🇨🇦 Canada, AI?

Inside Canada’s $2.4 billion AI investment...Skydance and Paramount's merger talks; Blackstone buys Apartment Income; Google and Meta announce AI chips; Chip companies recieve $31 billion; and more.

Good morning friends and enthusiasts 👋,

Happy Friday and welcome to the 22nd Weekly Brief. It’s crazy to think I’ve been writing these for almost 6 months. A warm welcome to the 19 new enthusiasts who joined J. Nicholas this week. We now have 268 subscribers (26.8% to our 1,000 subscriber goal).

US inflation data was released on Wednesday, causing the market to drop by almost 1.5%, only to rise by 1% the very next day. On top of that, a lot happened in the AI and semiconductor sectors; Justin Trudeau announced a $2 billion investment in AI; Google and Meta announced AI chip models; and the US granted over $31 billion to semiconductor companies.

It’s a lot. Let’s get into it.

IN THIS ISSUE

🇨🇦 Canada’s $2.4 billion AI investment

🎥 Skydance and Paramount in merger talks

🇺🇸 Chip companies receive $31 billion

On this day. On April 12, 1981, NASA launched the first space shuttle, Columbia, which was designed to orbit Earth, transport people and cargo to and from orbiting spacecraft, and glide to a runway landing on its return to Earth.

FEATURED STORY

🇨🇦 Canada, AI?

The Canadian Liberal government announced plans this week to set aside C$2.4 billion in its upcoming federal budget for funding artificial intelligence, the bulk of which is mainly for computing capabilities and upgrades. Since the Liberal government is a minority, they rely on NDP support for the new budget to pass.

According to Prime Minister Trudeau, $200 million of this amount will be used to promote AI adoption in sectors such as agriculture and healthcare, $50 million for an AI safety institute, and a $5.1 million office of the AI and Data Commissioner. This plan aligns with Bill C-27, the first Canadian federal legislation targeting AI passed by parliament back in 2022.

"Let's stop asking what AI will do to us, and why don't we start asking what we want AI to do for us." — François-Philippe Champagne

Believe it or not, Canada has a pretty big AI sector. According to the government, 10% of the world’s top AI researchers live in Canada. Canada also ranks third in the G7 in total funding per capita raised for AI companies, and in 2022, the Canadian AI sector raised over $8.6 billion in venture capital, accounting for nearly 30% of all venture capital activity in Canada.

“Currently, most compute infrastructure is in other countries, which is a barrier for AI firms and researchers. Through the new AI Compute Access Fund, we’re breaking through those barriers and ensuring that Canada is competitive in the global race to secure our AI advantage.” — Chrystia Freeland, deputy prime minister.

Whether or not this investment will benefit Canada’s AI market long-term is vague, as is everything when it comes to policy. For now, only time will tell, and let’s hope time tells us something positive.

Speaking of Canada

🏠 Canada allows 30-year mortgage for first-home buyers: On Thursday, Finance Minister Chrystia Freeland announced the federal government will allow 30-year amortization periods on mortgages for first-time homebuyers buying newly built homes. This change is a five year increase from the current rules, and will take effect August 1, 2024.

FINANCE

🎥 Skydance-Paramount merger

After failed merger discussions with Warner Bros., a potential deal between Paramount Global and Skydance Media, as reported by the Wall Street Journal, could result in Skydance acquiring Paramount in an all-stock transaction valued at about $5 billion, (or vice versa).

National Amusements, Paramount's controller, would initially receive over $2 billion in cash, essentially handing control over to Skydance. Paramount’s board is in favor of Skydance’s offer, and if successful, the merger would grant the combined entity more flexibility with its franchises, such as Star Trek. Paramount and Skydance have not yet commented on the report.

🤝 Blackstone acquires Apartment Income

This week, Blackstone announced its $10 billion acquisition of Apartment Income REIT Corp., consisting of 76 upscale rental housing communities in prime coastal markets like Miami, Los Angeles, and Boston.

