Work hard, Have fun, Make history

Amazon.com, Inc.

Surface-level analyses published before November 10, 2024 are free. For access to newer, fully researched and in-depth reports, consider upgrading to the paid membership.

Hello investors 👋,

I have a confession to make… I’m obsessed with Amazon.

Over the past year, Amazon has become the largest single position in my portfolio, now weighing in at nearly 20% (excluding cash). I’ve been slowly increasing this position since the start of the year, periodically through some minor corrections, and today’s the day I finally share the reasoning behind this decision. Amazon doesn’t need any introduction, and I don’t want to waste your time, so without further ado…

PS: Ok, sorry, I might need to waste some of your time by saying: From now on, at the end of every free post, I’m including a riddle called “Mind Moat,” where all subscribers from this community can participate in testing how wide their knowledge moat on investing is while earning a cool reward in the process. This will be an investing-related riddle that subscribers can answer by replying to the email. Whichever subscriber replies with the correct answer to the riddle below first, will receive a $10 Amazon gift card. Happy riddling!

Let’s get into it. (22 min read)

Today at a glance:

Turn Right Down E-Commerce Ave.

Amazon Analysis

Fundamentals, Moat,

Growth, Valuation

Turn Right Down E-Commerce Ave.

You’re on a road trip from New York City to Seattle.

You’re experiencing the beauty of one of the most culturally diverse, richest, and populous cities in North America, watching as that scenery slowly changes on a comfortable 4,589 km (~2,852 mi) car ride across the United States.

Time goes by. A few minutes turn into hours, hours into… more hours. Until eventually, you’re surrounded by vast lakes, clear and full of bright blue water, mountains with heights so high you notice snow slowly dripping down the side of the peak, and natural evergreen forests untouched by industrial civilization, contributing to one of the most outstanding views you have ever seen.

You somehow don’t think of the natural beauty of what is currently around you. You seem to not firmly grasp that ideal. No, instead, you think of creating the first-ever order-online e-commerce delivery company, with the hopes of revolutionizing how people purchase items, allowing them to buy anything they could ever want and need, without leaving their house or setting foot in a retail store during the process.

This was how Jeff Bezos, in 1994, founded Amazon (According to the, most likely totally legitimate parable outlined by a Wikipedia editor on Jeff Bezos’ Wikipedia page. (Makes for a great introduction to an Amazon stock analysis).

A Brief History

Cadabra was founded by Jeff Bezos on July 5, 1994, in Seattle, Washington, during a road trip from New York City. It was just a few months after incorporating the company that Bezos changed the name from Cadabra (as in “abracadabra”) to what we know today as Amazon, after his lawyer misheard the name as “cadaver.” Rightly so, after presumably a few minutes of scouring through a dictionary, Bezos found the word “Amazon” to replace Cadabra, symbolizing the ‘exotic nature’ of the business he soon wanted Amazon to become.

At the time, Bezos was a recent graduate of computer science and electrical engineering at Princeton University, who, before creating Amazon, worked as a hedge-funder on Wall Street for D.E. Shaw. Leaving his high-paying job at a New York hedge fund, Bezos pursued his vision — a vision that would revolutionize how we shop around the globe.

Bezos and his team worked out of his garage in Bellevue, Washington (as all early tech company employees seem to have done), working on custom desks made from doors until the official website, Amazon.com, launched a year later in July 1995. In its early years, Amazon was just an online bookstore, quickly becoming known as the go-to place for just that, thanks to its broad selection of over a million book titles listed on its site within the first year of operation.

Fast forward two years to 1997, and Amazon went public on the Nasdaq for $18 per share ($0.09 split-adjusted).

It wasn’t until 1998 that Amazon started expanding its inventory beyond books to include CDs, DVDs, electronics, and home supplies. At this stage of broadening its inventory, the company started its venture into international markets, launching its first localized websites in the UK (.co.uk) and Germany (.de). This decision marked Amazon’s first transition of many from being “just an online bookstore” to become the one-stop-shop for everything e-commerce.

When the dot-com bubble burst in the early 2000s, it hit Amazon extremely hard. Its stock price plummeted, diving better than an Olympic medalist, dropping over 80% by the time the year had ended. Despite this, Bezos stayed committed to the company’s long-term growth, reinvesting everything Amazon had into building out its infrastructure and logistics, and improving its technology (a trend you’ll see throughout this write-up).

