Is Oracle Cloud the Next AWS?

My thoughts on Oracle's looming threat to big tech's dominance on cloud, if it goes as planned. Friday Filter #92.

Morning investor 👋,

Welcome or welcome back to Friday Filter—the quality investor’s market recap.

A lot happened this week, across everything. If you’ve been keeping up, you’re either traumatized, worried about a potential World War III, coming to terms with the reality that the global economy is likely ruined for the next few decades, excited for the future of space travel, or simply happy that the stock market is up.

On the stock market end, we had Oracle reach close to $1 trillion in market cap, with its stock zooming 40% and its CTO becoming the new richest human being in the world overtaking Elon Musk.

This surge was due to Oracle Cloud’s future projections thanks to AI, and I want to talk about it with what I currently know about the company (in relation to this news) as we end the week, in less than 10 minutes.

Let’s get into it. (7 min read)

Today at a glance:

The Filter;

Is Oracle Cloud the next AWS?

📄 In other news

📚 Resource of the week

Is Oracle Cloud the next AWS?

The Filter

Earnings miss on the top and bottom line; stock up 40%; CTO Larry Ellison now the richest man on Earth (or at least was, for a brief moment). This sentence, ladies and gentlemen, is only part of why Oracle saw its market cap add $200 billion in a single day.

The remaining reason?

Cloud projections1.

I’m very vocal in my bullishness for cloud computing. I’ve weighted Amazon and Google as very large positions in my portfolio as a result, and I’m certain in my thesis that cloud is one of the only tech industries with the lowest risk of downside from AI and the highest upside.

