a given year, history says it will average out with time. As investors, that is what we should compare with: the nominal average.

I’m not sure of my long-term plan for the next 50 years or so, and planning out that many decades seems illogical. However, I’m confident that for the next two decades, I can achieve upwards of a 12% CAGR. (Plus minus, give or take.) I don’tbelieve I can reasonably expect any higher.

Something I really adhere to in my strategy is “buying at a fair price.” In no instance will you see me buying above what I believe is a fair price for my goals. In fact, it’s a rare instance to see me assign buy ratings to researched stocks in my published paid stock analyses. But when I do find something, and when I do assign a buy rating, my conservatism tends to reward.

But with all the home runs, I will miss as well.

Being conservative yields added returns, but it exposes you to “missing out” if it doesn’t fit your goals. Depending on how you define missing out, that is. Investors want to think they always get it right, but I don’t. Neither will you nor anyone, and that’s perfectly okay. The goal is to win more than lose. Stocks don’t trade at infinite prices if the fundamentals don’t support it.

Even if the stock price rises, it can only do so for so long.

The best investor out there has a 5/10 track record, not 10/10.

My plan is to focus on the fundamentals and compounding returns, and continue to perfect my strategy long-term. These return goals and my checklist are my guidelines to follow as I continue to learn and improve.

For my current portfolio and watchlist, see here:

With the paid membership you receive 3 distinct perks:

Perk #1: Paid posts and archive

Detailed analyses (research done for you) covering everything needed to know about a stock, every other Wednesday. Each analysis takes 50 minutes or less to read, and includes the following sections:

Business model & analysis

Risks & competitive advantages

Leadership quality

Stock price & financials

Growth aspects

Valuation and fair value

Final thoughts

Examples:

I only cover high-quality stocks that meet the following criteria:

Stock will generate a minimum of 12% returns annually over the next 5 years (fundamentals and price paid).

Stock has a sustainable competitive advantage without a high chance of losing it during the time you own it.

Stock has consistently grown and increased its fundamentals over time.

Stock has competent management with decent capital allocation skills.

My analyses do not cover short-term stock picks, but long-term picks able to generate you a minimum of 12% annualized returns over a period of time, with the research done for you on the stock yielding such a gain.

Perk #2: Free download of How to Analyze Stocks

Free download of my eBook, How to Analyze Stocks, a comprehensive book guiding you through a framework on how to analyze stocks, in five steps, over five chapters.

Perk #3: Discord invite

Access to The J. Nicholas Discord server, where you can chat with like-minded investors and gain exclusive insights and resources:

Early access to my trades and complete rationale

Earnings report summaries

A summary and thoughts on my portfolio companies’ quarterly earnings reports.

The J. Nicholas Quarterly Report

A quarterly update on my thoughts on the market, economy, portfolio, and newsletter business over the past three months.

Disclaimer: This blog and its posts or emails sent from it are not regulated investment advice. Nothing I write is investment advice. I’m human, but I’m not your financial advisor. Your investment decisions are your own.