OpenAI in Shambles

Microsoft and OpenAI are fighting, and it'll cost OpenAI billions. The Friday Filter #85.

Good morning investor 👋,

Welcome or welcome back to The Friday Filter—the quality investor’s market recap.

Before we get into talking about what’s going on with OpenAI and Microsoft, I want to remind you that my free Deep Dive series “How to Analyze Stocks” just finished yesterday. The eBook is next, and paid subscribers will receive that for free among the other valuable paid perks, so stay tuned!

Now, onto OpenAI’s nasty mess.

Let’s get into it. (8 min read)

Today at a glance:

The Filter;

The OpenAI-Microsoft situation

📄 In other news

📚 Resource of the week

The OpenAI-Microsoft situation

The Filter

When Sam Altman was fired as OpenAI CEO back in November 2023, Microsoft CEO came out saying (and quote):

“We [are] very confident in our own ability. We have all the IP rights and all the capability. I mean, look, if tomorrow OpenAI disappeared, I don’t want any customer of ours to be worried about it, quite honestly, because we have all of the rights to continue the innovation, not just to serve the products. But we can go and just do what we were doing in partnership, ourselves, and so we have the people, we have the compute, we have the data, we have everything.”

— Microsoft CEO Satya Nadella

Essentially, Microsoft is saying here that they don’t need OpenAI to survive the AI innovation curve. And this is true. Yet, OpenAI still needs Microsoft.