In fact, the same year Amazon’s stock took such a blow to the metaphorical face, Amazon introduced Amazon Marketplace, opening up the ability for third-party sellers to sell products on Amazon. Now, Amazon wasn’t just a bookstore or an e-commerce shop for buyers, but it was a place to be for sellers and Amazon could earn commissions.

However, nothing was quite as important to Amazon’s growth then the launch of Amazon Web Services in 2006. What first started out as an awkward internal side project, grew to popularize and standardize what is today, cloud-based infrastructure and storage solutions: cloud computing.

AWS was a game-changer for Amazon, and as its market share in cloud computing increased, the resulting dramatic increase in operating cash flow from this segment became crucial for the company’s diversification efforts. This influx of cash also allowed Amazon to spend massive amounts of capital building up and investing in infrastructure and logistics.

However, the innovation and growth didn’t stop there.

2005: Amazon launches Amazon Prime.

2007: Amazon launches Kindle.

2008: Amazon acquires Audible for $300 million.

2011: Amazon launches the Kindle Fire tablet.

2014: Amazon launches Echo (powered by Alexa).

2014: Amazon acquires Twitch for $970 million.

2014: Amazon launches Amazon Fire Phone.2017: Amazon acquires Whole Foods Market for $13.7 billion.

2018: Amazon acquires Ring for $1 billion.

Then, in 2020, the COVID-19 pandemic hit.

Normally, this would be the part of the story when I talk about how this virus crushed the business, but that’s the beauty of e-commerce… COVID was a blessing without disguise for Amazon.

With widespread lockdowns and nowhere to go, consumers turned their focus to online shopping for essentials and streaming for entertainment. This massively fuelled Amazon’s revenue and, therefore, its operating profits, which the company used (every dime) to invest right back into scaling up its logistics, expanding warehouses, hiring hundreds of thousands of employees, buying more delivery trucks, purchasing airplanes — the list goes on.

Switch in Leadership

In February 2021, after 23 years, Jeff Bezos announced he would step down as CEO to focus more on Blue Origin, taking on an executive chairman role in the company. Andy Jassy, the then head of AWS, became the new CEO of Amazon five months later.

Under Jassy’s leadership, Amazon has continued to expand, with a larger focus on technology and artificial intelligence thanks to his background in cloud computing. Today, Amazon remains one of the most valuable companies in the world, positioned on top as the leader in cloud computing and online retail, serving over 300 million customers each year while employing over 1.5 million people worldwide.

Amazon Analysis

Amazon is a colossal retail business — the largest e-commerce online retail business in the world. Amazon, as a company, is best explained using just three words: innovation, adaptability, and trust. And boy, oh boy, is that last point important! (But be patient, my friend; we’ll get there soon enough.)

Throughout his reign as the leader of the company, Jeff Bezos implemented a culture called “Day 1,” indoctrinating the current management of Amazon to follow it religiously. “Day 1” is a startup mentality based on the first day of starting a business. It’s a mindset telling management, “Don’t get too comfortable,” directing Amazon to keep innovating. This mentality continues to influence Amazon’s approach to innovation and growth to this day. Amazon’s ability to innovate in every possible way, pivot when necessary, and effectively scale has made it one of the most influential companies of the 21st century, largely due to this culture. This mindset is what led to the transition away from being just an online bookstore; it’s what led to Kindle, AWS, Amazon advertising, Prime, many strategic acquisitions, and so much more.

In every possible way, Amazon is never, ever behind. If there’s a developing problem that could threaten the business or a new sector emerging that could be valuable to the company, Amazon doesn’t think twice and goes straight for the opportunity. This contrasts with a company like, say, Apple, which loves to play the waiting game until it can leverage its brand power to dominate a sector once there’s proof of concept. Amazon doesn’t fear failure. They try, experiment, and do it many times until something works, and once they do, they profit much more than the losses they incurred along the way.

