Weekly Brief #77

Let's talk about Canada's AI leadership... Plus, Nvidia’s $500 billion U.S. investment plan, Palo Alto acquires Protect AI, Gemini to become Apple “AI” option(?), Waymo partners with Toyota, and more.

A huge welcome to the 18 investors who joined The J. Nicholas since last week! Haven’t subscribed yet? Join 1,015 intelligent investors by subscribing here.

Good morning investor 👋,

Welcome back to the 77th Weekly Brief.

The J. Nicholas has officially crossed the 1,000-subscriber mark! Thank you all. Much more to come. This is only the start.

This week’s performance:

S&P 500: +2.08% | Nasdaq: +3.08% | Dow Jones: +1.77% | TSX: +0.51% | Gold: -1.40% | Bitcoin: +3.36% | The Quality Fund: +1.61%.

More rebounding in the markets this week as White House rhetoric calms down (thank God). Also, Mark Carney has officially been elected Prime Minister of Canada in a federal election with the highest turnout since 1993. Being the optimist I am, amid all the “fears” or what have you from these election results, I wanted to talk more about something everyone seems to dismiss.

And that’s Canada’s AI sector.

Let’s get into it. (10 min read)

In this issue:

🇨🇦 Don’t dismiss Canada’s AI sector

📱 Gemini to become Apple “AI” option(?)

🇺🇸 U.S. economy shrinks in Q1

FEATURED STORY

🇨🇦 Don’t dismiss Canada’s AI sector

Canadian elections are done. No more politics in the near future. All great news. But there’s even more great news I’d like you to know, and that’s regarding Canada’s AI sector—something that continuously gets overlooked.

This won’t be an in-depth Deep Dive (you can go to Deep Dives for that—I will be expanding on this topic after my How to Analyze Stocks series is over), but it should give you a decent overview and summary in the meantime on how Canada is leading in AI. Without further ado, let’s talk about it.

Canada is leading in AI (a brief overview)

Most large, rich countries, in the private and public sectors, have been pouring billions of dollars into the AI industry for years to close the gap between fact and fiction for this tech. And over the last five years, Canada, of all countries, has been a leader in closing this gap (weird way of putting it, but bear with me).

In this timeframe, Canadians have created 670 AI start-ups worth at least $1 million, and venture capital funding invested in Canadian AI companies is third in the world1, only behind the U.S. and UK. These investments in AI, in particular, now make up over 30% of all Canadian VC activity. Canada also ranks second among G7 countries in the annual rate of increase of AI patents, just behind Italy.

But that’s not all.

Canada has long been the most educated country on earth (by OECD standards), and with this education comes talent. A lot of very educated talent.

Something that’s not talked about much with regard to the development of AI is talent. Other than capital and technological excellence (in which America is the world leader), technical skills for AI talent are incredibly important—especially when it comes to foundational research. Take a wild guess at which country leads in the number of highly skilled AI researchers.

Spoiler: The answer is Canada, more than any other country.

As of late last year (2024), Ontario had the world’s third-highest concentration of AI researchers. A year prior, Canada as a whole had the world’s largest concentration of AI talent, point blank.

Relative to its population, Canada punches way above its weight for AI talent. AI talent by itself is world-leading for Canada, and AI research in total is consistently ranked among the top 5–10 globally. You can thank investments dating back to 2010 to 2017—when Canada was the first country in the world to establish a national AI strategy (the Pan-Canadian Artificial Intelligence Strategy)—that led to this lead. As of the time of writing, the Canadian government has spent over US$2 billion towards AI research.

Now to blow your mind even more: 10% of the world’s total AI researchers, as a whole, are from Canada. This may not seem like a large slice in the grand scheme of things (and it isn’t), but relative to our small population, that’s huge. (The leading hubs in total are China, America, the EU, and India.)

But with all my optimism here, let’s talk about the problems. Because things aren’t just sunshine and rainbows.

The problems

For Canada, most of the domestic benefits of AI aren’t being capitalized on. The main benefits are productivity, higher GDP per capita growth, and economic diversification. Sadly, due to low wages and opportunity in Canada, well over 60% of Canadian AI talent leaves for America. So, while we have all of this capital investing in our firms, and a leading system for AI talent, paired with immense government support, we get none of the benefits.

It’s a double-edged sword from our last government, really. We can thank the Trudeau government for, in some part, contributing to this concentration of Canadian AI research talent, but also for weakening our productivity and economy in a way that disproportionately disincentivizes our own people from using their knowledge and innovation inside our own borders2.

The biggest strain for us today, to help solve this problem before our talent continues to drain to America, is AI adoption in businesses, particularly small- to medium-sized businesses, which lack funding or knowledge to fully implement AI. Without this implementation, there’s no productivity boost, and most of the benefits here start to deteriorate.

America has by far the best commercial adoption and the most advanced technological development of AI. Paired with Canada’s top talent, American tech companies and firms have no problem hiring said talent, and likewise, these Canadians will happily accept dramatically higher salaries or equity bonuses, paid in a stronger currency. The problem is not America being dominant; it’s America poaching our talent while we still have it.