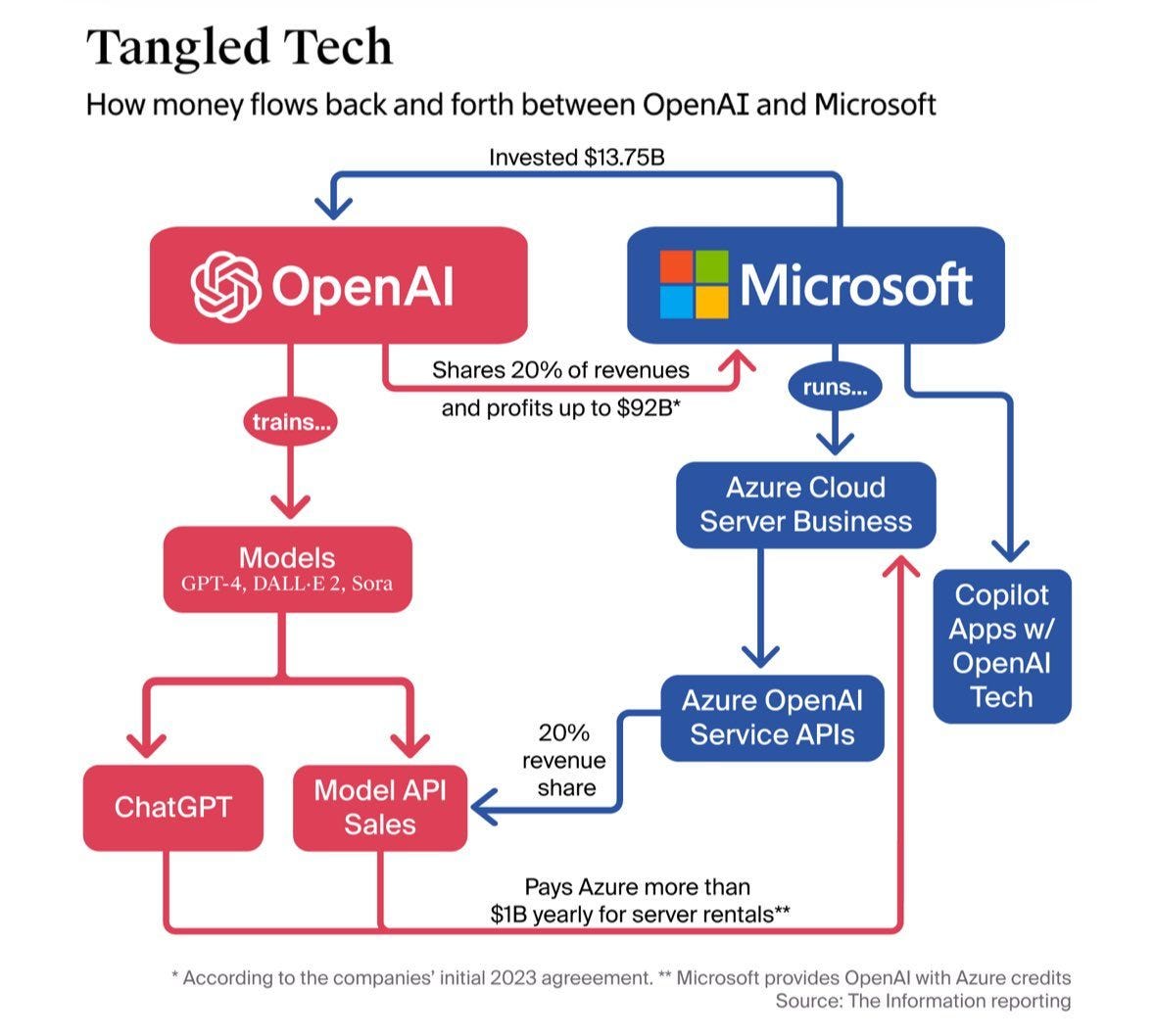

For the longest time, OpenAI has been holding an agreement with Microsoft (which has collectively invested ~$14 billion into the company) that gave them an entitlement to 49% of future profits (now 20% of revenue, but might be both) in exchange for continued capital injections by Microsoft into OpenAI. This investment(s) also gave Microsoft a large equity stake in OpenAI’s for-profit business, exclusive access to OpenAI’s APIs, revenue-sharing arrangements, and access to all of OpenAI’s intellectual property until 2030.

It’s an incredible partnership for Microsoft.

OpenAI has long had a weirdly complicated structure. It’s a non-profit, but also a for-profit, but then again also a capped-profit? It’s a whole mess, and I don’t want to hurt my brain neurons trying to share with you how all of that works at 1 a.m. on a Thursday. OpenAI realises this and is actively looking to switch towards a simple for-profit structure (the non-profit will still exist, but it’s all jargon to avoid negative PR, probably).

With a for-profit structure, OpenAI can raise money more easily and can feasibly have a path towards a future IPO. Because as it stands today, any new capital (i.e., the funding from SoftBank and Microsoft) isn’t considered investments in the traditional funding sense, and I’ll get into that.

But the main issue isn’t about funding, it’s that OpenAI is looking to break away from many of the terms of its Microsoft deal.

OpenAI can’t move forward with any of its restructuring plans without approval by Microsoft. But OpenAI wants to completely overhaul Microsoft’s control and its strategic agreements over the company, so Microsoft hasn’t felt compelled to sign off.

It’s been an exhausting feud, but here’s a timeline summary (and why, if not dealt with soon, could lead OpenAI into “shambles”):

OpenAI announces it wants to become a for-profit company to help raise capital and lay the groundwork for a future IPO.

But OpenAI needs Microsoft’s approval to go through with these plans.

Microsoft has IP rights to all of OpenAI’s models until 2030 (including those of future AGI; the holy grail of AI models that can reason fully, etc.), control of 20% of OpenAI’s future revenue until 2030, and 49% of profits up to $92 billion (I’ve heard conflicting sources that it’s “only the revenue share and not the profit share,” but then “also the revenue share and profit share,” so I’m not sure what the absolute truth is here.)

OpenAI wants to get rid of this AGI clause in the Microsoft agreement, as well as end Microsoft’s IP rights, and swap the 20% revenue share with royalties and equity in the new for-profit entity.

Microsoft is mad, and they ignore OpenAI’s demands.

Finally, OpenAI becomes mad about Microsoft’s stance and threatens to accuse Microsoft of anti-competitive behaviour.

If Microsoft doesn’t approve the for-profit operational restructuring in six months’ time (end of 2025), OpenAI’s current investment pledges will turn into debt, and SoftBank’s pledged $30 billion specifically will be cut by $20 billion. Meaning yes, OpenAI will lose $20 billion if these two companies don’t come to an agreement, and the clock is ticking. And all of this, on top of Meta and Mark Zuckerberg poaching OpenAI’s talent left and right.