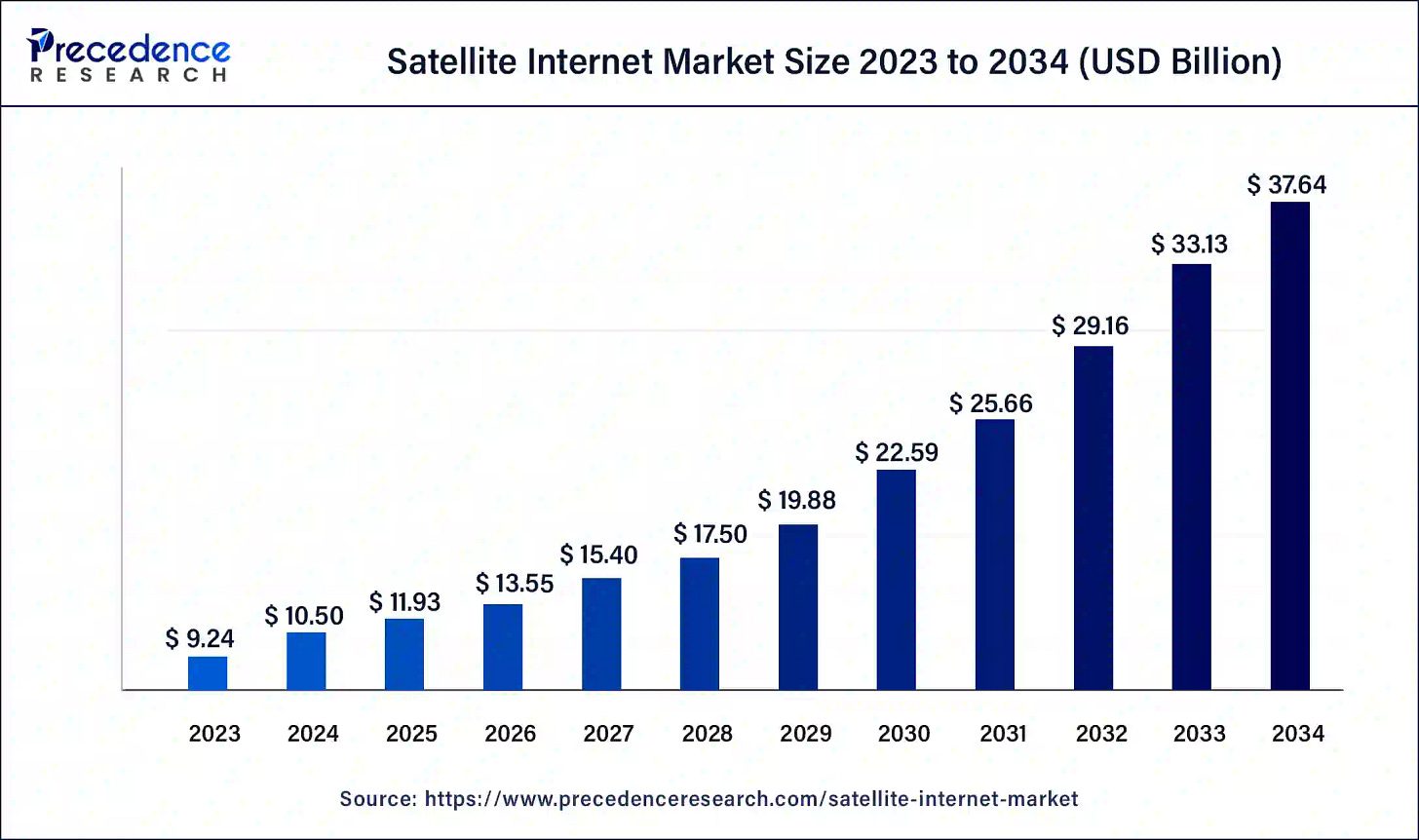

Is Amazon becoming too dependent on third-party shipping services? Amazon launches Operation Dragon Boat and develops an unmatched in-house shipping process and logistics network to reduce that reliance. Is COVID-19 providing an immense boost in revenue, profitability, and cash flow for the business? Amazon uses all of that newfound capital to invest back into improving its cloud and logistics infrastructure. Is online advertising gaining steam in the global economy? Amazon buys Twitch and launches the most effective in-house online advertising platform, where advertisers are matched with ready-to-buy prospects. Is streaming taking over cable, becoming the premier form of entertainment? Amazon adds Prime Video for free to its hundreds of millions of Prime subscribers (while standardizing ads across those Prime Video viewers and charging a few dollars a month on top to remove the ads). Is Temu threatening the value proposition of Amazon shopping? Amazon gets to work on creating its own Chinese-sourced discount store, leveraging its current logistics network and reach. Is SpaceX’s Starlink the clear winner in the satellite internet space (a market expected to more than septuple over the coming decade)? Amazon starts dedicating a team of engineers via Project Kuiper to begin developing a viable product to compete in that space. (More on these growth aspects below.)