Blackstone plans to take AIR Communities private and inject an additional $400 million to enhance the portfolio. This investment aligns with Blackstone's broader real estate strategy, investing in sectors such as rental housing, data centers, logistics, hospitality, and student housing. All of which will be financed through the $30.4 billion Real Estate Partners X fund.

BUSINESS

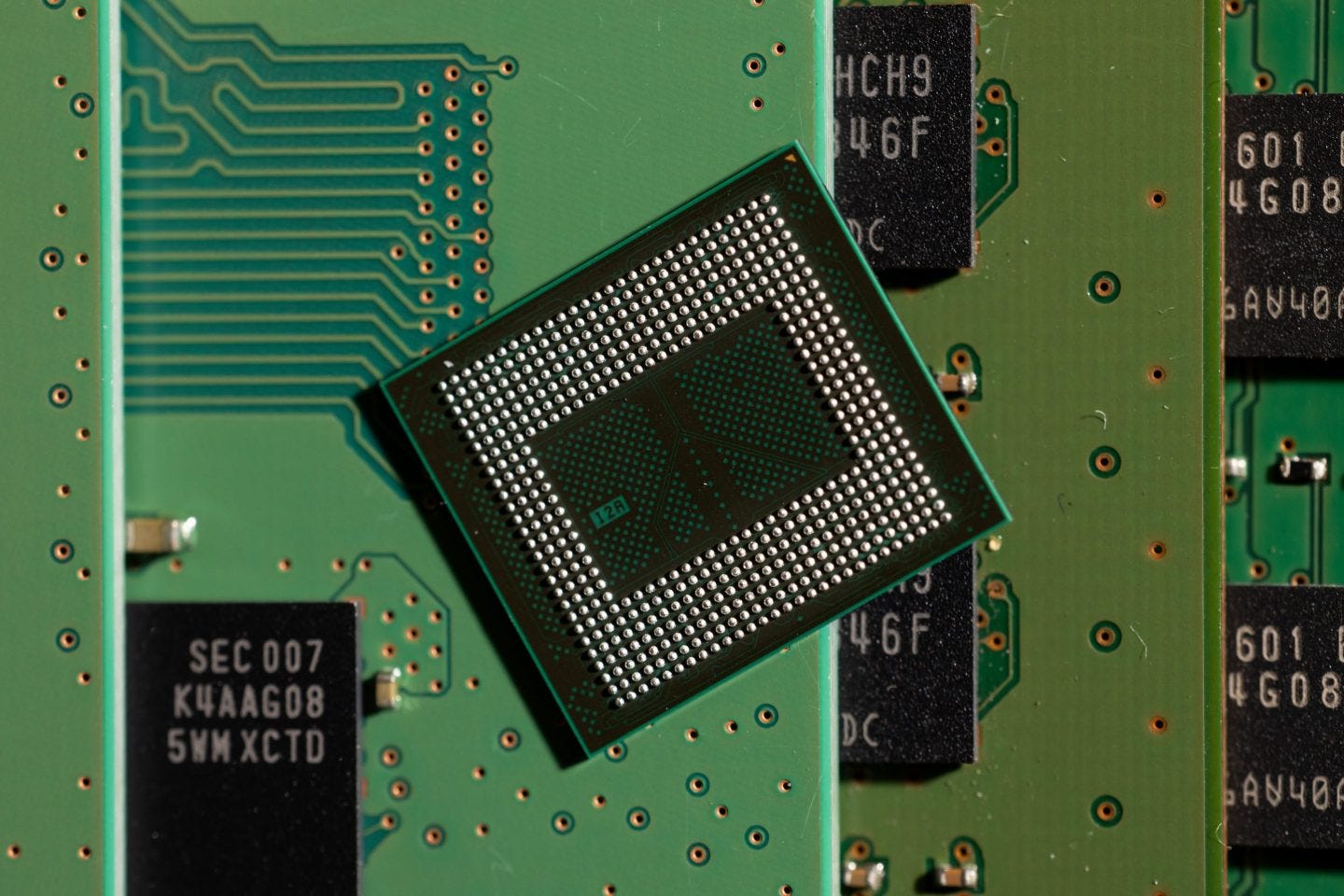

👾 Google and Meta announce AI chips

This week, Google and Meta announced their brand-new AI chip models, Axion and MTIA v1. Both companies view their semiconductor models as vital for advancing their AI platforms and as alternatives to Nvidia and Intel chips. This move allows them to customize hardware for their particular AI models, enhance performance, and save on costs.