My entire opinion on this feud is simple:

Microsoft won’t want to give up its lucrative terms for an equity stake that sees them lose tens of billions. If they do, it would be a very hard pill to swallow.

Right now, the equity stake OpenAI is reportedly offering to Microsoft in the new entity is 33%. Based on the last round of OpenAI’s funding, this stake would be worth about $110 billion. This is more than its cap on revenue/profit sharing of $92 billion (unless this is measured on an annual basis), but without IP and API access to OpenAI’s flagship models and future AGI model.

Microsoft would need to be pressured into a corner due to antitrust threats, or would have to be rewarded with a very large minority stake in the new for-profit arm. Still, Microsoft survives without ChatGPT because it has the data, storage, and processing power to train large-scale models. ChatGPT depends heavily on Microsoft, which gives it billions of dollars’ worth of free cloud storage under their agreement (not to mention flat capital funding just to operate).

I think both companies will survive, but ChatGPT disproportionately depends on Microsoft rather than the other way around. Microsoft wins by scale, both in terms of capital and infrastructure advantage (cloud access, vast amounts of data, and processing power). ChatGPT won’t disappear, but without Microsoft, its progress dramatically slows as costs to scale become much higher. Microsoft without ChatGPT leaves a slump, but Microsoft could reignite its own model fairly quickly using IP from OpenAI (even if the agreement doesn’t allow it anymore1), leveraging its infrastructure.

BUT, overall, I don’t think any doomsday scenarios will play out.

Both companies need each other in their own right, and both benefit from the current agreement. Obviously, Microsoft is in a far better position from the deal, but it’s more a lopsided symbiotic relationship rather than a parasitic host infection, if that makes sense.

In the meantime, happy investing.

Upgrade to a paid subscription for more. Don’t forget to check out the finished and full How to Analyze Stocks Deep Dive series!

a. 📄 In other news

Novo Nordisk ends Him’s partnership

One of the big news stories of the week. Not very knowledgeable on the operations of either of these companies, but if I recall correctly, Him’s was allegedly illegally selling Chinese-made compounded versions of Novo’s drug to its clients. Big no no, but you form your own opinion.

Amazon announces rural same-day delivery

As of now, Walmart wins in rural same-day and 1-day delivery thanks to its stores. Or at the least, it’s leading in many areas. Amazon on the other end, leads in the urban centres. Amazon is now starting to press Walmart on this, and it’s great to see.

Brookfield sells Aveo for $2.5 billion

A company sale of Brookfield’s Australian retirement housing operator, securing billions in extra capital. (Always good to see movements for Brookfield, but I have absolutely zero opinions on this deal.)

“Uber founder Travis Kalanick is looking for ways to buy the U.S. arm of Chinese autonomous vehicle company Pony AI,” and Uber is in talks to help him in the process. Big, if true.

b. 📚 Resource of the week

I believe I’ve shared this book on the newsletter before.

But for some reason, I randomly thought about reading it this week after thinking about Google. I’m personally not going to buy it because I have too many books on my bookshelf that I haven’t gotten around to reading yet. Plus, I already understand the premise and idea behind the book.

In short, The Innovator’s Dilemma shares the repeatable formula of a tech company’s journey, and how, when a tech company matures, it gets complacent which leads to disruption and downfall. It’s an interesting read, and I love this concept because it’s a powerful idea to keep in the back of your mind, particularly if you’re a tech investor like me, and more particularly in this “AI stock market.”

A quote I love (paraphrased) from this book:

“Disruptive technologies typically are cheaper, simpler, smaller, and, frequently, more convenient to use.” — Clayton Christensen, The Innovator’s Dilemma

Anyway, I have nothing more to add. That’s it.

Happy reading.

—-

Thanks for reading today. Hope to see you soon (only figuratively; I’m not spying on you, I swear). Cheers, friend.

All of my links here.

From the archives:

The finale of my “How to Analyze Stocks” Deep Dive series:

This would be unethical, but Microsoft already has this information and has had it for years. Why wouldn’t they use that to their advantage in the chance the OpenAI partnership falls through?

Great article!