More examples of this adaptability include, but are not limited to, Echo and Alexa, LLMs, and data centre build-outs thanks to artificial general intelligence.

Amazon does not miss out on opportunities. They adapt, and they do so with incredible skill. Sometimes they fail; sometimes they enter the opportunity at the wrong time. But the point is they try, and they win most of the time, according to their history. This leads us to the model of Amazon.

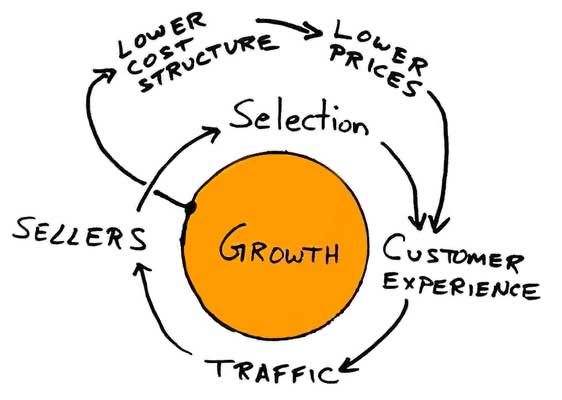

Amazon’s business model puts the primary focus on the customer experience. Amazon is possibly the best example of what makes up a customer-centric business model, rivalled only by Costco (in my eyes). Retail is generally a low-margin industry, including when we’re talking about physical retail. But there are exceptions in retail, like Costco and Amazon, and even Dollarama, which base their business on being the cheapest place to buy items. The prime value (pun intended) of Amazon is its low prices and ease of use. Low prices, while leveraging their world-class seller relationships, logistics, and distribution network for fast shipping, come together and create an incredible customer experience that leads to higher traffic from recurring users and word-of-mouth from them sharing the great experience, which leads to more sellers on the platform, ultimately resulting in a higher selection of products available.

At the core of this model is Amazon’s ability to grow other revenue streams and lower the initial cost structure of the products sold on the platform, which feeds this loop. Thanks to AWS, online advertising, third-party seller services, and Prime subscription revenue — all high-margin products created from the innovative “Day 1” culture strategy and a lack of fear of failure — Amazon can afford to keep prices considerably low, supporting the customer-centric model that makes Amazon, Amazon. A model that feeds consumers into those high-margin businesses listed above, like Prime, which feeds them back into the model over and over, creating a loop of maximized revenue per user. (ARPU1).

Prime, on its own, is an incredibly tough value proposition.

By leveraging its high-margin businesses, Amazon creates value-packed services bundled into the Prime subscription, which keeps consumers coming back to Amazon and familiarizes them with the platform, making them more likely to buy more of what Amazon sells. With a Prime subscription, for instance, you get access to: lower prices, Prime Day shopping, free 2-day shipping, a video streaming platform (Prime Video), a music streaming platform (Amazon Music), unlimited cloud storage in Amazon Drive, and a 2.5% cash back credit card — all for just $9.99 per month in Canada ($14.99 per month in the United States).

It’s a no-brainer for consumers who shop on Amazon to subscribe to Prime. That’s exactly what Amazon wants consumers to feel, and that’s precisely why 75% of all Amazon users have a Prime subscription.

Once a consumer is shopping on Amazon and subscribed to Prime, they are also most likely watching Prime Video, listening to Amazon Music, and more. This increased attention on Amazon’s products and platforms boosts its advertising revenue, allows for greater pricing leverage with third-party seller services, while providing Amazon with more data to improve its cloud business.