One “simple” solution I hope the Carney administration thinks over? Encouraging domestic investment from American tech for Canadian AI talent. Have these workers and companies pay Canadian taxes, investing in Canadian energy, on Canadian soil.

My thoughts

Canada is a leading talent hub for AI. It’s a leader in the AI sector—has been for years, and probably will be in the near future if we continue with domestic investment in talent and industry. But sadly, most of the benefits of this lead and talent are going beyond our borders. That needs to stop, and hopefully soon.

In the meantime, I’ll be doing my part to capitalize on this Canadian AI advancement thanks to my investments in Brookfield and Shopify. Brookfield, a Canadian company, has infrastructure and energy investments in data centres; Shopify, another Canadian company, is integrating AI e-commerce tech for its merchants.

Cheers, my friends. Happy investing. Have a great week ahead, eh.

FINANCE

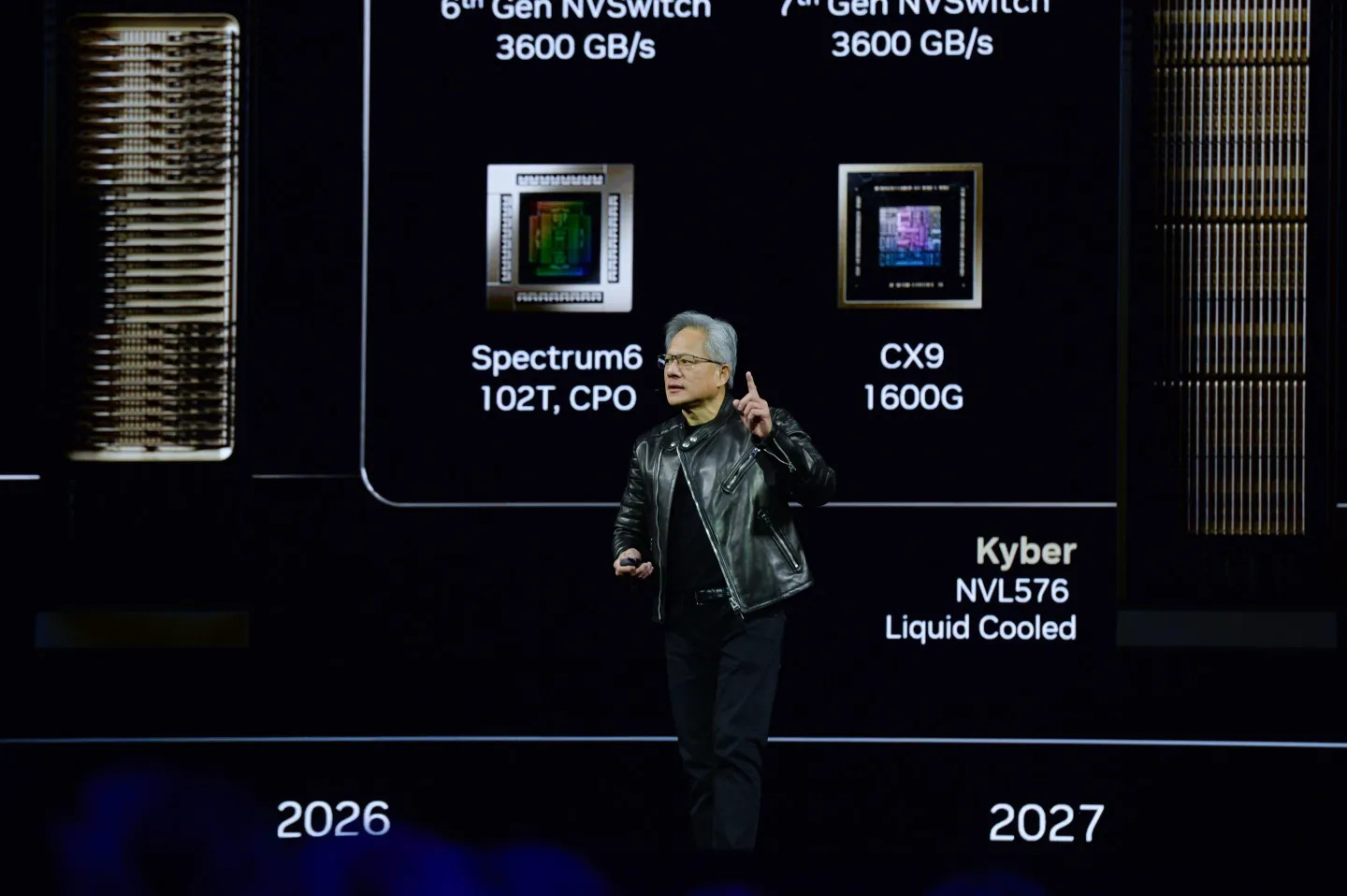

a. 💰 Nvidia’s $500 billion U.S. investment plan

This week, Nvidia CEO Jensen Huang announced a $500 billion investment in U.S. AI infrastructure at a White House meeting, which, if actually carried out, would massively reduce the company’s reliance on Taiwan for chip production. Huang said that Nvidia’s new powerful AI GPUs will be built in the U.S. “thanks to advanced manufacturing processes.”

