Weekly Brief #52

MercadoLibre’s 16% drop, explained... One-year anniversary of J. Nicholas, The Fed cuts rates, Apple faces largest-ever EU DMA fine, TD employee leaks data, Volkswagen recalls 100,000+ cars, and more.

Please read this week’s introduction in full, if possible. Thank you.

Good morning investors 👋,

Welcome back to the 52nd Weekly Brief.

Today marks the one-year anniversary of writing this newsletter every week without fail — an incredible accomplishment for me. I want to thank you all for being part of this journey so far. Over the past year, we’ve grown a small but smart community with over 485 subscribers. What started as a side hustle without clear direction is slowly evolving into the community I’ve always hoped to build.

In honour of this milestone, I’m offering every subscriber of this newsletter a 1-month free trial to the paid membership, valid until next week. The paid perks for the membership have fluctuated since I first announced them, and that’s been frustrating for me, and I bet all of you. I didn’t know exactly what I was doing at first, and it led to losing dozens of subscribers and damaging the trust I’d worked hard to build with this audience. No more. After reviewing the results from the survey a few weeks ago, I have a much clearer vision for how to move forward.

I found that the majority of readers are here primarily for my stock analyses and deep dives. This was the feedback I needed. Now, I can adjust the value to make this newsletter best-in-class and reward the readers for what they’re here for. I’ve learned what works, what you enjoy the most, and the perks are now set in stone — no more changes.

Every second and fourth week of the month, free subscribers will receive two posts: one Weekly Brief and one Deep Dive.

The Deep Dive is where I write a detailed piece on a specific subject related to investing, economics, or anything money-related (you will see what this issue looks like as the weeks go on).

The Stock Analysis, however, is a detailed breakdown of a specific stock. These will not be comparable to the current stock analyses I write. These will be an incredibly in-depth write-up, covering risks, valuation, business model — (nearly) all you would ever need to know about a stock to invest.

One of the main pain points in my newsletter, based on survey answers, was the lack of variety in my analyses or deep dives. This is going to change. These new deep dives will be incredibly diverse, focusing on many different topics. The stock analyses will focus heavily on individual stocks — not just mega-caps, not just large-caps, but also private company breakdowns, and even potential IPOs (everything you need to know about a company before it goes public).

These analyses will be unlike anything you’ve seen before. They won’t just be business and revenue breakdowns like I currently write. These will be full 30 hours of research condensed into a a detailed, 20 to 30 to 40-minute read. My goal is to give you everything you need to fully understand a company before considering an investment. I’ll do all the stock research for you, so you can take that research and use it to potentially make a return on your investments.

All paid subscribers can suggest stocks they want me to research, and I’ll provide an in-depth write-up for those suggestions, helping you build your own investment thesis, while learning the research process, in the process.

It’s hard to fully conceptualize the depth of value these analyses will provide. It goes beyond saving you time on research. The goal is to help you make better investments by understanding the research behind stocks, so you can, ultimately, make more money. This value is well beyond the price I’m currently offering, but it’s my way to start off clean as an apology for the constant paid membership perk changes. That’s why I’m giving all my subscribers a 1-month free trial to see this new content schedule in action and experience the value-packed, detailed analyses, firsthand. (Paid subscribers will also get the opportunity to hop on a phone call with me whenever possible if they’d like to chat about stocks or the newsletter (after today ends, this will not be a perk).

I will be increasing prices once the first detailed analysis comes out next Tuesday, raising the price from $8 per month and $70 annually to $9 per month and $85 annually (Canadian dollars). Keep in mind, anyone who subscribes at today’s prices will not be subject to the raised prices. So if you want a 20% discount on the membership, subscribe to paid before next Tuesday. Also, all subscribers enrolled in a college or university with a valid education email will receive 85% off their membership, regardless of future price increases, forever.