This strategy of being a customer-centric business by providing such amazing value across the board has been an incredible way to build trust with Amazon consumers. It has worked exceptionally well, dare I say. Among retail businesses worldwide, Amazon is the only one with the resources to provide this level of value without affecting profitability, which has helped them secure a high return on investment, even during times when they lose money. In the long run, a dollar potentially lost on providing Prime perks or perks to the customer is covered five-fold, or even ten-fold by AWS, advertising, or another high-margin segment of Amazon. (Remember again, these high-margin segments were indirectly or directly created as a result of this customer-centric model in the first place.)

Growth First, Shareholder Tenth

Although this constant consumer-first strategy and ongoing reinvestment to branch out and innovate to secure more revenue, and therefore leverage to benefit the value proposition for Amazon consumers is a good thing, it does have its drawbacks. Long-time investors in Amazon will know this.

The constant culture of innovation left by Jeff Bezos’s “Day 1” operational tenure means that Amazon leaves no room for shareholder value besides capital appreciation. No dividends, no meaningful buybacks — nada. Every dollar of cash flow, or nearly every dollar, is reinvested right back into something Amazon deems could make a return on capital.

Amazon is a greedy business. They won’t give a penny to shareholders if they could potentially make two or three pennies from that cash. Historically, Amazon has turned those pennies into dimes and quarters, so it’s not an unprofitable strategy — that is not what I’m insinuating. I’m more saying, as we’ve seen with Apple, Microsoft, and now Google and Meta, paying a dividend or announcing buybacks doesn’t affect long-term growth in the slightest. Amazon is not a startup anymore, but they continue to cling to a startup mentality.

Is this a bad thing? Not particularly.

This mentality is what has led to some of the most influential and important segments of Amazon’s current business after all. It’s a way for Amazon to safeguard against technological disruption of its business, and I respect that as a shareholder greatly.

But then again, at its current growth rate, Amazon is poised to produce $420 billion in operating cash flow by 2030. There will come a time when the amount of cash Amazon generates will become so gargantuan that it will not be possible to run it into the ground on reinvestment alone. Subsequently, I believe there will come a time when Amazon must in some way part with the “Day 1” strategy and start rewarding shareholders. This is not some hopeful thesis; this isn’t a prediction, and I’m very confident it will become a reality. In the rare case it’s not, Amazon will continue to flourish for decades to come nonetheless, and I’ll be a happy shareholder along the way.

Amazon’s revenue is broken down as follows (TTM2):

🛍️ Online sales (38.9% of sales)

Revenue generated from first-party sales and commissions earned from the sale of third-party products.

🚚 Third-party seller services (24.2% of sales)

Revenue generated from services provided to third-party sellers who use Amazon’s platform to sell their products. This includes fulfillment services, product listings, and more.

☁️ Amazon Web Services (17.2% of sales)

🌐 Advertising (8.9% of sales)

Twitch, Prime Video, Amazon Ads etc.

🔁 Subscriptions (7.0% of sales)

Revenue generated from subscription services like Amazon Prime, Kindle Unlimited, Amazon Music Unlimited, and Amazon Prime Video (no ads).

🏬 Physical stores (3.18% of sales)

Revenue earned from Amazon’s brick-and-mortar retail stores, such as Whole Foods Market, Amazon Fresh, and their Just Walk Out stores (Amazon Go).

🌱 Other bets (0.64% of sales)

Fundamentals, Moat, Growth, Valuation

Fundamentals

Most of the time, being a retail business means having a very consistent line of revenue growth. It’s a business piggybacking off domestic economic growth, which is generally a very upward consistent trend, since he economy will continue to grow over the long term, and consumers will continue buying things. This makes retail a very revenue-consistent business.

