Weekly Brief #51

Harris or Trump... who's better for the U.S. economy? Plus, Google sued for $20 decillion, Waymo raises $5.6 billion, Meta's AI search engine plans, Super Micro accounting firm resigns, and more..

Good morning investors 👋,

Welcome or welcome back to the 51st Weekly Brief. Officially, Happy Holidays!

The 2024 U.S. Presidential Election is upon us, with just four days until national voting formally begins. This got me thinking: What are each candidate’s economic policies, how will they affect the gargantuan U.S. national deficit, and who is most likely going to benefit your stock portfolio more? It’s a simple question, and I’ve answered it.

Last week, I announced a $50 Amazon gift card giveaway for subscribers who filled out this survey. I’ve just sent an email to the winner (chosen by a random wheel generator). Thank you to those who participated.

Let’s get into it. (14 min read)

In this issue:

🇺🇸 Harris or Trump? Economically speaking.

🧑⚖️ Russia fines Google $20 decillion (33 zeroes)

🇪🇺 EU approves €35 billion Ukraine loan

FEATURED STORY

🇺🇸 Harris or Trump? Economically speaking.

If you’re an American investor, who are you voting for in this election?

That is a rhetorical question. I don’t want your politics. At least, it’s a rhetorical question for you; I actually want to answer it.

Being a Canadian investor with nearly 70% of my equity portfolio skewed toward U.S. businesses, this election is incredibly important to me. U.S. elections generally are, but given my situation, depending on the policies that each specific candidate could potentially implement, it might affect my investments.

I actually wanted to know, with just days left until the votes are counted, economically speaking, from my investment portfolio to the entire U.S. stock market to the U.S. national deficit… who is actually the better candidate for the presidency based on the facts and data?

Before I start though, I’d like to mention first:

If Donald Trump wins the presidential election, I will keep investing into the U.S. stock market.

If Kamala Harris wins the presidential election, I will keep investing into the U.S. stock market.

History says you should do the same.

Long-term, the market has a clear track record of performance regardless of who is president. Sit back, enjoy some popcorn, and watch over the next couple days as Americans threaten to move to Canada if a certain candidate is elected. (The beauty of the American election cycle.)

Leading up to the election, the stock market usually becomes very soft. Sometimes a selloff is prone as uncertainty reaches extreme highs among investors. Then, as the election ends, a short rally usually follows. This is the simple psychology of the minds of everyday investors. People don’t like uncertainty, including knowing the policy implications of the market if a specific candidate were to be elected.

With that, let’s start with the blue donkey candidate.

Kamala Harris:

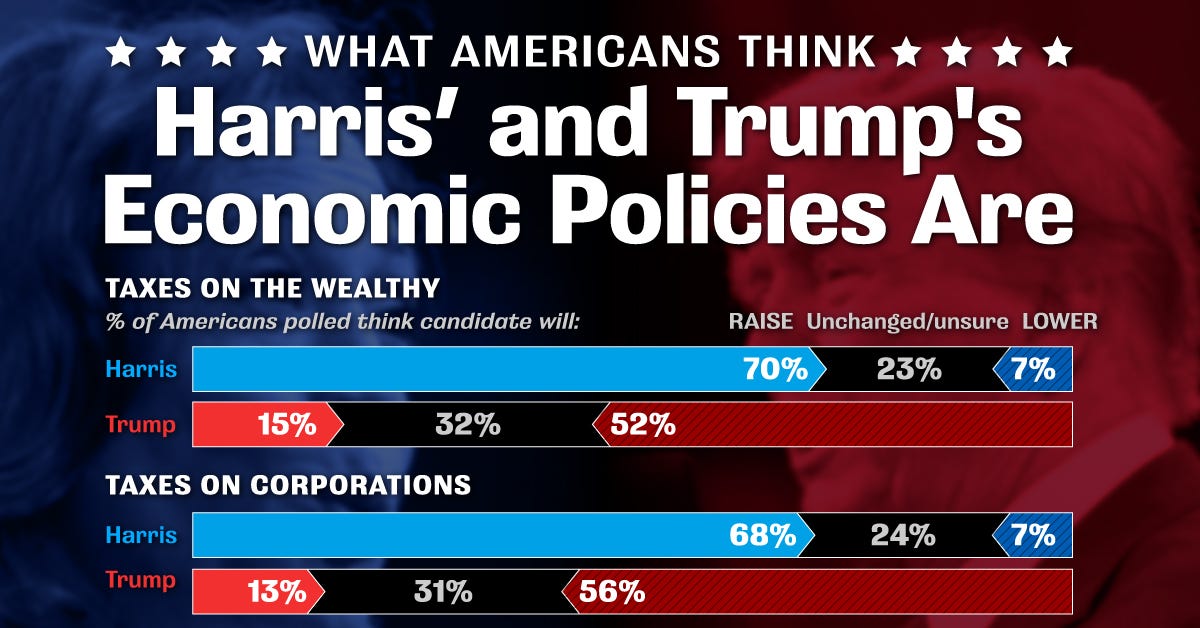

Proposed Tax Changes

Increase the marginal tax rate to 39.6% for high earners.

Increase capital gains tax to 28% for high-income individuals.

Increase corporate tax rate from 21% to 28%.

Raise the stock buyback tax by 400%, from 1% to 4%.

Credits and Subsidies

Expand the Child Tax Credit to $6,000 for children under 6 and $3,000 for children aged 6 to 17.

Introduce a $50,000 tax deduction for small businesses.

Overview: Harris’s proposed economic policy is estimated to raise approximately $4.25 trillion over the next decade. The total cost of her proposed plan would be around $7.65 trillion over the same period. This leads to her plan causing a $3.4 trillion increase in the national deficit over the same time frame, which includes a $500 billion increase in debt payments.

A huge point for Harris’s campaign is prioritizing middle-class growth. This prioritization has led to many policies that are perceived as anti-stock market, so to speak. Raising the corporate tax rate, increasing the rate on capital gains, and even increasing the tax on stock buybacks are included. Even a proposal to tax unrealized gains was brought up by Harris somewhere on the campaign trail. It’s a very unfavourable voter appeal for investors in the stock market, that’s a fact.

Kamala Harris’s main strategy for the economy focuses on an increase in progressive taxation across the board, with a large plan of support for working families and small businesses.

Other items on the Harris bucket list include expanding the Child Tax Credit and the Earned Income Tax Credit ($1.4 trillion); renewing and expanding premium subsidies to buy Affordable Care Act coverage ($550 billion); expanded funding for pre-kindergarten and child care ($700 billion); expanding Medicare to cover long-term care, hearing, and vision ($500 billion); and establishing paid national family and medical leave ($350 billion).

The total increase in federal revenue from Harris’s economic plan would amount to $4.25 trillion over a decade. This would primarily come from raising the corporate tax rate from 21% to 28%, which is expected to add another $900 billion in revenue, as well as from implementing higher taxes on capital gains, dividends, stock buybacks, and unrealized capital gains, totalling $850 billion; raising the Medicare surcharge to 5%, which would generate $800 billion; increasing taxes on corporations’ overseas earnings, amounting to $550 billion; and expanding prescription drug negotiations, projected to bring in $250 billion.

Now onto the red elephant candidate.

Donald Trump:

Proposed Tax Changes

Plans to extend the 2017 Tax Cuts and Jobs Act rates, with the top marginal rate remaining at 37%.

Plans to reduce the corporate tax rate to 15%, down from the current 21%.

Proposed Tariffs

Plans to implement new tariffs ranging from 10% to 20% on most foreign goods, even proposing as high as a 100% tariff on all Chinese goods, to protect American jobs and encourage domestic manufacturing.

Overview: Trump’s proposed economic policy is estimated to raise approximately $3.70 trillion in federal revenue over the next decade. The total cost of his proposed plan would be around $10.4 trillion over the same period. This leads to his plan causing a $6.7 trillion increase in the national deficit over the same time frame.

Donald Trump’s economic plans focus on corporate tax cuts, deregulation, and increasing domestic manufacturing through tariffs and incentives. A major point for the Trump campaign is the placement of tariffs on foreign goods to bolster a better domestic manufacturing industry and to raise federal revenue. Trump holds very stock market-friendly policies, with a huge part of his economic policy involving corporate tax cuts and an end of suppressing American businesses with taxes to ‘let them flourish.’

Trump’s tax cuts are expected to reduce federal revenue by approximately $3 trillion over the next decade, while the proposed tariffs could potentially generate between $300 billion to $600 billion in additional revenue. The net effect of these policies would result in a massive revenue loss for the federal government, estimated between $2.4 trillion and $2.7 trillion over ten years (that’s after accounting for tariff revenues).