I encourage you all to sign up for the free 1-month trial to see the value of the paid membership. If you decide it’s not for you, you can always cancel. But please, give it a try and see what it consists of — you won’t regret it. (This is the last time I mention the paid membership in the spotlight of a newsletter issue.)

Let’s get into it. (12 min read)

In this issue:

📉 MercadoLibre’s 16% drop, explained

💰 Apple faces first-ever EU DMA fine

🇺🇸 Trump’s president again, now what?

FEATURED STORY

📉 MercadoLibre’s 16% drop, explained

This week, one of my core investment holdings reported earnings, and following doing so, dropped 16%. It’s not the volatility that entices me — that’s something we, as individual stock investors, get accustomed to. What entices me is the questions that come from the volatility. We need to ask ourselves questions as investors when these things happen, so we don’t buy a stock that’s fundamentally getting worse. We need to ask ourselves, why is this stock down? And then subsequently, find the answer.

MercadoLibre’s reason for dropping? A 21% miss on earnings. Specifically, earnings per share. Was a 16% drop justifiable? Let’s find out.

Digging deeper

MercadoLibre is the “Amazon of Latin America,” as some would say. On the surface, yes, it’s essentially just an Amazon.com copycat — the most popular e-commerce option for South American consumers. But the difference between the two really starts to show when you analyze the business model. Both are e-commerce giants in their markets, and both have a similar growth strategy: they entice users to their platforms by setting low prices, then funnel those consumers into their high-margin revenue segments to continue offering low prices.

For Amazon, these high-margin segments include Amazon Web Services, third-party seller services, Prime (subscriptions), and advertising. Amazon invests billions of the cash earned from these segments into creating innovative technology and projects like Project Kuiper, Amazon One, and Just Walk Out.

MercadoLibre’s high-margin segments are fintech, logistics, and advertising.

Amazon’s model goes something like this (in no particular order):

Commerce → Prime → Advertising → Third-party sellers → AWS → Growth investments → 🔁

MercadoLibre’s business model goes (in no particular order):