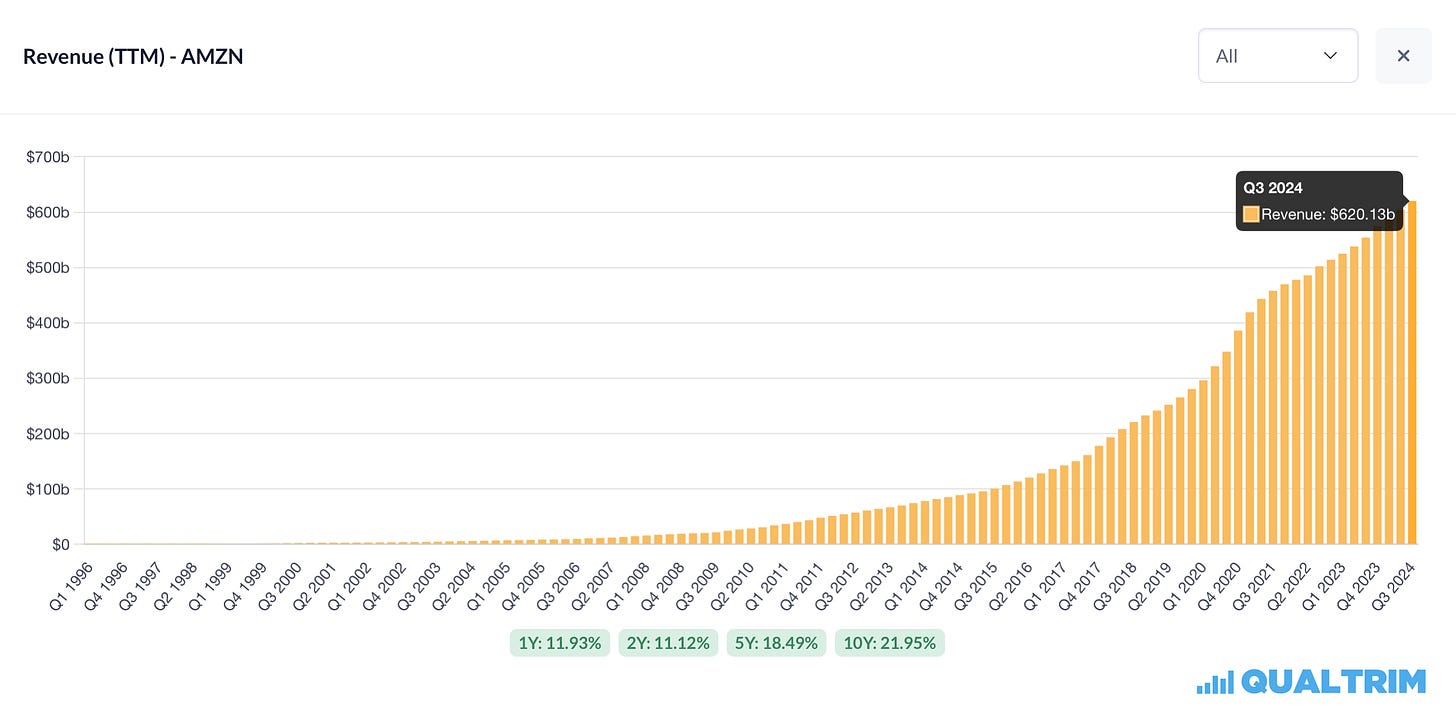

Amazon is no different. Albeit, partially, because there’s much more to the consistency for Amazon than just retail like a Costco or Walmart. Cloud computing, advertising, and subscription revenue to name a few. Speaking of which, take a brief moment to appreciate these beautiful fundamental graphs of Amazon’s business quarter by quarter since its inception:

Here’s a look at some of Amazon’s key fundamental metrics from the past five years (definitions for the abbreviations are listed at the bottom of this post):

Revenue CAGR3: 18.49%

Earnings CAGR: 34.36% (33.05% per share)

EBITDA4 CAGR: 26.75%

FCF5 Growth: 16.46% (15.18% per share)

Dividend Increased: N/A

Shares Outstanding: +1.27%

Profit Margin: 8.04%

Operating Margin: 9.77%

ROCE6 (TTM): 15.5%

Amazon’s competitive advantage

Amazon is the leader in global e-commerce, with approximately 40% market share. By that measure alone, Amazon has a wide economic moat. No contest. Over the years, Amazon has diversified beyond its e-commerce business to create many dominant, profitable businesses, almost as if by the snap of their fingers. These have made Amazon that much stronger. (Here are a few other segments where Amazon is a predominant or partial leader):

Cloud Computing: 31% market share.

Largest in this market via AWS, with Microsoft Azure in second place and Google Cloud in third, catching up fast.Online Advertising: 14% market share.

The third-largest in this market, with Google as the predominant leader and Meta following closely behind.Digital Streaming: 23% market share.

