Weekly Brief #48

Google stock analysis sneak peak... Tesla’s anticipated robotaxi event, TD Bank pleads guilty to fraud, CD&R closes in on Sanofi acquisition, Prime Video adds Apple TV+, DOJ considers Google breakup.

Welcome to the 19 investors who joined us since the last Weekly Brief! If you’re reading on the web and haven’t subscribed, join 454 curiosity-driven, enthusiastic stock market-addicted mortals by subscribing here.

Good morning investors 👋,

Happy Friday and welcome or welcome back to the 48th Weekly Brief.

First off, thank you so much to the 2 new subscribers who turned paid this week. Second, what in the hell is up with Google and the DOJ lately?

Back in August, the U.S. Department of Justice won a groundbreaking court case against Google, alleging it was an illegal monopoly over the online search market. Google is facing fines, (which was to be expected), but this week, the DOJ torched Google sentiment by announcing they are considering requesting a court to break up Google into separate entities. We’ll be discussing this, as well as Tesla’s robotaxi event, TD’s money laundering fine, and so much more in today’s issue of Weekly Brief.

(Make sure to check out this week’s ‘Book of the Week!’)

Let’s get into it. (12 min read)

In this issue:

🔍 Google analysis sneak peak

🚗 Tesla’s anticipated robotaxi event

🏦 TD Bank pleads guilty to fraud

FEATURED STORY

🔍 Google analysis (sneak peak)

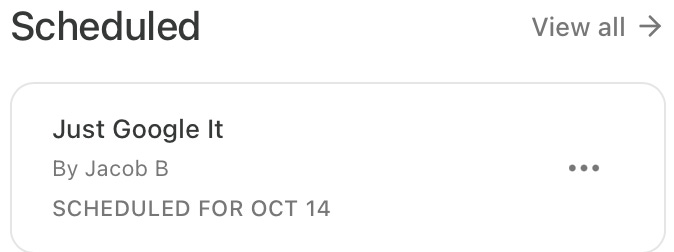

I announced last week that I was planning to release a stock analysis every week as a little challenge for myself. You might be wondering: “Well, a week has passed, and no stock analysis—why is that?” Well this week, I followed through with my plan and wrote an analysis on Google. But no joke, I forgot to schedule the post for Thursday morning, which is when I told everyone on Blossom it would be out.

Life got in the way, and by the time I noticed it, it was too late. If I had sent it out on Thursday at the later time when I discovered the oversight, I would have wrecked the schedule for when the Weekly Brief was supposed to be sent out (which I didn’t want to do because it would have ruined the release schedule I’ve stuck to for 48 consecutive weeks). Instead, I decided to schedule it for Monday.

Now, I felt a little guilty for promising to all of you that I would send this out on Thursday and not following through with that promise, so here’s the introduction, or I guess sneak peak, of my Google stock analysis, Just Google It:

When was the last time you googled something?

Ha, gotcha! That was a rhetorical question.

For most of us, googling something is how we’ve grown to obtain information nowadays. It’s a part of modern-day life. A developed habit some could say. Forget reading books (which is undoubtedly something you should do), tuning in to the 6 p.m. news, or listening to tape recorders. If some piece of information is googleable… well, let’s face it, you’re going to (1) subconsciously eliminate all other options for obtaining that piece of information, (2) pick up your phone, and (3) google it. The catch, of course, is that nearly any piece of information you could ever want to obtain is googleable in today’s world.

Google was created during the height of the internet's popularity after being founded way back in 1998 by Larry Page and Sergey Brin, just 3 years after the release of Windows 95. (Windows 95 is said to be the most pivotal moment in the home computer era, marking the beginning of the internet age and the normalization of owning a computer in a household.)

Larry and Sergey were just two relatively normal Stanford Ph.D. students minding their own business until stumbling across each other in 1995. In a very short amount of time, they garnered a liking for each other, and together, started working on a research project called “BackRub.” This project did not involve creams and massages. It instead involved creating a complex computing algorithm to rank web pages based on importance by analyzing their backlink data. For those unfamiliar with web development, a backlink is a link on one web page that points to another: a sort of recommendation of web pages.

By 1996, project BackRub was completed, and without knowing it at the time, Larry Page and Sergey Brin had just developed the original Google Search algorithm (now known as PageRank). Two years later, Larry and Sergey set up the first Google office in the garage of Susan Wojcicki, who was renting out the space to help with her mortgage. Little did Susan know, that with the help of that garage, she had singlehandedly contributed to the revolutionization of the internet, laying the foundation of a multi-trillion-dollar company.