The 10-year net cost of Trump’s proposals is $7.75 trillion, according to the Committee for a Responsible Federal Budget, which includes an extra $1 trillion in interest payments. Cutting the corporate tax rate from 21% to 15% for domestic manufacturers would cost $200 billion; exempting tips from income taxes would be $300 billion; exempting overtime income from taxes would cost $2 trillion; ending taxes on Social Security benefits would cost another $1.3 trillion; and boosting military spending would cost $400 billion.

A total of $3.7 trillion in revenue would come from Trump’s policies, mostly from tariffs totaling $2.7 trillion; canceling Inflation Reduction Act outlays, including tax credits for electric vehicles and energy and electricity production ($700 billion); and disbanding the Department of Education ($200 billion).

Unless Trump follows through with his aggressive tariff plan, he’ll need to find trillions of dollars worth of spending to offset his tax cuts. This is without mentioning the economic effects on consumer products following aggressive tariff policies, which would cost the American consumer an additional $4,000 per year and could potentially lead the U.S. economy into a recession. The only real mention of cutting spending came from Elon Musk, who Trump may appoint to lead cost cuts in government agencies in his second term.

Trump is the best candidate for mine and everyone’s stock portfolio, but at a huge long-term cost for the U.S. economy and its rising defict. Trump would need to apply these tariffs very strategically to avoid economic recession and a surge in prices for consumers. Among many other things, to justify such a high increase in the cost of the national deficit.

Who’s the better candidate?

According to the data, based on the total effect on the national deficit, Kamala Harris is the better candidate for America’s economy. For the stock market, maybe not so much, with the inclusion of her many progressive corporate tax policies, it would put pressure on the profitability of public businesses and potentially hurt stock prices. Some argue it could do the opposite. However, if the U.S. is looking to get out of its defict and eventually debt problem, taxing large corporations is a move in the right direction. It’s much easier to raise federal revenue from multinational trillion-dollar market-cap businesses than to implement tariffs like Trump plans to do or raise taxes on citizens.

Generally speaking, of course.

Even though Trump’s economic policies and corporate tax cuts would benefit the stock market and increase the profitability of American businesses by a large margin (along with a flourishing in the American manufacturing sector and faster GDP growth), but the actual cost of these great things far outweighs the potential good to come from them, in my eyes. Trump’s policy would cut tax revenue by trillions, increase tensions with China, hurt the U.S. consumer with increased prices, and would put the economy at high risk of reccession.

Maybe he can grow the economy at a faster rate than the total of his defict with his policies. If he does, that would be great. But time will tell.

Overall, based on the data and my thoughts on things: Harris is the best candidate for the economy in terms of how much her policy hurts the deficit and steers the U.S. on a path to getting out of debt. Trump is the best option for the stock market and manufacturing, fuelled by his proposed tax cuts, which would lead to a drastic increase in the profitability of American businesses and most likely a surge in public markets and job growth. All of that, granted, coming at a more than $3 trillion premium on the defict compared to the policies of Harris.

This doesn’t mean Kamala Harris would make a good president, and it doesn’t mean Donald Trump would make a bad president, or vice versa. This is purely an economic policy analysis weighing the effects on the U.S. national deficit, and Harris’s policy is the clear winner (from what I observed).