The second-largest in this market via Prime Video, right behind Netflix, but above Disney.Smart Home: 36% market share.

The largest in the market thanks to Alexa and Ring, with competitors like Google and Apple ramping up their efforts.Physical Retail (🇺🇸): 2.7% market share.

(Not a leader, but useful for broadening Amazon’s retail data to improve the technological capabilities of Just Walk Out.)

Growth aspects & valuation

Right now, the key drivers of Amazon’s future growth are cloud computing and advertising. These are the crucial points of growth and represent the fastest-growing segments of Amazon’s revenue.

I’m very bullish on the long-term trends of both cloud computing and online advertising. For cloud computing, with the continued push in artificial intelligence and the global shift from analogue to digital (which is still in progress in most of the world), cloud computing will become a necessity for the world. Amazon’s market dominance with AWS, although slowly being surpassed by Microsoft and Google, will continue to provide growth and capitalize on this growing secular trend of cloud computing. I’ve said it before, and I’ll say it again: betting on cloud seems like an inevitable win in my eyes.

For online advertising, my general thesis is simple: businesses want to maximize their marketing budget. Traditional advertising methods are profitable, but do not provide the in-depth analysis and data that online advertising provides and the sheer reach the internet allows. It’s just not close. As the world shifts to digital, similar to the cloud thesis above, online advertising will benefit.

Even more so for Amazon’s advertising platform, because Amazon is a business built for conversion.

People who use Amazon have saved credit card info on their accounts already. People who go on Amazon are looking to buy something. One click, and a customer buys. Advertisers or sponsored posts advertising on Amazon have access to an incredibly large, valuable, high-income, read-to-buy consumer base, which makes the advertising platform that much better. In the same realm, Amazon operates one of the largest search engines in the world on their website, which is another way Amazon could monetize its ad platform.

Among these two key drivers comes the external investments and other secular trends in different markets Amazon is leading in or plans to lead in. I’ve selected a few I personally believe are the most important for the future growth of Amazon that I am extremely bullish on:

Robotics:

Amazon has got to be the leader in warehouse robotics. (I say “got to” instead of a certainty because I could not find exact data on the fact, but it seems likely.) Since 2012, Amazon has expanded partnerships with companies and put forward billions in investments to enhance its fulfillment operations with automation. Most of Amazon’s fulfillment operations involve tasks like moving packages, sorting items, and labeling—fairly low-level work. These are the tasks that are being automated and offloaded to robotics and machinery. There aren’t many high-level tasks in a warehouse, so the innovation with the introduction of autonomous robots like Proteus into Amazon’s logistics network will both improve efficiency, lower human injury, and save on costs (mostly save on costs).

Just Walk Out:

There was some controversy surrounding this technology earlier in the year, and for those who still believe a bunch of workers in India are behind this tech and not complex AI engineering, read here. In my opinion, Just Walk Out has the potential to be a great opportunity. Retailers haven’t yet been convinced about the technology and don’t trust Amazon to hold their valuable shopper data, which is understandable considering Amazon also has a physical retail business; however, for contrast, Netflix and Disney both use AWS for hosting and simultaneously compete with Prime Video. Eventually, that trust will be established. As Amazon brings the opportunity for retailers to save on costs with this tech, I think there may be a future where Just Walk Out will become the standard for grocery and physical retail. No cashiers (lower wage costs), no checkout lines, and a more streamlined process seem like an amazing value proposition for retailers. Amazon has already started talking with retailers about this technology, and if done right, I believe it will be an amazing path for Amazon.

Artificial General Intelligence (AGI):

Amazon is a huge data company, possibly the largest out there (yes, beating both Meta and Google). With the vast amount of data from Amazon Web Services, its constant consumer search data on its platform, and even Alexa data and streaming data, it all comes together into this behemoth of a data company. With the rise of AGI and LLMs, and the huge demand for cloud computing—which will only give Amazon more data—Amazon will be a clear winner in this space. With Olympus in the works, I feel very bullish on Amazon as an AI play.