Commerce → Fintech → Logistics → Advertising → 🔁

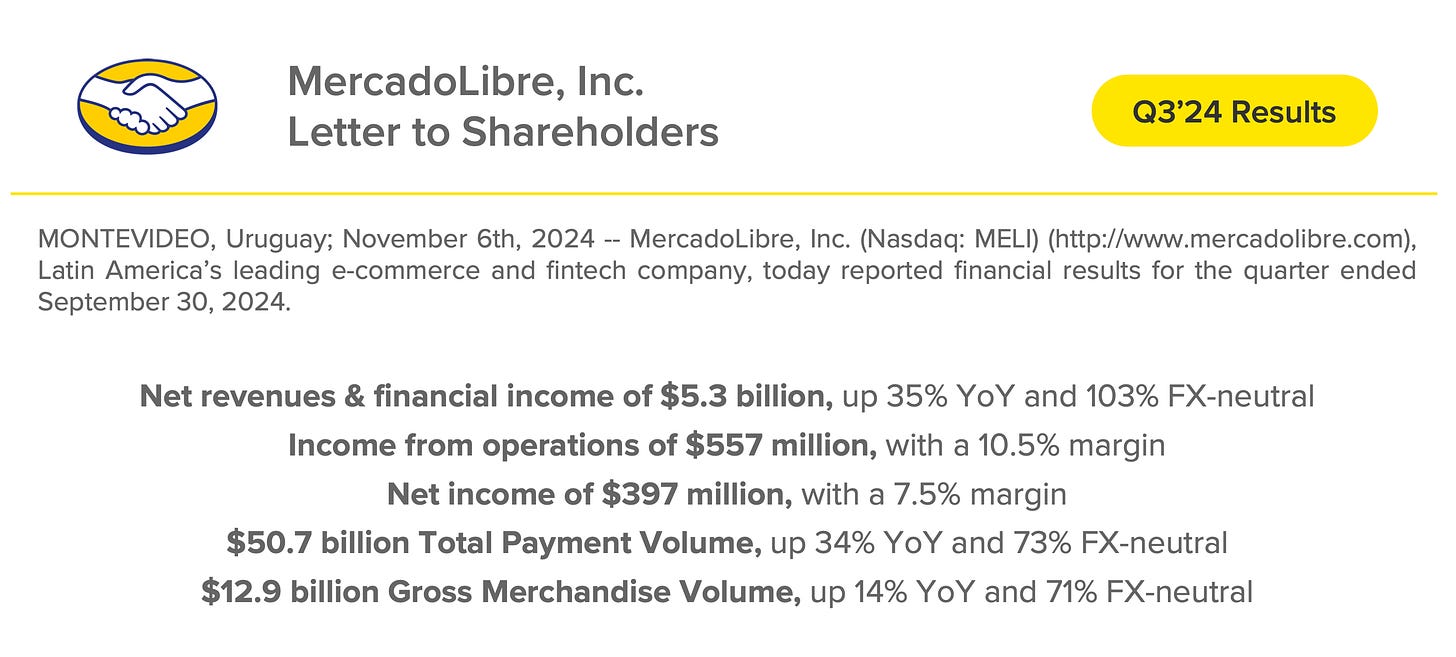

Fintech is the AWS of MercadoLibre. It’s that important to the company. Their payment and credit platform is the main driver of profitability for the company. I’ll save the business analysis for another day, but as the picture above shows, MercadoLibre is a business growing its top line at nearly 40%, with its merchandise volume growing at 14% and its payment volume growing at 34%. Obviously, its payments (fintech) business is the main growth driver here — almost three times as fast as its commerce business. With this simple rundown on the business, and an easy understanding of the importance of fintech for MercadoLibre, would you be I don’t know, mad as a shareholder if they invested in growing that revenue segment?

Of course not — or at least, you shouldn’t be. A company trying to maximize shareholder value is not something you should be upset about.

Nonetheless, the market thought otherwise.

This is why the stock was pushed down so much after earnings. They missed EPS estimates, but they missed those estimates because of MercadoLibre’s investments in their fintech segment—their fastest-growing segment and intrinsic value driver for the long term — which caused margin pressure.

Margin pressure in the short term, that is.

Over the long term, this is nothing to worry about. This sell-off is simply a blip on the chart. MercadoLibre is a company growing earnings at around 80% year on year, with its top line nearly 40%, while trading at a 5% FCF yield and a forward P/E of 35. Ok sure, this might seem like “nitpicking ratios,” but based on those ratios alone, it’s quite an amazing valuation. Not stretched, not expensive, but it’s, dare I say… undervalued.

I’m not worried from these earnings. It’s great to see management investing in growing MercadoLibre. That’s what I expect from my companies; I expect growth, and investments are what fuel growth for the business at the end of the day. Fintech is Mercado’s highest-margin segment, and it’s the fastest-growing. It makes total sense to invest more into that segment. Much like Amazon, another core position of mine, which is investing in AWS and other areas currently (which is also hurting cash flow and profitability), I believe MercadoLibre will benefit greatly from these investments.

This drop in stock price was unjustified. MercadoLibre is as good as ever, and the margin pressure that led to the 16% sell-off was from good cause. Therefore, I consider this an opportunity and I’ve purchased more of the stock since earnings.

FINANCE

a. 💰 Apple faces first-ever EU DMA fine

The EU is gearing up to impose a monstrous fine on Apple under the Digital Markets Act (DMA) by late November for ‘anti-competitive practices on its App Store.’ This would be the first-ever fine issued under this act, and if imposed, the penalty could be as high as 10% of Apple’s annual revenue (as of today, that would amount to nearly $40 billion).