In 2014, Susan became the CEO of YouTube.

It took Google a single year to reach 1 million users, just five years later to reach 100 million, and only seven years after that to reach 1 billion users. Google’s impeccable timing—launching right at the beginning of the internet’s rapid adoption—allowed it to grow at an almost unprecedented rate following its launch. As Google grew and the adoption of the internet exploded, Google’s active user count followed, with more and more people worldwide associating Google with the internet itself.

Google had become synonymous with the internet, and people like they always do, found a way to colloquialize it. This colloquializing of Google’s name transformed it into a societal ubiquity where today everyone and your grandmother knows what Google is and what it does.

The even quicker rise of smartphone adaption, paired with Google’s >$20 billion-per-year default search engine deal with Apple’s Safari, extrapolated this colloquializing even further. In fact, if you want something that will blow your mind, at the beginning of this section, I used four colloquialisms related to Google in a single paragraph, and you comprehended the entire thing—those were google, googling, googleable, and googled. I would not have been able to say those four words just 26 years ago, and maybe it’s a personal thing, but that is mind blowing to me.

Today, our world is more online than ever. Google Search is now used by over 3 billion people globally, generating 2 trillion queries every single year. (Or roughly 60% of the total online population typing 2-4 queries to Google every single day.)

Full analysis is scheduled for Monday October 14, 2024 at 9:30 a.m. That same week I will try to send out a second analysis to meet my goal of one analysis per week (because the Google analysis was supposed to be this week). Thanks for understanding.

Also, a quick side note (I thought this was absolutely crazy):

I came across a video this Thursday linked on my Blossom feed, posted by Blossom CEO Maxwell Nicholson, where it showcased Google’s podcast audio generator AI model tool called NotebookLM. The video featured an audio conversation between two podcasters, totally AI-generated, discussing the newest issue of his newsletter, The Weekly Buzz. It blew my mind, so like any curious human, I decided to paste my entire finished Google analysis into this model.

You can listen to that here.

It won’t give you the depth the actual analysis will, but it’s a nice summary of what to expect—with the added benefit of being absolute technological mind-blowing mayhem, if that even makes comprehensible sense. It’s very cool is what I’m trying to say, so definitely check it out if you have the time. Thank me later.

FINANCE

a. 🏦 TD Bank pleads guilty to fraud

TD Bank pleaded guilty to money laundering lapses this week, agreeing to a deal that involves paying $3 billion in fines, the largest in U.S. history—and not even from an American bank, but a Canadian one, which I found quite funny. The deal also includes an asset cap and restrictions on operating in the U.S. market due to significant compliance failures (more below).

U.S. Attorney General Merrick Garland stated that TD prioritized profits over compliance when investigations revealed the bank had failed to monitor over $18 trillion in transactions over a decade, allowing money laundering networks to send illicit funds on their watch. The asset cap in particular is a massive blow to TD’s U.S. expansion efforts and caused the stock to fall by 5%.

CEO Bharat Masrani apologized for the failures, taking full responsibility, and has chosen to resign as CEO effective October 2025.

Related articles:

b. 💼 CD&R closes in on Sanofi acquisition

Sanofi, the French $100 billion+ market cap pharmaceutical company, is nearing a deal to sell its consumer health unit for about €15 billion ($16.4 billion) to U.S. private equity firm Clayton Dubilier & Rice (CD&R) to increase funding for new drug development, per Bloomberg.

Bloomberg reported that Sanofi received separate bids from CD&R and rival PAI Partners for the Opella unit, with CD&R currently leading in the negotiations. Sanofi has been reviewing separation scenarios for its consumer healthcare business, with a transaction possible in the fourth quarter, so a deal could be announced fairly soon. This would be one of the largest acquisitions of 2024.

BUSINESS

c. 🚗 Tesla’s anticipated robotaxi event

Well, it’s happened. Tesla officially unveiled its robotaxi, called the Cybercab (image above), at its much-anticipated “We, Robot” event this Thursday. CEO Elon Musk showcased a lineup of 20 vehicle variations of the Cybercab, which is a smaller, sleeker version of the Cybertruck, a car with no pedals and no steering wheel.

