Weekly Brief #37

Is SearchGPT the end for Google?...Loblaws settles for $500 million, Amazon’s in-house Nvidia replacement, Disney+ and Warner Bros. bundle up, Joe Biden drops out of presidential race, Google earnings

Good morning investors 👋,

Happy Friday and welcome, or welcome back, to the 37th Weekly Brief.

Some good economic news this week: The Bank of Canada cut the key interest rate by 25 basis points (0.25%), and the U.S. economy grew by 2.8% last quarter (faster than expected due to strong consumer spending and business investment), with expectations for a rate cut in September.

Let’s get into it.

In this issue:

🔎 Is SearchGPT Google’s end?

💰 Magnificent 7 Q2 earnings have arrived

🇺🇸 Joe Biden drops out of election race

FEATURED STORY

🔎 Is SearchGPT the end for Google?

Over the past year, worries about ChatGPT and an AI-powered Bing crept into investor sentiment regarding Google stock. Things became even worse when Google misrepresented the abilities of their AI, Gemini, to investors, and when that AI generated pictures of African George Washingtons and women and Black men wearing Nazi military uniforms. It was a mess, and back in March, it sent the stock plummeting over 15% within a month.

However, all of that has thankfully passed. After an amazing Q1 earnings report this year, which threw those ‘Google search is doomed’ arguments out the window, Google stock surged 45%.

Then, after what Wall Street thought was a ‘weak’ Q2 earnings report for Google, OpenAI decided to smear those gains in investors’ faces.

Meet SearchGPT, an AI search engine ‘that gives you fast and timely answers with clear and relevant sources.’ Or, put bluntly, exactly what Google investors were scared about at the start of the year. (If I’m being honest, it’s a very cool idea, much superior to what Google Search is currently, but a full fledged Gemini-powered Google Search would be the same thing.)

Quote from CEO of The Atlantic (magazine) on OpenAI’s AI search:

“AI search is going to become one of the key ways that people navigate the internet, and it’s crucial, in these early days, that the technology is built in a way that values, respects, and protects journalism and publishers. We look forward to partnering with OpenAI in the process, and creating a new way for readers to discover The Atlantic.” — Nicholas Thompson, CEO of The Atlantic

But is SearchGPT actually a threat? If it is, what happens to Google? And is SearchGPT the end for Google?

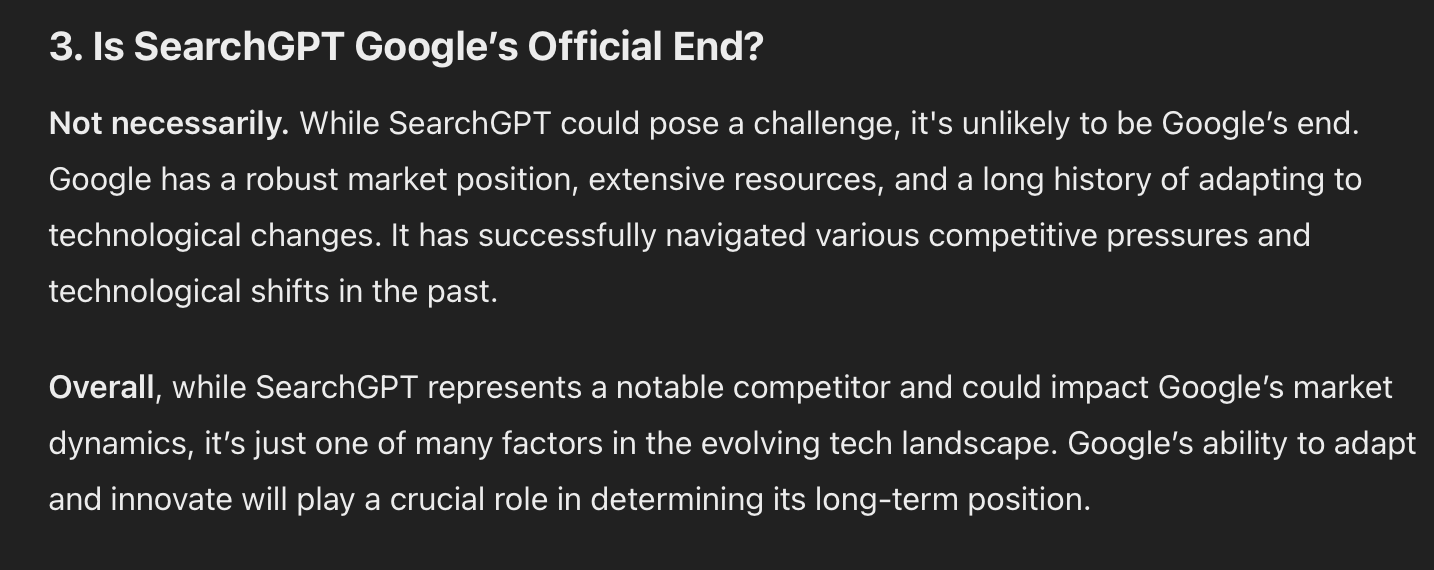

No, Google isn’t going anywhere

Google has been growing search revenue consistently year-over-year since its inception. The vast array of properties Google owns, such as YouTube and Gmail, will probably never cease to exist. Not to mention, Google has a long history of adapting to technological changes. As Google pushes to improve its AI model, Gemini, in search, SearchGPT will become obsolete in comparison.