Nvidia currently controls over 90% of the AI chip market, but if major customers shift to making their own chips, Nvidia’s dominance (and share price) could suffer. Although Nvidia and Intel aren’t going anywhere, if Big Tech starts entering this market with their massive amount of resources (over $500 billion cash), it could hurt them in the long-term.

💣 Lockheed Martin secures US contract

Lockheed Martin announced on Thursday that it secured a contract worth up to $4.1 billion from the U.S. government’s Missile Defense Agency to further develop its battle command system. The contract focuses on enhancing and upgrading the Command and Control, Battle Management, and Communications (C2BMC)-Next system.

Part of the C2BMC-Next initiative involves enhancing global integration and exploring opportunities to connect the system with allied nations for the first time. The contract spans from May 1, 2024, to April 30, 2029, with the possibility of extension through April 30, 2034. Lockheed Martin will carry out the upgrades at a new facility in Huntsville, Alabama, and Colorado Springs, Colorado.

POLITICS

🇺🇸 US grants chip companies over $31 billion

Taiwan Semiconductor Manufacturing Company (TSMC) is set to manufacture its most advanced chips in Arizona after securing a pledge of up to $11.6 billion in US government subsidies under President Joe Biden’s 2022 Chips Act. Intel, another chip manufacturer, received nearly $20 billion in support.

TSMC, the world's leading chipmaker, aims to start production of the two-nanometer chips at a new facility in Phoenix by 2028. This marks its third factory in Arizona. TSMC's investment is expected to create over 6,000 direct jobs and tens of thousands of indirect jobs for the Arizonan economy.

🇻🇳 Truong My Lan sentenced to death

A Vietnam court just sentenced real estate tycoon Truong My Lan to death for her involvement in a $12 billion fraud case, amid the Vietnam Communist Party’s commitment to fighting back on corruption. She was also ordered to pay about 674 trillion dong ($27 billion) in compensation.

Lan was arrested in 2022 and faced charges including bribery of government officials and violating bank lending rules. Under Vietnamese law, Lan can appeal the verdict within 15 days. Paired with the death penalty and compensation, she also received 20 years in prison for two other charges.

Thank you for reading today’s issue of Weekly Brief. I’ve been working on some more Deep Dives on Tesla, Big Tech, EQ Bank, Hershey, and Adobe. I’m hoping for one of the prior to come out next Wednesday (hopefully).

If you have any questions or feedback, reply to this email (I read every reply). Have a great week ahead!

— Jacob

✩ This newsletter, along with my weekly Morningstar fair value estimates and PDFs, will always be free of charge. Your support, whether through a donation or by reading this newsletter and following along, is greatly appreciated.

📚 Book of the Week

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

Common Stocks and Uncommon Profits — Philip A. Fisher

Book Description:

Widely respected and admired, Philip Fisher is among the most influential investors of all time. His investment philosophies, introduced almost forty years ago, are not only studied and applied by today’s financiers and investors, but are also regarded by many as gospel.

This book is invaluable reading and has been since it was first published in 1958. The updated paperback retains the investment wisdom of the original edition and includes the perspectives of the author’s son Ken Fisher, an investment guru in his own right in an expanded preface and introduction

“I sought out Phil Fisher after reading his Common Stocks and Uncommon Profits...A thorough understanding of the business, obtained by using Phil’s techniques...enables one to make intelligent investment commitments.”

―Warren Buffet

As of Jan 31, 2024, (resulting from my Amazon.ca Associates account being terminated) I do not earn any affiliate commissons from the links below.