Sources (huge part of today’s write-up) at the bottom of the post1

FINANCE

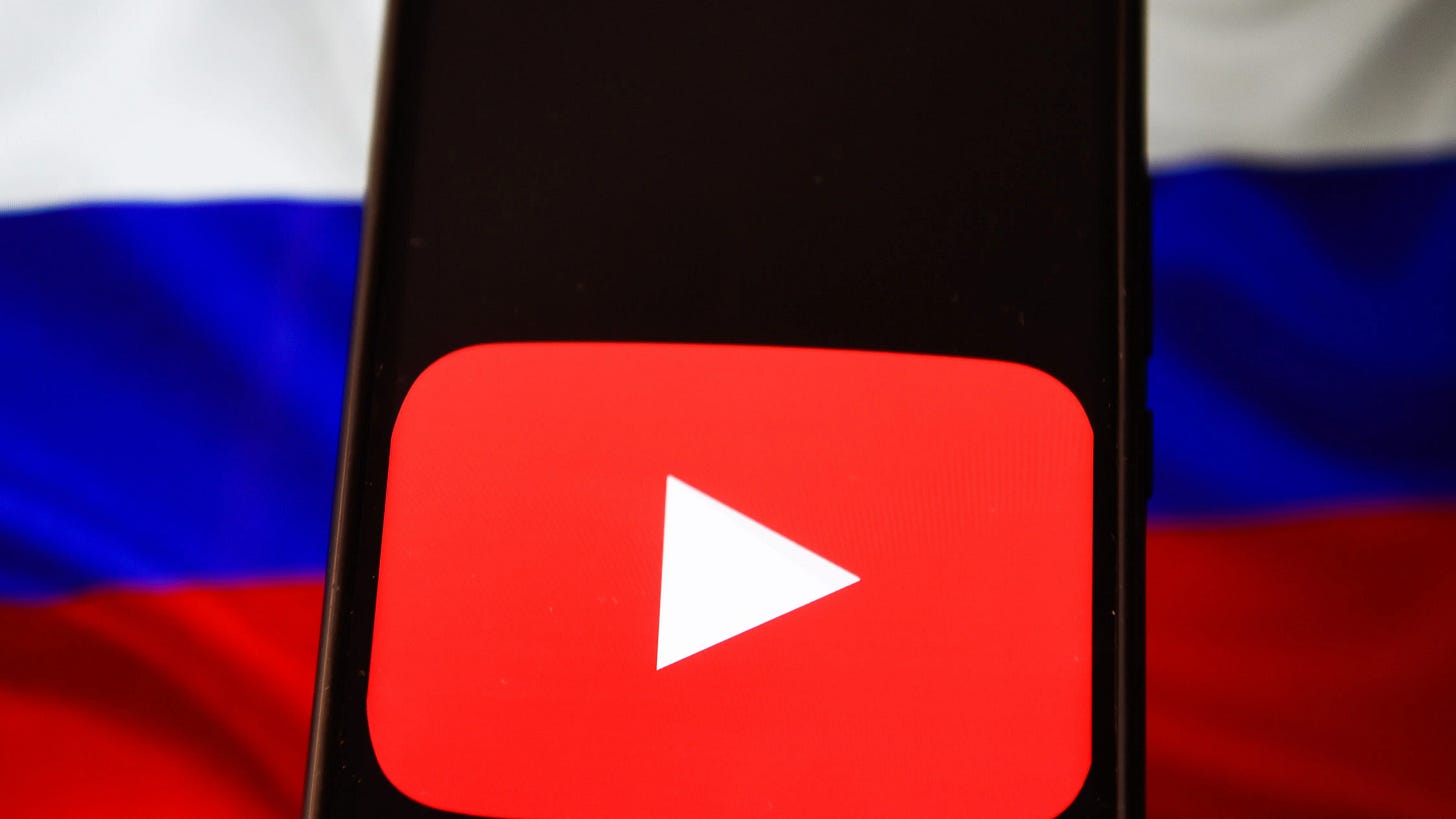

a. 🧑⚖️ Russia fines Google $20 decillion

A Russian court fined Google an unworldly $20 decillion this week after 17 Russian media outlets settled a case involving YouTube from back in 2020. To put that number in perspective, global private wealth is around $450 trillion, and the global economy is valued at $110 trillion. Combined, these two amounts would only be 0.0000000000000000000264% of the $20 decillion Google is required to pay. Absolutely insane.

The case began in 2020 over Google blocking channels linked to sanctioned Russian state-influenced creators. Tensions only escalated further after Russia’s full-scale invasion of Ukraine in 2022. Here’s what that number looks like written out: $20,000,000,000,000,000,000,000,000,000,000,000. That’s 33 zeroes and the fine doubles weekly with no cap.

b. 🚘 Waymo raises $5.6 billion

Waymo, Google’s autonomous driving business, was recently valued at over $45 billion following a $5.6 billion funding round led primarily by Google, with additional investors such as Andreessen Horowitz, Fidelity, Perry Creek, Silver Lake, Tiger Global, and T. Rowe Price. No exact valuation was disclosed.

Waymo currently provides around 150,000 paid rides weekly in cities like San Francisco and Phoenix and plans to expand to Atlanta and Austin through Uber’s app next year. This company is part of Google’s “Other Bets” revenue segment, with about $30 million in current annual revenue.