Google has far more resources than OpenAI.

Google has a huge market position.

Google and its products attract massive amounts of attention (over 4 billion people actively use at least one of its products).

Google has enormous amounts of data to train its AI models.

“Google it” isn’t applicable to SearchGPT (dealbreaker).

My thoughts are that SearchGPT isn’t a massive threat to Google over the long term because Google will inevitably catch up to OpenAI and what they’re doing. Once they do catch up, Google will implement accordingly.

Plus, if AI search is indeed the future, it seems obvious that Google, the leader in search, generally has the upper hand due to its decades of experience in operating search as its main business. In other words, Google has the experience.

Again, I personally don’t believe SearchGPT will have much of an effect on Google in the long term, but in the short term, it will probably put some pressure on the stock. And in that case, I’ll probably be buying. SearchGPT is yet to be publicly released, and until it is, and unless the fundamentals of Google show some signs of wear, I’ll be holding onto my Google shares.

Some of my other write-ups on AI:

FINANCE

💰 Google earnings results

… Speaking of Google!

Magnificent 7 Q2 2024 earnings are upon us, and to start this season off, we have Alphabet (Google) who reported their quarterly earnings on Tuesday this week. Here’s how that went:

GOOG Q2 2024:

Earnings per share: $1.89 vs. $1.85 expected

Revenue: $84.74 billion vs. $84.19 billion expected

Google Cloud revenue grew 28.8% to $10.35 billion vs. $10.16 billion expected

Net income was $23.62 billion, or $1.89 per share, up 29% from $18.37 billion, or $1.44 per share a year ago. Revenue rose 14% to $84.74 billion from $74.60 billion the previous year.

🛍️ Loblaws settles for $500 million

Loblaw and its parent company, George Weston, have agreed to pay $500 million to settle class-action lawsuits (yes, that’s plural) related to an illegal scheme to artificially raise the price of bread.

The lawsuits accused not only Loblaw and George Weston, but also Metro, Walmart Canada, Giant Tiger, Sobeys, and Canada Bread Co. of fixing packaged bread prices in Canada since Nov 2001, thereby artificially raising prices. George Weston will pay $247.5 million in cash, while Loblaw will pay $252.5 million, with $156.5 million in cash and $96 million in credits.

BUSINESS

👾 Amazon’s in-house Nvidia replacement

This Friday, engineers at Amazon’s new chip lab in Austin, Texas, tested a new server design featuring Amazon’s AI chips. Amazon has been developing its own processors over the past year or two to reduce dependence on Nvidia’s chips, which power some of its AI cloud business, AWS.

Amazon wants to help customers compute complex calculations and process large data sets at a lower cost, which they believe can only be accomplished with their own in-house chips. Microsoft and Alphabet (Google) are currently doing the same, and these cost-saving measures are actually working:

“So the offering of up to 40%, 50% in some cases of improved price (and) performance - so it should be half as expensive as running that same model with Nvidia.” — David Brown, VP, Compute & Networking at AWS

📺 Disney+ and Warner Bros. bundle up

After announcing it back in May, Disney and Warner Bros. Discovery have launched a new streaming bundle with subscriptions to Disney+, Hulu, and Max in the United States (kind of like Crave here in Canada). They are also working on another bundle for a new sports streaming service with ESPN and Fox.

Starting July 25, 2024, U.S. customers can purchase the bundle for $16.99/month with ads or $29.99/month ad-free. This bundle joins other recent streaming bundles, such as Verizon’s Netflix and Max bundle, and Comcast’s Peacock, Apple TV+, and Netflix bundle. We’re entering the bundle era in TV again.