Apple has faced several fines in the EU this year, including, notably, a €13 billion (~$14.02 billion) tax bill fine to Ireland (even though Ireland did not deem the fine necessary). These EU fines and regulatory problems are beginning to become catastrophic for Apple, leading to CEO Tim Cook calling and asking Donald Trump for help (more on that below):

Related articles:

b. 💾 Kioxia files for December IPO

Kioxia, one of the world’s largest computer memory chip companies, plans to file for an IPO as early as Friday (November 8, 2024 — it should be filed when this issue is released), with a public listing aimed for December to ‘gauge investor interest,’ according to sources.

Bain Capital, Kioxia’s majority shareholder, postponed a Kioxia IPO in October after investors halved its expected ~$10 billion valuation. Kioxia will (would) be the first to use the new Tokyo Stock Exchange rules that allow companies to test investor interest before formal listing approval. Approval is expected in late November, when prices will be announced.

Related articles:

BUSINESS

c. 🏦 TD employee leaks customer data

A former TD Bank employee, named Daria Sewell, has just been indicted by the Manhattan District Attorney for allegedly sharing sensitive customer data on Telegram while working in the anti-money laundering department (ironic). Authorities found images of 255 cheques along with the personal information of nearly 70 customers on her personal phone, which she allegedly used to deposit the cheques and split profits with others.

The indictment is part of a larger cheque fraud case involving five other employees. Sewell worked at TD Bank from 2023 to May 2024, and has justifiably been fired. TD is cooperating with the investigation.

Related articles:

d. 🚘 Volkswagen to recall 114,000 cars

Volkswagen is recalling 114,478 vehicles in the U.S. due to driver-side airbag safety concerns, according to the National Highway Traffic Safety Administration on Thursday, where long exposure to humidity and high temperatures may cause the airbags to explode. The recall affects certain 2006-07 and 2012-14 Passat models, 2017 Passat Wagons, and 2017-19 Beetles.

Owners can get their airbags replaced for free at Volkswagen dealerships. Volkswagen is set to announce this via notifications on December 27.

The J. Nicholas Vroomsday Counter is now at 7.498 million.

What is the vroomsday counter? Vroomsday is doomsday but for car recalls. The vroomsday counter is the total of all cars mentioned in recalls since the inception of The J. Nicholas newsletter.

POLITICS

e. 🇺🇸 Trump’s president again, now what?

Inherently, this means nothing. Trump won — I’m sure you heard — and that’s great. First, there’s no more uncertainty in the market hanging over the election. Less uncertainty means a clearer market vision and ultimately, higher stock prices. Second, if you’re worried about the impact of Trump’s election on your stock portfolio, don’t be. Instead of worrying, you should be celebrating.

Trump’s economic policy, as outlined last week, shows that his victory could be (more so, actually is) a positive for the stock market. Corporate tax cuts and tariffs on foreign goods are two factors of policy he’s proposing that benefit American businesses by increasing the profitability of U.S. companies. More profits = higher stock prices. Congrats to Trump, and congrats to the investors who are likely to experience some impressive gains in the coming months.

Related articles:

📚 Book of the Week

⭐️ For every book purchased using the links below, 100% of affiliate commissions are donated to charity. (Amount donated so far: $30.00.)

Astrophysics for People in a Hurry - Neil deGrasse Tyson

Book Description:

What is the nature of space and time? How do we fit within the universe? How does the universe fit within us? There’s no better guide through these mind —expanding questions than acclaimed astrophysicist and best-selling author Neil deGrasse Tyson.

But today, few of us have time to contemplate the cosmos. So Tyson brings the universe down to Earth succinctly and clearly, with sparkling wit, in tasty chapters consumable anytime and anywhere in your busy day.

While you wait for your morning coffee to brew, for the bus, the train, or a plane to arrive, Astrophysics for People in a Hurry will reveal just what you need to be fluent and ready for the next cosmic headlines: from the Big Bang to black holes, from quarks to quantum mechanics, and from the search for planets to the search for life in the universe.

Thanks for reading! Feel free to reply to this email or comment on the web if you need anything — I always reply. If you enjoyed today’s issue, feel free to share it with friends and family.

All the best,

Jacob