Related articles:

BUSINESS

c. 🔍 Meta in-works on an AI search engine

Meta is reportedly developing an AI-powered search engine to reduce its reliance on Google and Microsoft, as per The Information this week. This new engine would offer AI-generated summaries of current events within the Meta AI chatbot (which currently uses Google and Bing for news queries).

Meta’s own web crawler has been active for months, and a dedicated team has spent nearly eight months building a data repository for the chatbot. Just a few days ago, this same week, Meta signed a multi-year deal with Reuters to integrate its news content, putting it ahead of OpenAI and Perplexity, which are facing lawsuits from media sites, including News Corp and The New York Times.

Related articles:

d. 💰 Super Micro accounting firm resigns

Super Micro Computer’s market cap was cut by a third this Wednesday after Ernst & Young (EY), one of the largest accounting firms in the world, resigned as its auditor over concerns about transparency in its financial reporting. EY raised similar issues in July, and after further review, began to question Super Micro’s integrity and transparency. A very serious concern, may I say.

Super Micro denied EY’s decision and its claims, and is working to find new firms. Once one of the best-performing stocks of 2024, peaking at a return of over 100% year-to-date, Super Micro shares now stand at a 17% increase year-to-date, pretty significantly underperforming the market.

Related articles:

POLITICS

e. 🇪🇺 EU approves €35 billion Ukraine loan

While technically last week’s news, I thought it was worthwhile to cover: Last Tuesday, European Parliament members approved a €35 billion EU loan to Ukraine, to be repaid using future revenues from frozen Russian assets. Over 518 votes were in favour, 56 against, and 61 abstained.

The Ukraine Loan Cooperation Mechanism, created by the European Union, will channel revenues from around $220 billion of frozen Russian Central Bank assets in the EU to help Ukraine repay the EU’s loan and those from other G7 nations. Ukraine can allocate the funds as needed. The loan will be paid out until 2025.

Related articles:

📚 Book of the Week

⭐️ For every book purchased using the links below, 80% of affiliate commissions are donated to charity.

Total donated to date: $30.00

Note: I don’t recommend books that I haven’t read or that I would never read. The books I recommend are books I have already read or that I will eventually read.

The Subtle Art of Not Giving a Bleep — Mark Manson

Book Description:

In this generation-defining self-help guide, a superstar blogger cuts through the crap to show us how to stop trying to be “positive” all the time so that we can truly become better, happier people.

For decades, we’ve been told that positive thinking is the key to a happy, rich life. “F**k positivity,” Mark Manson says. “Let’s be honest, everything is f**ked and we have to live with it.” In his wildly popular Internet blog, Manson doesn’t sugarcoat or equivocate. He tells it like it is—a dose of raw, refreshing, honest truth that is sorely lacking today. The Subtle Art of Not Giving a F**k is his antidote to the coddling, let’s-all-feel-good mindset that has infected American society and spoiled a generation, rewarding them with gold medals just for showing up.

Manson makes the argument, backed both by academic research and well-timed poop jokes, that improving our lives hinges not on our ability to turn lemons into lemonade, but on learning to stomach lemons better. Human beings are flawed and limited—”not everybody can be extraordinary, there are winners and losers in society, and some of it is not fair or your fault.” Manson advises us to get to know our limitations and accept them. Once we embrace our fears, faults, and uncertainties, once we stop running and avoiding and start confronting painful truths, we can begin to find the courage, perseverance, honesty, responsibility, curiosity, and forgiveness we seek.

There are only so many things we can give a f**k about so we need to figure out which ones really matter, Manson makes clear. While money is nice, caring about what you do with your life is better, because true wealth is about experience. A much-needed grab-you-by-the-shoulders-and-look-you-in-the-eye moment of real-talk, filled with entertaining stories and profane, ruthless humor, The Subtle Art of Not Giving a F**k is a refreshing slap for a generation to help them lead contented, grounded lives.

Thank you all for your support, and thank you for reading.

All my links here.

https://itep.org/a-distributional-analysis-of-kamala-harris-tax-plan/

https://taxfoundation.org/research/all/federal/kamala-harris-tax-plan-2024/

https://kamalaharris.com/wp-content/uploads/2024/09/Policy_Book_Economic-Opportunity.pdf

https://itep.org/a-distributional-analysis-of-donald-trumps-tax-plan-2024/

https://taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024/#:~:text=The%20five%20additional%20major%20tax,the%2010%2Dyear%20revenue%20reduction.