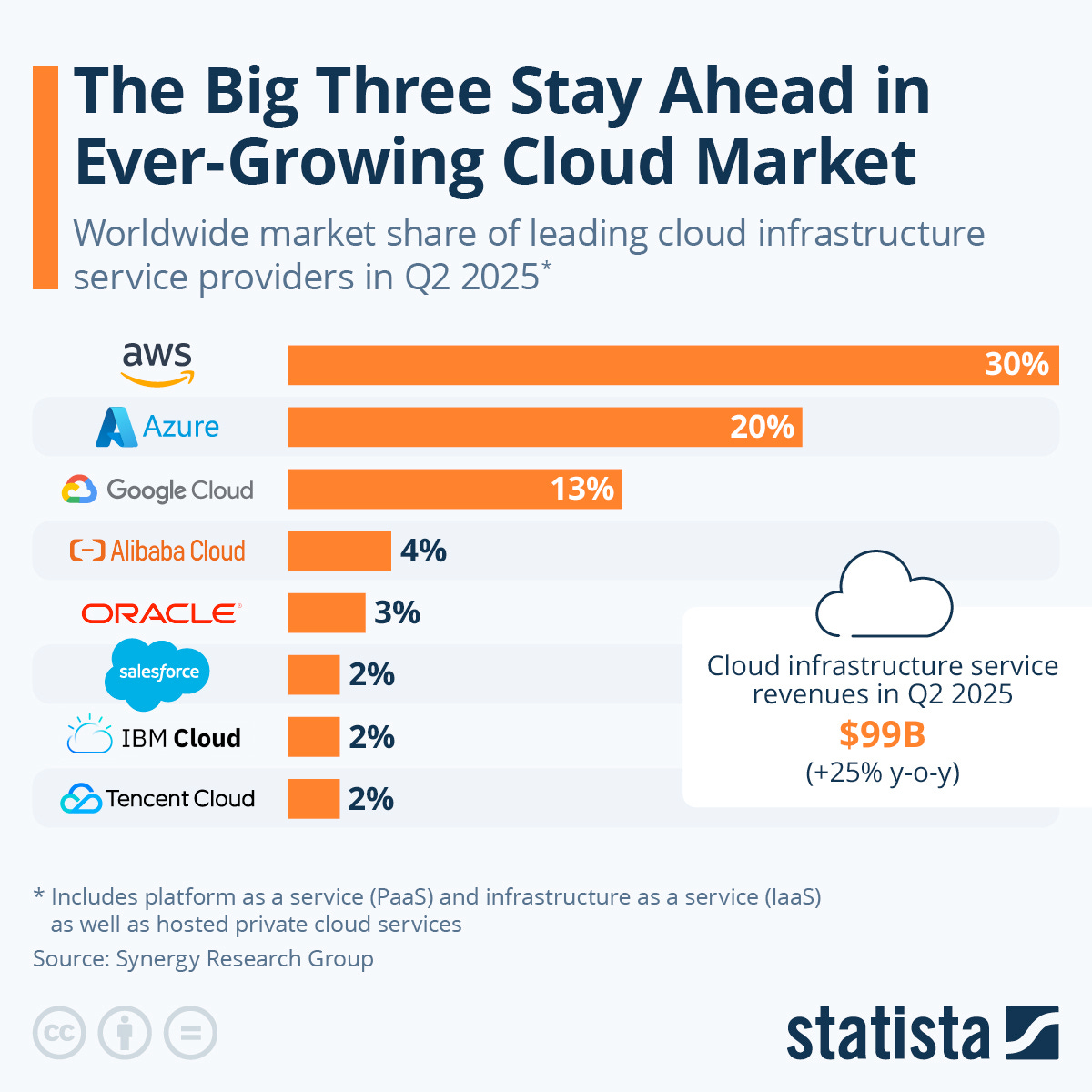

Cloud as an industry has been historically dominated by the big three: AWS, Azure, and Google Cloud. The three tech giants with the capital to maintain the servers, buy new GPUs, manage client integration, and (crucially) the capital. Mind you, I am fully aware I mentioned that last point twice.

As of Q2 2025, the big three cloud giants hold a collective ~65% share of the global cloud market. Oracle is fifth on the list at 3%.

In annual revenue (TTM numbers as of Q2 2025):

AWS: ~$116 billion

Microsoft: ~$120 billion

Google Cloud: ~$55 billion

Oracle Cloud: ~$20-40 billion

depending on your definition

The crux of the stock boom came from a few key metrics:

Remaining Performance Obligations (RPO) jumped ~360% year over year to $455 billion.

Signed several multi-billion-dollar AI/cloud contracts with OpenAI, xAI, etc.

Oracle forecast its Cloud Infrastructure (OCI) revenue will be $18 billion in the coming fiscal year (~77% more than this year) and $144 billion by around fiscal 2030.

On the surface, my thoughts were that these goals were unrealistic. Azure and AWS will have reached ~$150 billion+ run rates by 2030, and Oracle is in no way comparable to the scale of those two. However, then I thought deeper. First, Oracle has xAI and Stargate (OpenAI-SoftBank partnership) as its cloud partners. That alone will carry huge weight.

Second, it already has the clout and proof of demand for its services with its RPO surge and the contracts with xAI and OpenAI.

And third… I can comfortably say Oracle isn’t a threat to the big three.

AWS, Azure, and Google Cloud will be here for as long as cloud is needed, and that won’t change. Oracle won’t be purging clients directly off the back of these other companies. But the slow capacity in the big three and the ever-growing demand for cloud is propping up Oracle as it takes share from the companies big tech capacity-wise couldn’t get themselves.

The reason I repeated that “big tech has capital” point above is because that was the core advantage they had over other players.

Other players materially could not rival them, and therefore they couldn’t build capacity and thus wouldn’t take share. The problem, and the reason Oracle has become the exception, is because of its deals with xAI and OpenAI, which have been at the centre of the American government’s huge support for domestic investment in AI. I feel that, alongside receiving some of the demand that the big three haven’t been able to take due to capacity constraints, Oracle is also receiving a lot of the new domestic investment capital from companies and foreign governments.