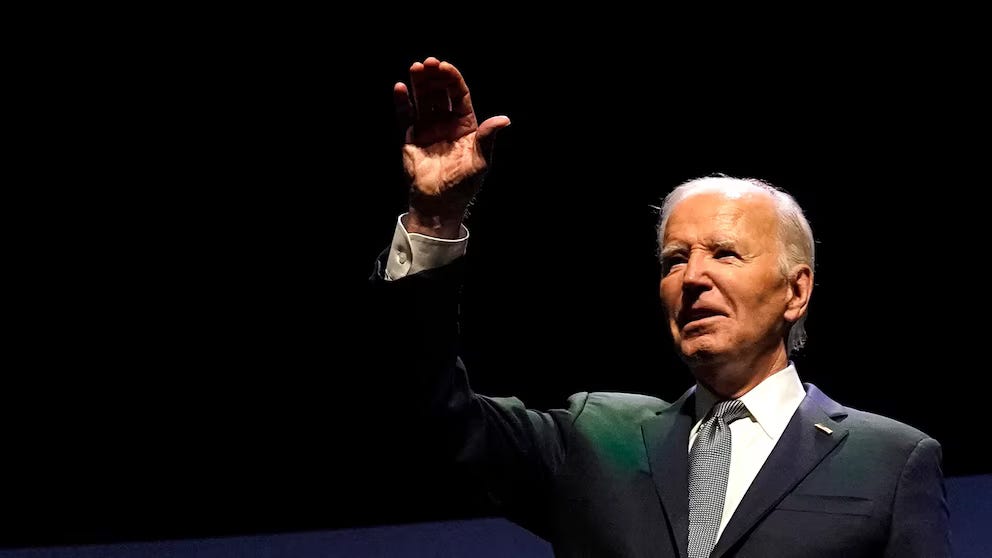

🇺🇸 Joe Biden drops out of presidential race

U.S. President Joe Biden dropped out of the presidential election on Sunday, officially ending his re-election campaign and endorsing Vice President Kamala Harris as the Democratic candidate. Biden said it was in the best interest of the party and the country to do so. He will remain president until January.

This decision follows a poor debate performance against Trump, a bout with COVID-19, calling the Ukrainian president “President Putin,” and mistaking Vice President Harris for “Vice President Trump.” (This all happened in just under a month by the way.)

Democrats, including former Presidents Obama and Clinton, have voiced support for Harris. Many supposed rivals, such as California Governor Gavin Newsom and Pennsylvania Governor Josh Shapiro, have also backed her. The Democratic National Committee will officially nominate her on August 19 and has already started amending its fundraising committees to support Harris.

In other US political news: After facing backlash and calls to be fired from the huge lapse in security over the Trump assasination attempt, Secret Service directer Kimberly Cheatle, former senior director of global security at PepsiCo, resigned this week.

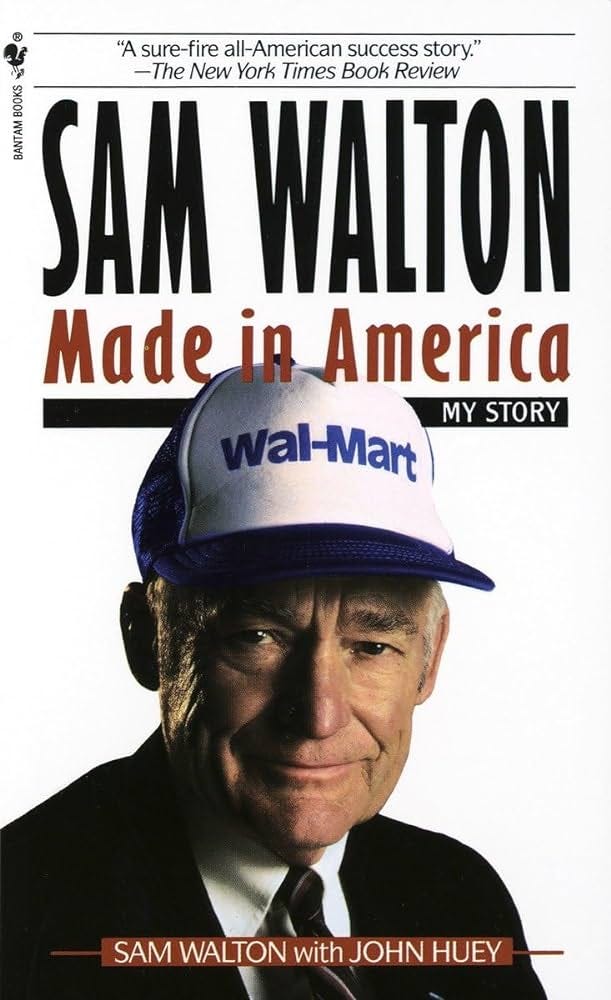

📚 Book of the Week

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

Sam Walton: Made in America — Sam Walton

Book Description:

Meet a genuine American folk hero cut from the homespun cloth of America’s heartland: Sam Walton, who parlayed a single dime store in a hardscrabble cotton town into Wal-Mart, the largest retailer in the world. The undisputed merchant king of the late twentieth century, Sam never lost the common touch. Here, finally, inimitable words.

Genuinely modest, but always sure if his ambitions and achievements. Sam shares his thinking in a candid, straight-from-the-shoulder style. In a story rich with anecdotes and the “rules of the road” of both Main Street and Wall Street, Sam Walton chronicles the inspiration, heart, and optimism that propelled him to lasso the American Dream.

✩ This newsletter, along with my weekly Morningstar fair value estimates and PDFs, will always be free of charge. Your support, whether through a donation or by reading this newsletter and following along, is greatly appreciated.

Thank you for reading today’s Weekly Brief! If you enjoyed or learned anything, please spread the word.

— Jacob