The Cybercab when for sale, will include wireless (inductive) charging instead of a plug-in charger, have an operating cost of around $0.20 per mile (or $0.12 per kilometre), and a purchase price of under $30,000. Production of the Cybercab is set to begin in 2026. Tesla also unveiled the Robovan, a 20-passenger autonomous bus, but no timeline was provided for its release. However, Musk did announce plans to launch “unsupervised FSD” in Texas and California next year.

Related articles:

d. 📺 Amazon adds Apple TV to Prime Video

Later this month, Apple TV+ will be available as an add-on subscription for $9.99 per month through Prime Video in the U.S., the same price as a standalone subscription. Apple TV+ joins over 100 other add-on options on Prime Video, including services like Max and Paramount+. Although Amazon takes a cut of this subscription revenue, it doesn’t disclose the specifics (sadly 😔).

Collaboration between the two companies in streaming has already been established through Amazon’s Fire TV and its native Apple TV+ app, as well as the Apple TV 4K boxes that stream Prime Video. This integration is another check off the box for Amazon’s strategy of consolidating consumer entertainment into one app and one bill.

“Amazon can offer Apple TV+ to hundreds of millions of Prime subscribers globally.” — Mike Hopkins, SVP of Prime Video

Related articles:

POLITICS

e. 🇺🇸 DOJ considers breakup of Google

This year has been a roller coaster for Google regarding regulatory issues. They lost a case set forth by the EU and ordered to paid a fine, then they won a case set forth by the EU and didn’t have to pay a fine. It was, and is still, a lawsuit game of back and forth. However, one case this year served as the final blow for Google’s regulatory roadblocks… a ruling from a 2020 lawsuit by the U.S. Department of Justice stating they are an illegal monopoly.

And this Tuesday, unlike the EU’s approach, the DOJ hinted at a little something more than just some fines: A potential breakup of the company as an “antitrust remedy.” Breakups of Android and Chrome more specifically. (This is the second time the DOJ has mentioned a breakup for Google since the ruling.)

Aside from the potential breakup, the DOJ’s filing suggested measures to prevent monopoly maintenance, including contract requirements, non-discrimination policies, structural changes, and a proposed “choice screen” where users could select alternative search engines, ending Google’s distribution control. Recommendations also included ending default agreements and revenue-sharing agreements, such as Google’s deals with Apple and Samsung.

My opinon: I’m sorry, but what is an antitrust remedy for if there is absolutely no antitrust in the first place? Consumers just prefer Google—end of story. There’s no illegal coercion from Google to make people use their products; people simply choose to do so. Plus, Google’s control of products like Chrome, Gmail, and Android helps keep prices low because Google can afford to offset costs. This is why Gmail can offer 15 GB of data for free. If those services were separated, consumers would have to pay more. This logic applies to many of Google’s products. Google Play Store for example, where Google only collects a 15% fee (for apps making under $1,000,000 in revenue), which seems reasonable to me.

In my eyes, there is nothing inherently illegal here, especially when considering the deals with Samsung and Apple for default search settings and so forth. People will just end up using Google regardless of whether it is the default option on their browser. It’s just the better option.

Google plans to appeal the original ruling.

Related articles:

📚 Book of the Week

⭐️ For every book purchased using the links below, 80% of affiliate commissions are donated to The Princess Margaret Cancer Foundation.1

Total donated to date: $30.00

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

The Most Important Thing — Howard Marks

Book Description:

Legendary investor Howard Marks is chairman and co-founder of Oaktree Capital Management, which has $100 billion under management. He is sought out by the world’s leading value investors and his client memos brim with insightful commentary and a time-tested, fundamental philosophy.

Now for the first time, readers can benefit from Mark’s wisdom, concentrated into a single lifetime of experience and study, The Most Important Thing explains the keys to successful investment and the pitfalls that can destroy capital or ruin a career. Utilising passages from his memos to illustrate his ideas, Marks teaches by example, detailing the development of an investment philosophy that fully acknowledges the complexities of investing and the perils of the financial world. Brilliantly applying insight to today’s volatile markets, Marks offers a volume that is part memoir, part creed, with a number of broad takeaways.

Thank you for reading today’s Weekly Brief! If you enjoyed or learned anything, please spread the word. (Remember, none of this is financial advice, please do your own research.)

— Jacob xx

All my links here.

Only applicable for books purchased on Amazon.ca. The commission is 5.50% of the total retail price on physical books and 10% for Kindle books. All donation dollar amounts in Canadian dollars.