I do not doubt Oracle can reach what it is projecting given the market growth of cloud and the deals it has already secured, though I do have doubts over its ability to retain clients beyond its deals with xAI, OpenAI, and other exclusive $10 billion+ deals alone. A lot of people are pointing at the RPO figure, but what if customer retention doesn’t stick?

Oracle is known for ancient software, and only companies that have been with the company for so long that they can’t leave stick with it.

Walmart, as a prime example, has much of its employee infrastructure on Oracle, yet everything else is on AWS. That’s out of necessity, not choice.

And that would be my only bear case on this issue.

The “nevertheless news” is that cloud computing is here to stay. With or without Oracle’s incredible projected growth.

The growth is insatiable and demand is still alive, and that’s bullish for all of the major cloud giants. I truly believe Oracle can reach a great position in this market given its connections, and growth is there… I know it. But there’s a lot of uncertainty in such a rise, and I’m going to have to research further.

I would expect everyone else to before jumping to conclusions as well. (Or you can wait until next Wednesday for a Stock Analysis issue which I’m debating to be on a small cap or about Oracle given these new circumstances. Your call, let me know by commenting or replying to this email.)

Overall, I’ll be sticking with the inevitable, more versatile, adaptable plays with broad optionality like Google, Amazon, and/or Microsoft.

Nothing changes. I’m not selling.

Until then, happy investing.

a. 📄 In other news

Amazon is developing AR glasses

Amazon is joining Google, Meta, and Apple in the AR glasses race the same week it launched its robotaxi service, Zoox, in Las Vegas. Very bullish news.

Uber to launch helicopter rides

I remember reading a comment last week on how Uber can easily be replaced by Tesla robotaxi. I’m not sure that argument sticks even remotely with this announcement (I suspect it won’t make up a large share of revenue, but it’s still very notable).

If anyone is curious about my honest thoughts on Klarna, I believe it’s, frankly, a junk-debt business marketed as a software business in an environment where no one can afford anything and is constantly looking for ways to take on more debt. I’m staying away.

The only debt business I would own (and do) is Amex, due to its incredible underwriting and more affluent base.

b. 📚 Resource of the week

Book Review (0.5)

This week, I started reading Wealth of Nations, a book (or more accurately, an essay) that would later become the foundation of capitalism and political right economic theory. Something to note is that this book isn’t a single book; it’s many books in one, spanning 1,000 pages or more.

I am reading Books 1–3 (around 500 pages), and it’s a very dense read. Full stop. Though I will add to that by saying it’s very interesting to read, and it’s rewarding every time I pick it up.

It’s quite like researching stocks, which many times is dense and repeatedly stumps you as you try to grasp a concept. But in the end, it’s worth it to press “publish” or press “buy” in your brokerage after all that work, and I wouldn’t change anything about doing so.

I haven’t come close to making a dent in this book with the limited reading over the week, but I will be looking to finish it over the course of the next few weeks, and I’ll be back with my full thoughts thereafter.

There is an abridged version available, but I apparently like putting my brain through constant 500-pound deadlifts.

—-

Thank you for reading. Please do enjoy the weekend.

All the best,

Jacob

If you enjoyed, follow me on Blossom and Substack (if you haven’t already) for more. Both are free with an optional paid tier for this Substack to support and get exclusive content and access (Discord access, my eBook, and all past and future stock analyses).

(The entire reason was because of the cloud projections and obligations growing 400%.)

Good luck with the Wealth of Nations, it's a dense read indeed. With the cloud market undergoing significant growth, there will be enough room for multiple winners. That's my thinking at least

I personally feel Oracle is likely to split the cloud computing pie more evenly. But their growth is propped up by undercutting AWS in pricing, similar to Azure and GCP and that may not sustain over years... just enough to lock in some customers. 🧐

For convenience of use and cost effectiveness, AWS is still the king - they focus more on optimizing customer costs over the others.