The plan involves partnerships with TSMC, Foxconn, Wistron, Amkor, and SPIL, with over a million square feet of facilities and hundreds of thousands of jobs. TSMC has already started making Nvidia’s Blackwell chips in Arizona as I publish this. Two supercomputer plants are currently planned in Texas. In recent months, major companies like Apple, Oracle, TSMC, Hyundai, SoftBank, and OpenAI have pledged over ~$1.7 trillion in U.S. investment.

Related articles:

b. 🤝 Palo Alto acquires Protect AI

Palo Alto Networks has announced a definitive agreement to acquire Protect AI, a leader in securing AI and machine learning software. The buyout “strengthens Palo Alto’s AI security capabilities amid growing threats like model manipulation, data poisoning, and prompt injection attacks,” the company said in a press release. The buyout price wasn’t disclosed, but rumours suggest it’s around the $500–700 million mark.

Specifically, the acquisition will help enhance Palo’s “Prisma AIRS™” platform, which offers end-to-end AI security from development to runtime. Sound too wordy? No problem. That’s cybersecurity for you. Protect AI’s team will join Palo Alto Networks once the deal closes, which is expected to be completed by Q1 2026—pending regulatory approval.

BUSINESS

c. 📱 Gemini to become Apple “AI” option(?)

Interesting news from Google this week: during court proceedings for one of their gazillion lawsuits on April 30 (Wednesday), CEO Sundar Pichai said Gemini—Google’s GenAI model for those unfamiliar—could soon be built into the iPhone alongside OpenAI’s ChatGPT as an option.

Apple currently uses its own models for most AI tasks but has integrated ChatGPT with Siri and Writing Tools for queries Siri can’t provide to the user. Pichai told Bloomberg he’s “hopeful Gemini will be added as an AI option this year” and said he hopes to finalize a concrete deal with Apple by mid-2025. Apple’s WWDC25 starts June 9, so if a deal is struck, that’s when it would likely be announced. Bullish.

Related articles:

d. 🚙 Waymo partners with Toyota

Even more interesting news from Google: Waymo (owned by Google) has announced a new partnership with Toyota to integrate its self-driving tech into Toyota vehicles—aiming to bring self-driving features to personally owned cars, not just its own fleets.

It’s in the early stages, but this deal is another step forward for Waymo, which is not only leading in autonomous vehicles (AVs) on the commercial end but soon on the personal consumer end. And as Tesla plans to start its AV ventures soon, Waymo now operates in San Francisco, Phoenix, Los Angeles, and Austin, with over 250,000 paid rides per week. Bullish (x2).

Related articles:

MACRO

e. 🇺🇸 U.S. economy shrinks in Q1

You read that right: one of the most resilient economies in the world, the U.S. economy, shrank in Q1 2025—by about 0.3% to be exact. It’s the first contraction since 2022, according to Commerce Department data released Wednesday. Economists say the decline was mainly driven by a surge in imports due to tariff concerns (imports subtract from GDP; exports add).

As a reminder, developed economies aim for about 2% Q/Q growth, and the U.S. economy had been growing slightly above this threshold for a while—until now. President Trump then blamed Biden for the weak report and said tariffs will help long-term growth. Of course, politics aside, tariffs will not do that, as I wrote about not once, not twice, not thrice, not four times, not five times, not six times, not seven times, but eight separate times (all eight links below).

Related articles:

📚 Book of the Week

For every book purchased using the links below, 100% of affiliate commissions are donated to charity. (Amount donated so far: $36.42.)

An investor’s bookshelf: Here.

The Art of Spending Money - Morgan Housel

Book Description:

Most of us don’t know how to spend money. We chase things that impress others but leave us cold. Or we save endlessly, afraid to spend on what would actually make life better. We confuse admiration with envy, comfort with excess, and status with utility.

The Art of Spending Money is about finding balance. It isn’t about budgets, hacks, or one-size-fits-all solutions. It’s about understanding how your relationship with money shapes your decisions—and how to reshape it so money works for you.

Morgan Housel’s work has helped millions rethink how they earn, save, and invest. Now he turns his attention to the other side of the equation: how to spend. With insight and warmth, he shows why the most valuable return on investment is peace of mind, why expectations matter more than income, and why doing well with money has less to do with spreadsheets and more to do with self-awareness.

This book isn’t about getting rich. It’s about getting the most out of what you already have—and learning to want what’s worth wanting.

Thank you for reading, partner. If you enjoyed today’s issue, feel free to share it with friends and family. I’ve placed a button below for you to do so (right underneath the paid membership line (see what I did there).

All the best,

Jacob

All of my links here.

My best work is members-only. Don’t miss out on exclusive posts, insights and benefits—upgrade today and join the community.

According to this LinkedIn article by Jerry Haar.

Not a political statement. Simply objective.