Project Kuiper:

Then we have space. More specifically, satellite internet. For Amazon, Project Kuiper is their satellite broadband initiative to leave their mark by providing high-speed internet access globally to compete with SpaceX (which holds 90% of the market) in a market expected to triple over the next decade. The plan is to deploy over 3,200 satellites in low Earth orbit (LEO) to deliver reliable broadband services. From this, Amazon wants to help bridge the digital divide that affects hundreds of millions of people worldwide who lack access to the internet.

Since its creation in 2018, Amazon has so far secured 80 launches through partnerships with Arianespace, Blue Origin, SpaceX, United Launch Alliance, and more. The first two prototype satellites were successfully launched in October 2023, and the first commercial services are expected to roll out in 2025. I’m very bullish on space, and satellite internet is no exception. I think this will be a good path for Amazon in the future.

Valuation

Amazon is again following its historic strategy of high investments today, but this time into growing its data centres, improving its robotics efforts, and investing in Project Kuiper. Amazon CEO Andy Jassy even said he believes these investments will rise even more through 2025. I think this is a smart move, so no complaints from me. History says Amazon makes returns on their capital most of the time, and I don’t see a reason it will be different this time. Amazon is a very forward-looking company—much more than average. An investment in Amazon is a bet on the management being able to execute on that forward vision to the best of their ability. I believe that with the power of the pristine business of Amazon, management will do just that.

Since Amazon’s reinvestment efforts involve high capex, it affects the reliability of their free cash flow like it has in the past. This means I need to resort to analyzing Amazon based on OCF and OCF growth and multiples. Currently, Amazon is producing $113 billion in operating cash flow on an annual basis, growing at 59% year-over-year. This places Amazon at a roughly 4% OCF yield.

Interestingly enough, Amazon is the only big tech business in present day with a cash flow multiple lower than historical averages, currently at 18.51, while historical averages are 26.49. They currently trade at a forward P/E of 32, a PEG ratio of 2.26, P/S of 3.31, and an EV to EBITDA of 18.63. Using extremely conservative numbers in my eyes — saying Amazon will grow its OCF at a 15% growth rate for the next 5 years, a 15% discount rate, and a 30% margin of safety, with a 20x OCF multiple — I get a fair value of about $1.843 trillion, or about $171 per share. Averaging this estimate with Morningstar’s $200 estimate to bring in an extra opinion gets us to a fair value of about $186. I think it’s safe to assume a good fair value of Amazon is somewhere in this range based on DCF analyses.

Factoring in the many revenue diversification opportunities and growth in ventures like Kuiper, continued growth in online advertising, the secular trend in cloud, LLMs, continued third-party services growth, subscription revenue growth (including streaming), robotics, Just Walk Out technology, even pharmaceuticals, and so much more behind the scenes, all of this together — regardless of what my DCF says — is a clear path for growth. Growth I believe will benefit me as a shareholder over the long term, buying at these prices.

Overall, I consider Amazon stock a buy at today’s levels. For transparency, my cost-basis is $172.

Here’s a good podcast I listened to recently from Lex Fridman that talks briefly with Jeff Bezos about Amazon’s upbringing, and here’s (affiliate) my current all-time favourite book on Amazon.

More on Amazon, AGI, cloud computing and online advertising:

Thanks for reading! Feel free to reply to this email or comment below if you need anything. I always make sure to answer. Remember, none of this is financial advice, so please do proper due diligence.

🧩 Mind Moat7: I help you share pieces, but I’m not a pie. I can go up and down, but I’m not an elevator. You can own a part of me without ever stepping into my doors. What am I?

Happy investing!

— Jacob xx

All my links here.

Average revenue per user.

Trailing twelve-month data as of the time of writing.

Compound annual growth rate (CAGR): a metric to determine how much a stock’s price has returned every year over a certain period of time. (CAGR can also be used to determine revenue growth, profit growth, etc.)

Earnings before interest, taxes, depreciation and amortization (EBITDA).

Free cash flow (FCF): the money left over to shareholders after subtracting a business’s operating income by its capital expenditures.

Return on capital employed (ROCE): a financial ratio used to assess a company’s profitability and capital efficiency. Helps understand how well a company is generating profits from the money it spends.

An investing riddle with a reward. Answer the riddle correctly by replying to this email to win a $10 Amazon gift card!

Lovely analysis! My largest holding also happens to be Amazon, and not without reason!